Latest Version

16.0.1

August 17, 2025

Intuit Inc

Finance

Android

0

Free

com.intuit.mobile.taxcaster

Report a Problem

More About TaxCaster by TurboTax

Maximize Your Tax Refund with the Latest TaxCaster Features

As tax season approaches, understanding your tax obligations and potential refunds becomes crucial. With the latest updates for 2024, TaxCaster offers a suite of features designed to simplify your tax preparation process. This article delves into the key functionalities of TaxCaster, ensuring you are well-equipped to navigate your taxes efficiently.

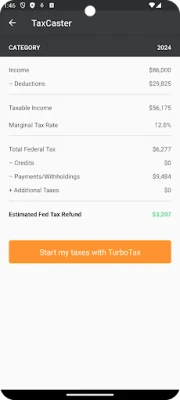

Stay Current with 2024 Tax Laws

Tax laws are constantly evolving, and staying informed is essential for accurate tax filing. TaxCaster is updated to reflect the latest 2024 tax regulations, providing you with a reliable estimate of your tax refund. This ensures that you are not only compliant but also maximizing your potential return.

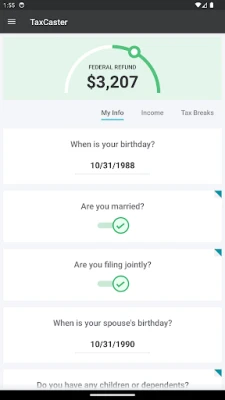

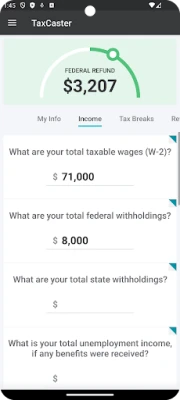

Quick Tax Estimates at Your Fingertips

Before diving into the complexities of your tax return, it’s beneficial to have a preliminary understanding of your tax situation. The federal income tax calculator within TaxCaster allows you to quickly estimate your taxes. This feature provides a snapshot of your tax obligations, enabling you to prepare more effectively for filing your return.

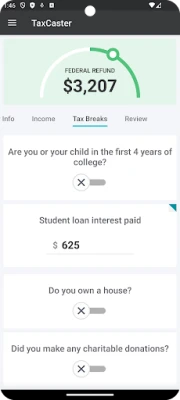

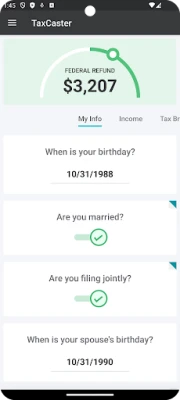

Plan for Life Changes with Tax Scenarios

Life events such as marriage, the birth of a child, or purchasing a home can significantly impact your tax situation. TaxCaster allows you to run various scenarios based on these life changes. By adjusting your paycheck withholdings, you can optimize your take-home pay or plan ahead to minimize your tax liability. This proactive approach helps you manage your finances more effectively throughout the year.

TaxCaster en Español: Accessibility for Spanish Speakers

Inclusivity is a priority for TaxCaster. If your device is set to Spanish, the app will automatically switch to the Spanish interface, making it accessible for Spanish-speaking users. Additionally, you can easily change the language settings within the app, ensuring a user-friendly experience for everyone.

Seamless Integration with Intuit’s Family of Apps

TaxCaster is part of a broader ecosystem of Intuit applications, including TurboTax. The navigation drawer feature allows you to switch effortlessly between these apps, enhancing your overall user experience. This integration means you can estimate your taxes with TaxCaster and then transition smoothly to TurboTax for filing, streamlining the entire process.

Privacy and Security Assurance

When using financial applications, privacy is a top concern. Intuit prioritizes your security and privacy. For detailed information on how your data is protected, visit Intuit's Privacy Policy. With offices worldwide and a headquarters located at 2700 Coast Ave, Mountain View, CA 94043, Intuit is committed to maintaining the highest standards of data protection.

Important Disclaimers to Consider

While TaxCaster is a powerful tool for estimating your taxes, it’s important to note that it does not prepare your tax returns. Use TaxCaster to gain insights into your tax situation, and then utilize TurboTax for the actual preparation and filing of your taxes. Furthermore, TaxCaster and TurboTax are not affiliated with any government entity. For specific tax requirements, refer to the official IRS website at IRS.gov and your local tax authority’s site at Intuit's State Tax Support.

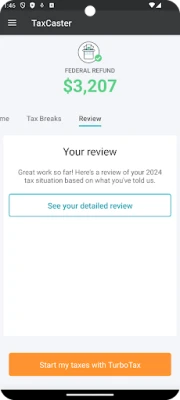

Conclusion: Empower Your Tax Experience with TaxCaster

In conclusion, TaxCaster is an invaluable resource for anyone looking to navigate the complexities of tax season. With its up-to-date features, quick estimates, and planning tools, you can take control of your financial future. Whether you’re preparing for significant life changes or simply want to ensure you’re maximizing your tax refund, TaxCaster is here to help. Embrace the power of informed tax planning and make the most of your financial situation this tax season.

Rate the App

User Reviews

Popular Apps

Editor's Choice