Latest Version

October 17, 2025

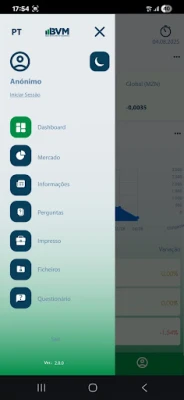

BVM-MZ

Finance

Android

0

Free

com.BVM.BVM

Report a Problem

More About BVM Móvel

Comprehensive Guide to Stock Market Index Verification and Transaction Analysis

The stock market is a dynamic environment where investors seek to maximize their returns through informed decisions. Understanding the various components of the market, including index verification, transaction statistics, and detailed analysis of securities, is crucial for both novice and experienced investors. This article delves into the essential aspects of stock market indices, transaction statistics, and the tools available for in-depth analysis.

Understanding Stock Market Index Verification

Stock market indices serve as benchmarks for measuring the performance of a group of stocks. Regular verification of these indices and their variations is vital for investors to gauge market trends and make informed decisions.

Daily Index Verification and Variations

Investors should regularly check the stock market index to understand its daily performance. This includes:

- Current Index Value: The latest value of the index, reflecting the overall market performance.

- Percentage Change: The daily variation in the index, indicating whether the market is trending upwards or downwards.

Key Statistics in Stock Market Transactions

Statistics play a crucial role in understanding market dynamics. Here are some key metrics to consider:

Daily Market Capitalization

Market capitalization represents the total value of all listed companies within the index. Monitoring daily changes in market capitalization helps investors assess the overall health of the market.

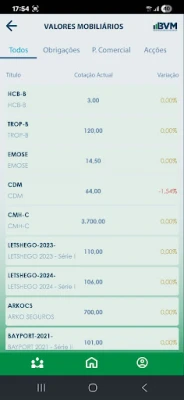

Daily Transaction Volume by Security Type

Understanding the volume of transactions for different types of securities provides insights into investor behavior and market interest. This includes:

- Equities: Stocks traded on the exchange.

- Bonds: Debt securities that are also actively traded.

- Derivatives: Financial contracts whose value is derived from underlying assets.

Daily Number of Transactions by Security Type

The number of transactions conducted daily can indicate market activity levels. A higher number of transactions often correlates with increased investor interest and market volatility.

Recent Market Transactions

Keeping track of the latest transactions is essential for understanding market movements. Here’s what to look for:

Listing of the Last 5 Transactions

Investors should review the most recent transactions, which include:

- Transaction Price: The price at which the security was traded.

- Price Variation: Changes in price compared to previous transactions.

In-Depth Transaction Analysis

For a more granular understanding of market activity, detailed transaction analysis is invaluable.

Grouped Analysis by Security Type

Investors can analyze transactions grouped by security type, allowing for targeted insights into specific market segments.

Detailed Security Information

Each security has unique characteristics that investors should monitor closely. Key information includes:

Security Overview

- Current Price: The latest trading price of the security.

- Percentage Variation: The percentage change in price over a specified period.

- Price Variation Over the Last 7 Days: Historical price changes that provide context for current performance.

- Events: Important occurrences such as offerings or suspensions that may impact the security.

- Price Variation History: A record of price changes over time, helping investors identify trends.

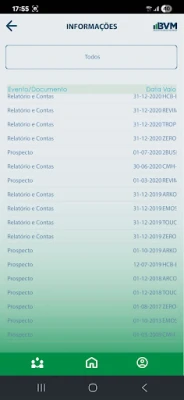

Comprehensive Event Listings

Staying informed about events related to securities is crucial for making timely investment decisions. A general listing of all events can provide valuable insights into market movements.

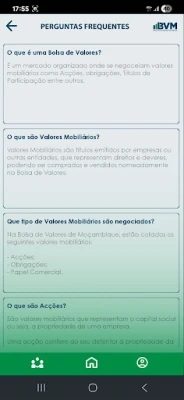

Frequently Asked Questions

Investors often have questions regarding stock market operations. Here are some common inquiries:

What is a stock market index?

A stock market index is a statistical measure that reflects the performance of a specific group of stocks, providing insights into market trends.

How can I track daily market performance?

Investors can track daily market performance through financial news websites, stock market apps, and brokerage platforms that provide real-time data.

What factors influence stock prices?

Stock prices are influenced by various factors, including company performance, market conditions, economic indicators, and investor sentiment.

How do I analyze a security's performance?

To analyze a security's performance, consider its price history, market trends, and any relevant news or events that may impact its value.

Conclusion

Understanding the intricacies of stock market indices, transaction statistics, and detailed security analysis is essential for making informed investment decisions. By staying updated on market trends and utilizing available tools, investors can enhance their strategies and potentially increase their returns.

Rate the App

User Reviews

Popular Apps

Editor's Choice