Latest Version

5.74.5

August 16, 2025

Allied Irish Banks, Public Limited Company

Finance

Android

0

Free

aib.ibank.android

Report a Problem

More About AIB Mobile

Unlock the Power of AIB Mobile Banking: Your Financial Hub on the Go

In today's fast-paced world, managing your finances efficiently is crucial. With the AIB Mobile Banking app, you can take control of your banking needs right from your smartphone. This comprehensive guide will explore the app's features, permissions required, and how it can simplify your financial management.

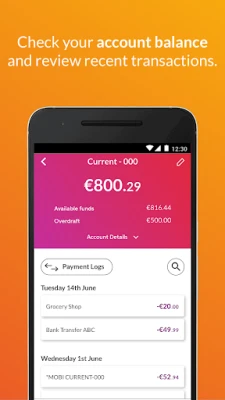

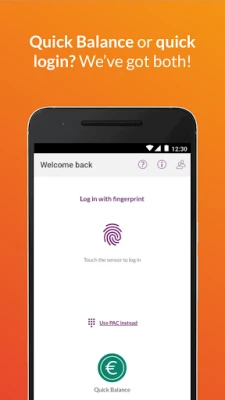

Access Your Accounts Instantly

One of the standout features of the AIB Mobile app is the ability to view up to two accounts without the need to log in. Simply press the Quick Balance button to get an instant overview of your finances. This feature is perfect for those who want to keep track of their spending without the hassle of entering passwords.

Share Your IBAN and Account Details Securely

Need to share your banking information? The AIB Mobile app allows you to easily share your IBAN and account details with trusted contacts. This feature is particularly useful for setting up payments or transfers without the need for lengthy phone calls or emails.

Comprehensive Statement Access

With the AIB Mobile app, you can view and export up to seven years of bank statements. This feature is invaluable for budgeting, tax preparation, or simply keeping track of your financial history. Accessing your statements has never been easier, allowing you to stay informed about your financial activities.

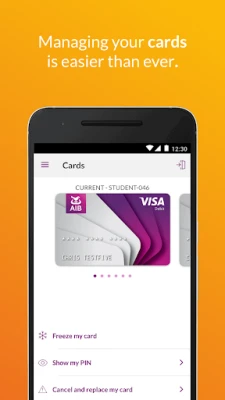

Card Management Made Easy

Lost your card? No problem! The AIB Mobile app enables you to report a lost or stolen card quickly. Additionally, you can freeze or unfreeze your card with just a few taps, providing peace of mind and security at your fingertips.

Reset Your PAC and Recover Registration Information

Forgetting your PAC (Personal Access Code) or registration number can be frustrating. The AIB Mobile app simplifies this process, allowing you to reset your PAC or recover your registration number effortlessly. This feature ensures you can access your account whenever you need it.

Manage Direct Debits and Standing Orders

Stay in control of your recurring payments with the ability to view and cancel your Direct Debits and Standing Orders directly from the app. This feature helps you manage your monthly expenses and avoid unnecessary charges.

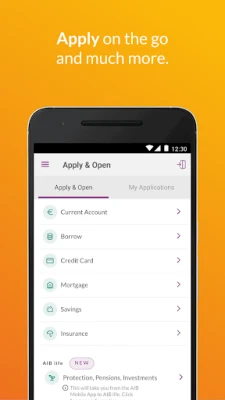

Apply for Personal Loans on the Go

Need a personal loan? The AIB Mobile app allows you to apply for personal loans while on the move. This convenience means you can take care of your financial needs without having to visit a branch or spend time on the phone.

Additional Features and Benefits

The AIB Mobile app offers a plethora of features designed to enhance your banking experience. From viewing your account balances to managing your transactions, the app is your all-in-one financial tool. And the best part? You can access these features 20 hours a day, subject to terms and conditions, with occasional nightly maintenance.

Permissions Required for Optimal Functionality

To ensure the AIB Mobile app functions smoothly, it requires specific permissions on your device:

- Identity/Contacts: This permission allows the app to identify your device, enabling you to unregister or remotely wipe the app if necessary.

- Phone: This feature allows you to call AIB's help or product numbers directly from the app.

- Device ID & Call Information: This permission helps the app read your phone's status and identity.

- Calendar: Use this feature to add reminders for important banking tasks, such as serving notice on Online Notice Deposit savings accounts.

Stay Informed and Empowered

For more information about the AIB Mobile app and its features, visit our website at AIB Mobile Banking. If you're interested in exploring our loan products, check out AIB Loans.

In conclusion, the AIB Mobile app is designed to make your banking experience seamless and efficient. With its user-friendly interface and robust features, managing your finances has never been easier. Download the app today and take the first step towards financial empowerment!

Note: Transaction fees and charges may apply, and transaction limits could be in effect. Allied Irish Banks, p.l.c. is regulated by the Central Bank of Ireland.

Rate the App

User Reviews

Popular Apps

Editor's Choice