Latest Version

4017.2.0

October 17, 2025

Credit Union of Southern California

Finance

Android

0

Free

com.socalcu.socalcu

Report a Problem

More About CU SoCal Mobile Banking

Maximize Your Banking Experience: A Comprehensive Guide to Mobile Banking

In today's fast-paced world, managing your finances efficiently is crucial. Mobile banking offers a convenient way to handle your accounts, from checking balances to transferring funds. This article explores the various features of mobile banking, ensuring you make the most of your financial management tools.

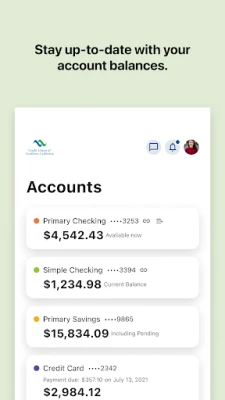

Check Your Account Balances Anytime, Anywhere

With mobile banking, you can easily check balances on your checking, savings, certificates, loans, and credit cards. This feature allows you to stay informed about your financial status without needing to visit a physical branch. Whether you're at home or on the go, accessing your account balances is just a few taps away.

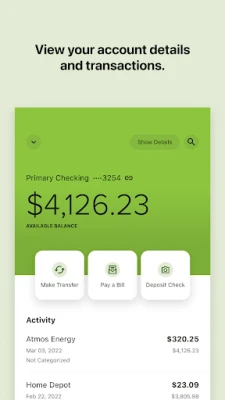

View Transaction History for Better Financial Management

Understanding your spending habits is essential for effective budgeting. Mobile banking enables you to view your transaction history effortlessly. By reviewing past transactions, you can identify trends, track expenses, and make informed financial decisions. This feature empowers you to take control of your finances and plan for the future.

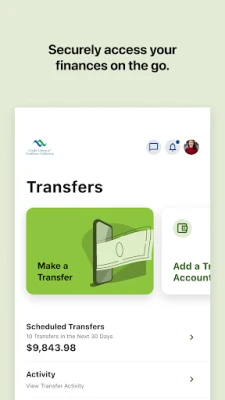

Seamless Money Transfers

Transferring money between accounts or sending funds to friends and family has never been easier. With mobile banking, you can transfer money quickly and securely. This feature eliminates the need for checks or cash, making it a convenient option for managing your finances. Whether you need to pay a bill or share expenses, mobile banking simplifies the process.

Deposit Checks with Ease

Gone are the days of visiting the bank to deposit checks. Mobile banking allows you to deposit checks directly from your smartphone. Simply take a picture of the check, and the funds will be credited to your account. This feature saves you time and provides a hassle-free way to manage your deposits.

Pay Your Bills on the Go

Staying on top of your bills is crucial for maintaining a healthy financial life. With mobile banking, you can pay bills directly from your device. Set up recurring payments or make one-time payments with just a few clicks. This feature ensures you never miss a due date, helping you avoid late fees and maintain a good credit score.

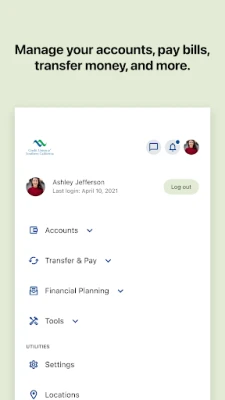

Manage Your Banking Services Efficiently

Mobile banking offers a comprehensive suite of tools to manage your services effectively. From updating personal information to setting up alerts for account activity, you have complete control over your banking experience. This level of management ensures that your accounts are always up to date and secure.

Find a Branch or ATM Near You

Need to visit a physical location? Mobile banking makes it easy to locate the nearest CU SoCal branch, CO-OP shared branch, or deposit-taking fee-free ATM. With just a few taps, you can find the most convenient option for your banking needs, ensuring you have access to services when you need them.

Your Security is Our Top Priority

When it comes to mobile banking, security is paramount. Your peace of mind is our commitment. We implement robust security measures to protect your transactions. All information transmitted via mobile banking is safeguarded with advanced encryption methods that mask sensitive data. Additionally, a password or fingerprint authentication is required every time you log in, ensuring that only you have access to your accounts.

It's important to note that data and text charges may apply, so check with your mobile provider for details. Eligibility requirements may also apply, ensuring that you have the right access to our services.

Federally Insured for Your Protection

Rest assured, your funds are safe with us. All accounts are federally insured by the NCUA, providing an extra layer of security for your hard-earned money. This insurance means that your deposits are protected, giving you confidence in your banking experience.

Conclusion: Embrace the Future of Banking

Mobile banking revolutionizes the way you manage your finances. With features like checking balances, viewing transaction history, transferring money, depositing checks, and paying bills, you have everything you need at your fingertips. Coupled with a commitment to security and convenience, mobile banking is the future of financial management. Embrace this technology and take control of your financial journey today!

Rate the App

User Reviews

Popular Apps

Editor's Choice