Latest Version

1.0.6

March 16, 2025

Gold Bank®

Finance

Android

0

Free

com.goldbank.liveprice

Report a Problem

More About Gold Bank® Live Prices

Unlock the Latest Insights on Precious Metals: Gold, Silver, Platinum, and Palladium Prices

In the ever-evolving world of finance, staying informed about precious metals is crucial for investors and enthusiasts alike. This article delves into the latest information regarding gold, silver, platinum, and palladium spot prices, along with a comprehensive look at historical trends spanning the last 50 years.

Understanding Precious Metals: An Overview

Precious metals have long been regarded as a safe haven for investors, especially during times of economic uncertainty. Gold, silver, platinum, and palladium each hold unique properties and market dynamics that influence their value. By understanding these metals, you can make informed decisions about your investments.

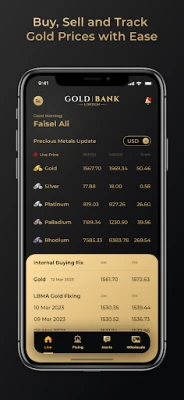

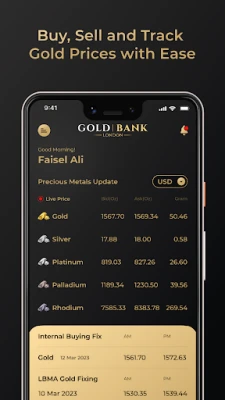

Current Spot Prices of Precious Metals

As of today, the spot prices for precious metals fluctuate based on market demand, geopolitical events, and economic indicators. Here’s a snapshot of the current prices:

- Gold: The price of gold remains a benchmark for the precious metals market, often reflecting global economic stability.

- Silver: Known for its industrial applications, silver's price can be more volatile than gold.

- Platinum: This rare metal is primarily used in automotive catalytic converters, making its price sensitive to the automotive industry.

- Palladium: Similar to platinum, palladium is essential in the automotive sector, and its price has seen significant fluctuations in recent years.

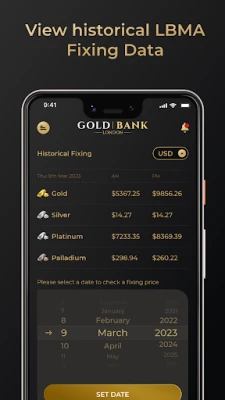

Historical Spot Prices: A 50-Year Perspective

Understanding historical spot prices is essential for recognizing trends and making predictions about future movements. Over the past 50 years, the prices of these precious metals have experienced significant changes:

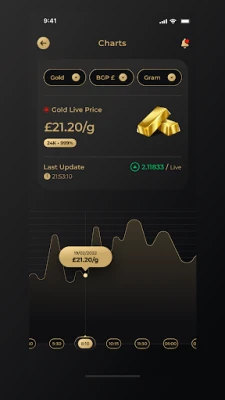

Gold Price Trends

Gold has seen a remarkable increase in value, particularly during economic downturns. Historical data shows that gold prices surged during the 2008 financial crisis and have continued to rise, reaching new heights in recent years.

Silver Price Fluctuations

Silver's price history reveals a more erratic pattern compared to gold. While it has experienced substantial peaks, such as in 1980 and 2011, it has also faced significant declines. Understanding these fluctuations can help investors time their purchases effectively.

Platinum and Palladium: The Volatile Duo

Both platinum and palladium have shown considerable volatility over the decades. Their prices are heavily influenced by industrial demand, particularly in the automotive sector. For instance, palladium prices skyrocketed in the late 2010s due to increased demand for cleaner emissions.

Factors Influencing Precious Metals Prices

Several key factors impact the prices of precious metals:

- Economic Indicators: Inflation rates, interest rates, and currency strength can all affect precious metals prices.

- Geopolitical Events: Political instability and conflicts often lead to increased demand for gold and silver as safe-haven assets.

- Market Demand: Industrial demand for silver, platinum, and palladium can significantly influence their prices.

Investing in Precious Metals: Strategies for Success

Investing in precious metals can be a lucrative venture if approached strategically. Here are some tips to consider:

Diversification

Don’t put all your eggs in one basket. Diversifying your portfolio with a mix of gold, silver, platinum, and palladium can help mitigate risks.

Stay Informed

Regularly monitor market trends and news related to precious metals. This knowledge will empower you to make timely investment decisions.

Consider Long-Term Holding

While short-term trading can be profitable, consider holding onto your precious metals for the long term to ride out market fluctuations.

Conclusion: The Future of Precious Metals

As we look ahead, the landscape of precious metals continues to evolve. By staying informed about current spot prices and historical trends, investors can navigate this dynamic market with confidence. Whether you are a seasoned investor or a newcomer, understanding the intricacies of gold, silver, platinum, and palladium will enhance your investment strategy and help you capitalize on future opportunities.

For the latest updates and detailed insights into precious metals, make sure to access reliable financial news sources and market analysis platforms. Your journey into the world of precious metals starts with knowledge and informed decision-making.

Rate the App

User Reviews

Popular Apps

Editor's Choice