Latest Version

October 22, 2025

CNVMONEY FinTech Pvt. Ltd.

Finance

Android

0

Free

com.iw.creditnvault

Report a Problem

More About CNVMONEY: Mutual Fund, SIP,

Unlocking the Power of Investment: A Comprehensive Guide to Mutual Funds, Equity Shares, Bonds, and More

In today's fast-paced financial landscape, understanding various investment options is crucial for building a secure future. This article delves into the key investment avenues, including Mutual Funds, Equity Shares, Bonds, Fixed Deposits, Portfolio Management Services (PMS), and Insurance. We will explore their features, benefits, and how to effectively manage your investments using innovative tools.

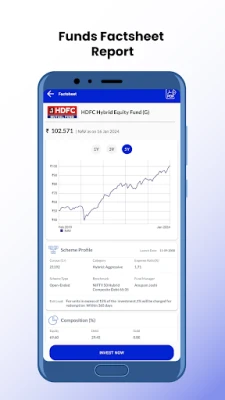

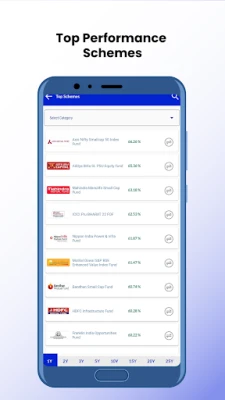

Understanding Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They offer a convenient way for individuals to invest in a professionally managed fund without needing extensive market knowledge.

Key Features of Mutual Funds

- Research-Driven Investments: Mutual funds are managed by experienced professionals who conduct thorough research and analysis to select the best-performing assets.

- Accessibility: With a dedicated app, investors can easily access their mutual fund accounts, track performance, and make informed decisions.

- Paperless Investment: The account opening process is quick and straightforward, allowing investors to start their journey in minutes.

Exploring Equity Shares

Equity shares represent ownership in a company. When you buy equity shares, you become a shareholder and can benefit from the company's growth through capital appreciation and dividends.

Benefits of Investing in Equity Shares

- High Return Potential: Historically, equity shares have provided higher returns compared to other investment options over the long term.

- Liquidity: Equity shares can be easily bought and sold on stock exchanges, providing investors with liquidity.

- Ownership and Voting Rights: Shareholders have a say in company decisions, making equity investment more engaging.

Understanding Bonds

Bonds are fixed-income securities that represent a loan made by an investor to a borrower, typically a corporation or government. They are considered safer than stocks and provide regular interest payments.

Why Invest in Bonds?

- Stable Income: Bonds offer predictable returns through regular interest payments, making them ideal for conservative investors.

- Capital Preservation: Bonds are less volatile than stocks, providing a safer investment option during market downturns.

- Diversification: Including bonds in your portfolio can help balance risk and enhance overall returns.

Fixed Deposits: A Safe Haven

Fixed deposits (FDs) are a popular investment choice for risk-averse individuals. They offer a fixed interest rate over a specified tenure, ensuring capital protection and guaranteed returns.

Advantages of Fixed Deposits

- Guaranteed Returns: FDs provide assured returns, making them a reliable investment option.

- Flexible Tenure: Investors can choose the duration of their deposits, ranging from a few months to several years.

- Tax Benefits: Certain fixed deposits qualify for tax deductions under Section 80C of the Income Tax Act.

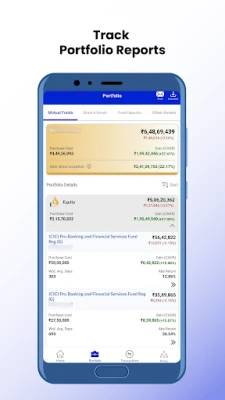

Portfolio Management Services (PMS)

PMS offers personalized investment management services for high-net-worth individuals. It involves a tailored investment strategy based on the client's financial goals and risk appetite.

Why Choose PMS?

- Customized Investment Strategy: PMS provides a bespoke approach, aligning investments with individual financial objectives.

- Professional Management: Experienced fund managers oversee the portfolio, ensuring optimal asset allocation and performance.

- Regular Monitoring: PMS includes continuous tracking and rebalancing of the portfolio to adapt to market changes.

The Importance of Insurance

Insurance is a critical component of financial planning, providing protection against unforeseen events. It ensures financial security for you and your loved ones.

Types of Insurance to Consider

- Life Insurance: Offers financial protection to beneficiaries in the event of the policyholder's death.

- Health Insurance: Covers medical expenses, ensuring access to quality healthcare without financial strain.

- Property Insurance: Protects your assets, such as homes and vehicles, against damage or loss.

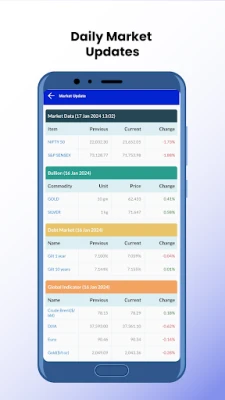

Investment Tools and Calculators

To effectively manage your investments and achieve your financial goals, utilizing investment calculators can be invaluable. Here are some essential tools:

- Retirement Calculator: Estimate how much you need to save for a comfortable retirement.

- SIP Calculator: Calculate the potential returns on your Systematic Investment Plan (SIP).

- SIP Delay Calculator: Understand the impact of delaying your SIP investments.

- SIP Step-Up Calculator: Plan for increasing your SIP contributions over time.

- Marriage Calculator: Estimate the funds required for your child's marriage.

- EMI Calculator: Calculate your Equated Monthly Installments for loans.

Conclusion

Investing wisely is essential for securing your financial future. By understanding various investment options such as mutual funds, equity shares, bonds, fixed deposits, PMS, and insurance, you can make informed decisions that align with your financial goals. Utilize the available tools and resources to track your investments and ensure you are on the right path to achieving your financial aspirations.

Rate the App

User Reviews

Popular Apps

Editor's Choice