Latest Version

Version

1.32.1

1.32.1

Update

October 15, 2025

October 15, 2025

Developer

CB BANK PCL

CB BANK PCL

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.cbbank.cbmbanking

com.cbbank.cbmbanking

Report

Report a Problem

Report a Problem

More About CB Pay

CB Bank PCL is one of the largest private banks in Myanmar. CB Bank was established on 21st August 1992 with the permission of the Central Bank of Myanmar under the law of Financial Institutions of Myanmar and the Central Bank of Myanmar.

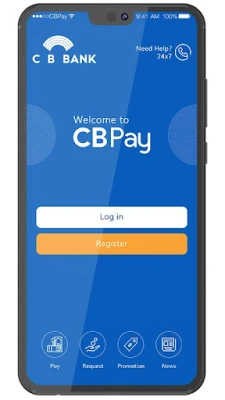

Unlocking Convenience: Discover the Benefits of CB Pay Mobile Banking

In today's fast-paced world, banking needs to be as dynamic as the lives we lead. CB Bank is committed to enhancing customer experiences by providing innovative and reliable financial services. With the launch of the CB Pay mobile banking app, customers can now enjoy seamless banking solutions right at their fingertips. This article explores the features and benefits of CB Pay, designed to simplify your financial transactions and elevate your lifestyle.What is CB Pay?

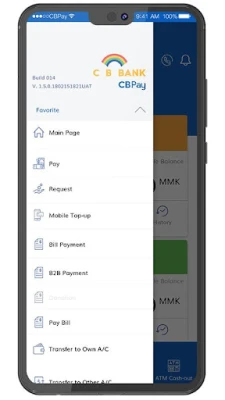

CB Pay is a cutting-edge mobile banking application that caters to all mobile devices. This user-friendly app allows customers to easily register for a wallet account, ensuring that banking is accessible to everyone. For those who already possess an ATM card, registration is even simpler; just input your ATM card number, and CB Pay will automatically link to your account.Key Features of CB Pay

CB Pay is packed with features that make banking not only convenient but also enjoyable. Here’s a closer look at what this app has to offer:1. Effortless Money Transfers

With CB Pay, transferring money has never been easier. Customers can send funds to any CB Bank account using various methods, including ATM card numbers, account numbers, phone numbers (CB Pay numbers), or even NRIC numbers for those without a bank account or wallet. This flexibility ensures that everyone can participate in the digital banking revolution.2. Dynamic QR Code Payments

Paying or requesting money is a breeze with the dynamic QR code feature. CB Pay users can generate and scan QR codes to facilitate quick and secure transactions, making it ideal for both personal and business use.3. Static QR Code Payments

Whether you’re dining at a restaurant, shopping at a store, or hailing a taxi, CB Pay allows you to make payments using static QR codes. This feature enhances convenience and speeds up the payment process, ensuring you can complete transactions without hassle.4. Instant Balance Checks

Stay informed about your finances with the ability to check your default account balance at a glance. CB Pay provides a sneak peek into your account, helping you manage your funds effectively.5. Mobile Top-Ups

CB Pay supports mobile top-ups for major service providers, including MPT, MecTel, Telenor, and Ooredoo. This feature allows you to recharge your mobile phone quickly and efficiently, ensuring you stay connected.6. Comprehensive Banking Services

Beyond basic transactions, CB Pay offers a range of banking services. Customers can apply for ATM cards, loans, or cheque books directly through the app, streamlining the banking experience.7. Bill Payments Made Easy

Paying bills is often a tedious task, but CB Pay simplifies this process. Users can pay for utilities, such as electricity and 4-TV bills, as well as insurance premiums, all from the comfort of their mobile devices.8. Credit Card Management

CB Pay also allows users to top-up their MasterCard or Visa cards and repay credit card balances. This feature helps you stay on top of your financial obligations without the need for multiple apps.9. Locate CB Bank Services

Need to find the nearest CB Bank ATM, CRM, branch, or exchange counter? CB Pay has you covered. The app provides real-time locations of CB Bank services and merchants, making it easy to access banking facilities on-the-go.10. Scheduled Payments

Plan your finances with the scheduling feature, which allows you to set up payments for specific purposes and dates. This functionality ensures you never miss a payment deadline again.11. Up-to-Date Exchange Rates

Stay informed about the latest exchange rates with CB Pay. This feature is particularly beneficial for those who frequently engage in foreign transactions or travel abroad.Why Choose CB Pay?

CB Pay is more than just a mobile banking app; it’s a comprehensive financial solution designed to meet the needs of modern customers. With its user-friendly interface, robust features, and commitment to security, CB Pay stands out in the competitive landscape of mobile banking. By choosing CB Pay, you gain access to a world of convenience, allowing you to manage your finances effortlessly. Whether you’re transferring money, paying bills, or applying for banking services, CB Pay ensures that your banking experience is smooth and enjoyable.Conclusion

In conclusion, CB Pay is revolutionizing the way customers interact with their finances. With its innovative features and commitment to customer satisfaction, CB Bank is paving the way for a new era of banking. Download the CB Pay app today and experience the future of banking at your fingertips. Embrace the convenience, security, and efficiency that CB Pay offers, and take control of your financial journey like never before.Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Roman empire games - AoD RomeRoboBot Studio

CHANCE THE GAMETake Your Chance !

XENO; Plan, AutoSave & InvestXENO Investment

Dot PaintingChill Calm Cute

Trovo - Watch & Play TogetherTLIVE PTE LTD

Tank Hero: Jump 3DAMANDA

Commando Assault: Gun ShooterCommando Gun Shooter Game

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD