Latest Version

4014.0.0

December 23, 2024

Canvas Credit Union

Finance

Android

0

Free

com.canvascu.canvascu

Report a Problem

More About Canvas Credit Union

Unlocking Financial Wellness: Essential Tools for Your Financial Journey

In today's fast-paced world, achieving financial wellness is more important than ever. With the right tools and resources, you can set savings goals, track your spending, and enhance your overall financial health. This article explores various financial wellness tools that can help you take control of your finances and make informed decisions.

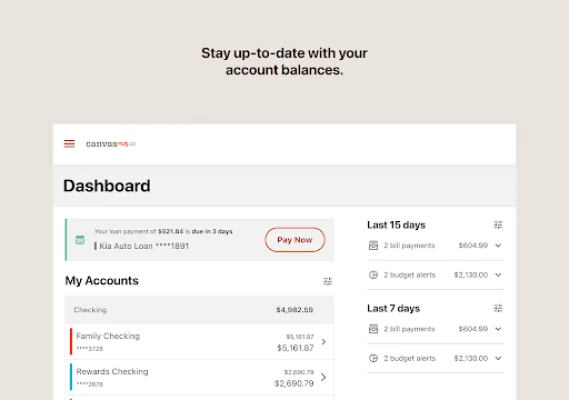

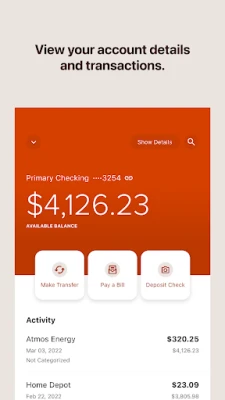

Set Savings Goals and Track Your Spending

Establishing clear savings goals is the first step toward financial wellness. Whether you're saving for a vacation, a new car, or an emergency fund, having a target in mind can motivate you to save consistently. Utilize budgeting apps and tools that allow you to track your spending habits. By monitoring where your money goes, you can identify areas to cut back and allocate more towards your savings.

Mobile Check Deposit: Convenience at Your Fingertips

Gone are the days of rushing to the bank to deposit checks. With mobile check deposit, you can securely deposit checks by simply taking a photo with your smartphone. This feature not only saves you time but also provides peace of mind knowing your funds are deposited quickly and securely.

Apply Online: Financial Services Made Easy

Applying for financial products has never been easier. With online platforms, you can apply for credit cards, loans, savings accounts, and more from the comfort of your home or on the go. The QuickApply feature streamlines the application process, allowing you to get the financial products you need without the hassle of in-person visits.

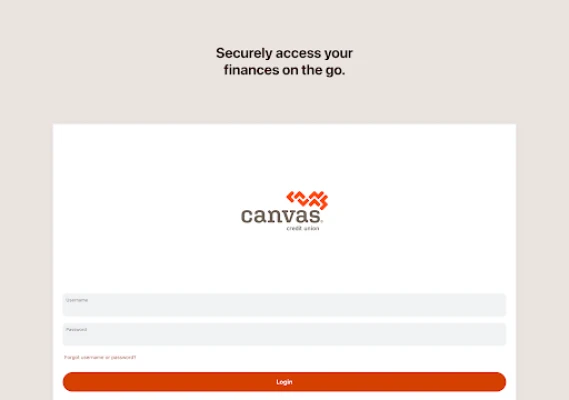

Secure Login: Protecting Your Financial Information

Your financial security is paramount. Utilizing multi-factor authentication for secure login adds an extra layer of protection to your accounts. This ensures that only you can access your sensitive financial information, safeguarding you against potential fraud and identity theft.

Connect Outside Accounts: A Comprehensive Financial Overview

Managing multiple accounts can be overwhelming. By connecting accounts from other financial institutions through a 360 View feature, you can simplify your finances. This tool provides a comprehensive overview of your financial situation, allowing you to make informed decisions and better manage your money.

Make Payments: Streamlining Your Financial Obligations

Setting up bill and loan payments has never been easier. With the ability to establish one-time or recurring payments, you can ensure that your financial obligations are met on time. This not only helps you avoid late fees but also contributes to a healthier credit score.

Move Money: Quick Transfers Made Simple

Need to transfer money between accounts or send funds to friends and family? With Zelle®, you can quickly and securely send and receive money. This feature eliminates the need for cash or checks, making transactions seamless and efficient.

Overdraft Protection: Peace of Mind for Your Transactions

Overdrafts can lead to costly fees and financial stress. By utilizing overdraft protection, you can ensure that your transactions are covered. This feature allows you to link a second account to your checking account, providing a safety net for unexpected expenses.

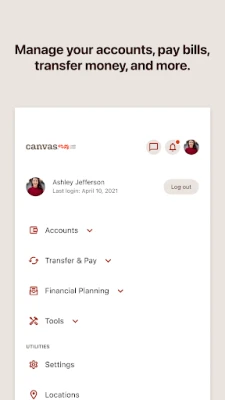

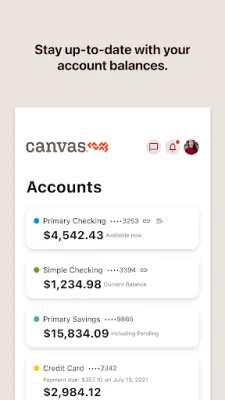

The Benefits of Online & Mobile Banking

Online and mobile banking offer numerous advantages that enhance your financial management experience:

- 24/7 Access: Manage your finances anytime, anywhere.

- Card Control: Monitor and control your debit and credit cards with ease.

- Mobile Wallet: Make secure payments using your smartphone.

- Free Credit Score: Stay informed about your credit health.

- Update Personal Info: Easily keep your information current.

- Find Locations: Locate nearby ATMs and branches effortlessly.

- Get eStatements: Access your financial statements online for convenience.

In conclusion, leveraging financial wellness tools can significantly enhance your financial journey. From setting savings goals to utilizing mobile banking features, these resources empower you to take control of your finances and work towards a secure financial future. For more information, visit canvas.org/disclosures. Remember, your financial wellness is within reach!

Insured by NCUA. Equal Housing Opportunity.

Rate the App

User Reviews

Popular Apps

Editor's Choice