Latest Version

1.0.9

June 09, 2025

CANARA BANK

Finance

Android

0

Free

com.canarabank.candimerchant

Report a Problem

More About Canara ai1 - Merchant App

Canara Bank Unveils Innovative UPI-Centric App for Merchants

In a significant move to enhance digital transactions, Canara Bank has launched a cutting-edge UPI-centric application tailored specifically for merchants. This app is designed to streamline payment processes and provide a comprehensive suite of features that empower businesses to manage their transactions efficiently. Below, we explore the key functionalities of this innovative app.

Seamless Registration Process

The app offers a user-friendly registration process that allows merchants to sign up quickly and easily. By providing essential business information, merchants can create their accounts in just a few simple steps. This streamlined approach ensures that businesses can start accepting payments without unnecessary delays.

Add Sub-Merchants Effortlessly

One of the standout features of the Canara Bank app is the ability to add sub-merchants. This functionality is particularly beneficial for businesses with multiple locations or those that operate under various brands. By enabling the addition of sub-merchants, the app allows for better management of transactions and sales data across different outlets.

Comprehensive Business Dashboard

The app includes a robust business dashboard that provides merchants with real-time insights into their sales performance. This dashboard displays key metrics such as total sales, transaction history, and customer engagement, allowing merchants to make informed decisions based on accurate data. With this feature, businesses can track their growth and identify areas for improvement.

Access to Detailed Account Statements

Merchants can easily access their account statements through the app, providing them with a clear overview of their financial transactions. This feature simplifies record-keeping and helps businesses maintain transparency in their financial dealings. By having access to detailed statements, merchants can better manage their cash flow and prepare for tax obligations.

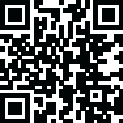

Download BHIM QR Codes Instantly

The app allows merchants to download BHIM QR codes directly, facilitating quick and easy payment acceptance. By displaying these QR codes at their physical locations or online platforms, merchants can offer customers a convenient payment option, enhancing the overall shopping experience.

Local Language Support for Enhanced Accessibility

Understanding the diverse linguistic landscape of India, the Canara Bank app provides local language support. This feature ensures that merchants from various regions can navigate the app comfortably, making it accessible to a broader audience. By breaking down language barriers, Canara Bank aims to empower more merchants to embrace digital payments.

Voice Notifications for Transaction Updates

To keep merchants informed about their transactions, the app includes a voice notification feature. This functionality alerts users about successful payments, refunds, and other important updates, ensuring that merchants stay updated without needing to constantly check their devices. This hands-free approach enhances convenience and allows merchants to focus on their core business activities.

Timely App Notifications

The app also sends timely notifications to keep merchants informed about new features, updates, and promotional offers. These notifications ensure that users are always aware of the latest enhancements and can take full advantage of the app's capabilities. By staying connected, merchants can optimize their use of the app and improve their overall business operations.

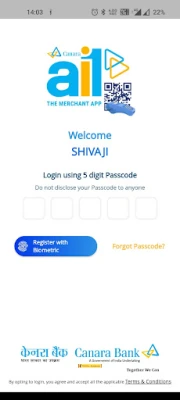

Easy Login for Onboarded Merchants

For merchants who have already onboarded, accessing the app is a breeze. They can log in using their registered mobile numbers and complete the OTP verification process. This secure login method ensures that only authorized users can access sensitive business information, providing peace of mind to merchants.

Conclusion: Empowering Merchants with Digital Solutions

The launch of Canara Bank's UPI-centric app marks a significant step towards empowering merchants in the digital payment landscape. With its array of features designed to simplify transactions and enhance business management, this app is set to revolutionize the way merchants operate. By embracing this innovative solution, businesses can not only improve their payment processes but also drive growth and customer satisfaction in an increasingly digital world.

Rate the App

User Reviews

Popular Apps

Editor's Choice