Latest Version

1.6.8

March 06, 2025

Fortune Finserve LLP

Finance

Android

0

Free

com.iw.fortunefinserve

Report a Problem

More About Fortune FinServe

Maximize Your Investment Potential: A Comprehensive Guide to Mutual Funds, Equity Shares, Bonds, and More

In today's dynamic financial landscape, understanding various investment options is crucial for building a robust portfolio. This article delves into key investment vehicles such as mutual funds, equity shares, bonds, fixed deposits, portfolio management services (PMS), and insurance. We will also explore essential features and tools that can help you manage your investments effectively.

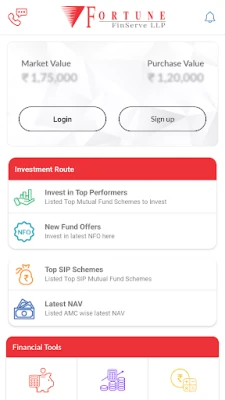

Understanding Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They offer a convenient way for individuals to invest in a professionally managed fund without needing extensive market knowledge.

Key Features of Mutual Funds

- Complete Portfolio Report: Download a comprehensive report that includes all your assets, providing a clear overview of your investments.

- Historical Performance Tracking: Easily view the historical performance of your portfolio to make informed decisions.

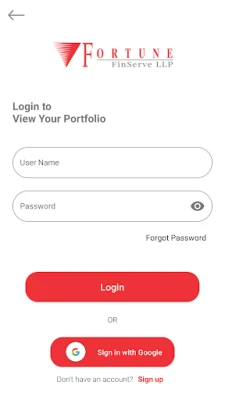

- Easy Login: Access your account effortlessly using your Google email ID.

- Transaction Statements: Obtain transaction statements for any period, ensuring transparency in your investment activities.

- One-Click Statement Downloads: Download your statement of account from any Asset Management Company (AMC) in India with just one click.

Exploring Equity Shares

Equity shares represent ownership in a company. When you buy equity shares, you become a shareholder and can benefit from the company's growth through capital appreciation and dividends.

Benefits of Investing in Equity Shares

- High Return Potential: Historically, equity shares have provided higher returns compared to other asset classes.

- Liquidity: Equity shares are traded on stock exchanges, offering high liquidity and the ability to buy or sell shares quickly.

- Ownership and Voting Rights: Shareholders often have voting rights in company decisions, giving them a voice in corporate governance.

Understanding Bonds

Bonds are fixed-income securities that represent a loan made by an investor to a borrower, typically corporate or governmental. They are considered safer than stocks and provide regular interest payments.

Advantages of Investing in Bonds

- Stable Income: Bonds provide regular interest payments, making them an attractive option for income-seeking investors.

- Capital Preservation: Bonds are generally less volatile than stocks, offering a safer investment option.

- Diversification: Including bonds in your portfolio can help reduce overall risk and enhance returns.

Fixed Deposits: A Safe Investment Option

Fixed deposits (FDs) are a popular investment choice for conservative investors. They offer a fixed interest rate over a specified period, ensuring capital protection and guaranteed returns.

Key Features of Fixed Deposits

- Guaranteed Returns: FDs provide assured returns, making them a low-risk investment option.

- Flexible Tenure: Investors can choose the tenure that suits their financial goals, ranging from a few months to several years.

- Loan Against FD: Many banks offer loans against fixed deposits, providing liquidity without breaking the deposit.

Portfolio Management Services (PMS)

PMS is a tailored investment service that offers personalized portfolio management for high-net-worth individuals. It provides professional management of investments based on individual financial goals.

Benefits of PMS

- Customized Investment Strategy: PMS offers a personalized approach, aligning investments with your financial objectives.

- Expert Management: Professional fund managers handle your investments, leveraging their expertise to maximize returns.

- Regular Monitoring: Your portfolio is continuously monitored and adjusted based on market conditions and performance.

Insurance: Protecting Your Financial Future

Insurance is a critical component of financial planning, providing protection against unforeseen events. It ensures financial security for you and your loved ones.

Types of Insurance to Consider

- Life Insurance: Provides financial support to your beneficiaries in the event of your untimely demise.

- Health Insurance: Covers medical expenses, ensuring you receive necessary healthcare without financial strain.

- Property Insurance: Protects your assets, such as your home or vehicle, against damage or loss.

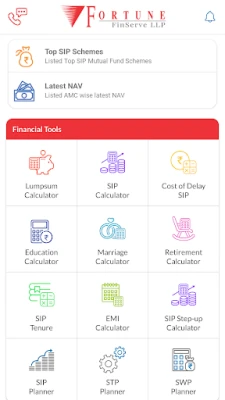

Essential Investment Tools and Calculators

To effectively manage your investments, utilizing various tools and calculators can be beneficial. Here are some essential tools to consider:

- Retirement Calculator: Estimate how much you need to save for a comfortable retirement.

- SIP Calculator: Calculate the potential returns on your Systematic Investment Plan (SIP).

- SIP Delay Calculator: Understand the impact of delaying your SIP contributions on your overall returns.

- SIP Step-Up Calculator: Plan for increasing your SIP contributions over time to meet your financial goals.

- Marriage Calculator: Estimate the amount needed for your child's marriage and plan accordingly.

- EMI Calculator: Calculate your Equated Monthly Installments (EMIs) for loans to manage your finances better.

Conclusion

Investing wisely in mutual funds, equity shares, bonds, fixed deposits, PMS, and insurance can significantly enhance your financial future. By understanding the features and benefits of each investment option and utilizing the right tools, you can create a diversified portfolio that aligns with your financial goals. Start your investment journey today and take control of your financial destiny!

Rate the App

User Reviews

Popular Apps

Editor's Choice