Latest Version

0.1.7

August 17, 2025

MAA PRANAAM FORTUNE LLP.

Finance

Android

0

Free

com.fortunemf

Report a Problem

More About Fortune MF

Unlock Your Financial Future: A Comprehensive Guide to Mutual Fund Investments

Investing in mutual funds has become a popular choice for individuals looking to grow their wealth and achieve financial goals. With the right tools and knowledge, you can navigate the world of mutual funds with ease. This article will guide you through the essential steps to start investing, the benefits of Systematic Investment Plans (SIPs), and how to track your investments effectively.

Quick and Easy Sign-Up Process

Getting started with mutual fund investments is a breeze. You can sign up in just a few minutes and complete a one-time Know Your Customer (KYC) process directly through the app. This streamlined approach ensures that you can begin your investment journey without unnecessary delays.

Investing Made Simple: Lumpsum or SIP

Once you’re registered, you can choose to invest in mutual funds either as a lumpsum or through a Systematic Investment Plan (SIP). SIPs allow you to invest a fixed amount regularly, starting as low as Rs. 100 per month. This method not only makes investing more manageable but also helps in averaging out the cost of your investments over time.

Comprehensive Scheme Analysis

Before making any investment, it’s crucial to evaluate various performance parameters of mutual fund schemes. You can check key metrics such as:

- Net Asset Value (NAV)

- Fund Manager Name

- Asset Size

- Technical Ratios

These insights will help you select the most suitable scheme that aligns with your financial objectives.

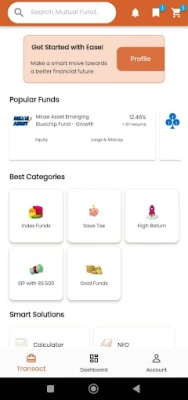

Explore a Vast Array of Mutual Fund Schemes

With access to over 10,000 mutual fund schemes, you can easily search and compare options. Add your preferred schemes to your cart or mark them in your wishlist for future consideration. This flexibility allows you to make informed decisions before proceeding with your investments.

Link Investments to Your Financial Goals

Investing is not just about growing your wealth; it’s about achieving specific financial goals. You can select from predefined goals or create your own, linking your investments to these objectives. Whether it’s saving for retirement, your child’s education, or purchasing your dream home, aligning your investments with your goals is essential for success.

Monitor Your Investment Performance

Stay updated on the performance of your investments through a user-friendly dashboard. You can track the live performance of your invested schemes and monitor your progress towards achieving your financial goals. This real-time tracking ensures that you remain informed and can make adjustments as needed.

Effortless Redemption Process

When it’s time to access your funds, selling your investments is just a click away. The redemption process is designed to be quick and efficient, allowing you to receive your money back within a few days.

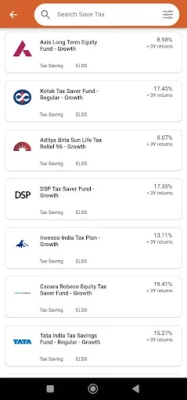

Tax Benefits with ELSS Mutual Funds

Investing in Equity Linked Savings Schemes (ELSS) not only helps you grow your wealth but also offers significant tax benefits. You can save up to Rs. 46,800 per year through ELSS mutual fund SIP investments. This makes it an attractive option for those looking to save on taxes while investing for the long term.

Diverse Investment Solutions

Mutual funds offer a variety of investment categories to suit different risk appetites and financial goals:

- Equity Mutual Funds

- Large Cap Mutual Funds

- Mid Cap Mutual Funds

- Small Cap Mutual Funds

- Debt Mutual Funds

- Balanced Mutual Funds

- Long Term Mutual Funds

- ELSS Tax Savings Mutual Funds

This diversity allows you to create a well-rounded investment portfolio tailored to your needs.

All Major Mutual Fund Companies at Your Fingertips

The Fortune MF mutual fund app supports all 43 mutual fund companies (AMCs), including:

- SBI Mutual Fund

- Reliance Mutual Fund

- ICICI Prudential Mutual Fund

- HDFC Mutual Fund

- Axis Mutual Fund

- And many more

This extensive selection ensures that you have access to the best investment options available in the market.

Track Your Investments Effectively

Utilize the dashboard feature to keep a close eye on all your investments. You can track your annualized returns, total returns, and even calculate potential returns using a mutual fund calculator. Additionally, you can check the details of your holdings and monitor the NAV of your mutual funds, ensuring you stay informed about your financial progress.

Conclusion: Start Your Investment Journey Today

Investing in mutual funds is a powerful way to build wealth and achieve your financial goals. With a user-friendly app, diverse investment options, and the ability to track your performance, you can take control of your financial future. Start your investment journey today and unlock the potential of mutual funds!

Rate the App

User Reviews

Popular Apps

Editor's Choice