Latest Version

Version

4.2.0

4.2.0

Update

December 21, 2024

December 21, 2024

Developer

The Budgeting App

The Budgeting App

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.thebudgetingapp.thebudgetingapp

com.thebudgetingapp.thebudgetingapp

Report

Report a Problem

Report a Problem

More About Budgeting App - Spend Tracker

The Budgeting App is a simple and easy-to-use budget planner and daily expense tracker designed to simplify your personal finance.

Master Your Finances: The Ultimate Guide to Effective Budgeting Tools

Managing your finances can often feel overwhelming, but with the right tools, you can take control of your spending and achieve your financial goals. This article explores essential features of modern budgeting apps that can help you streamline your financial management.Seamless Device Synchronization

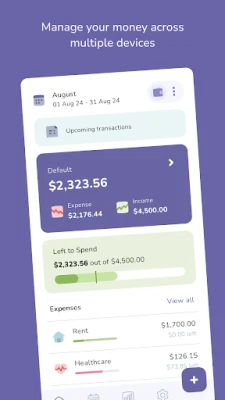

One of the standout features of contemporary budgeting applications is the ability to sync across multiple devices. This functionality allows you to effortlessly switch between your smartphone, tablet, and computer, ensuring that you always have access to your financial data. Whether you’re at home or on the go, you can stay updated on your spending habits and financial objectives, making it easier to make informed decisions.Flexible Budgeting Options

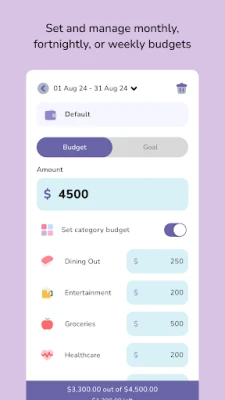

Every individual has a unique pay cycle, and a flexible budgeting tool can adapt to your specific needs. Whether you receive your income monthly, bi-weekly, or weekly, a good budgeting app allows you to adjust your budget accordingly. This adaptability ensures that you can allocate your funds effectively, helping you to manage your expenses without stress.Customizable Categories for Personal Touch

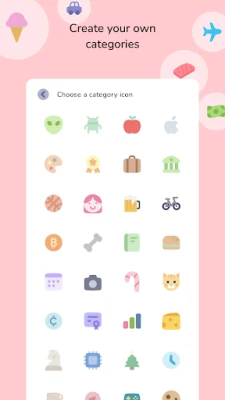

Personalization is key when it comes to budgeting. Many apps offer a variety of charming icons and customizable categories, allowing you to tailor your budget planner to reflect your lifestyle. By creating categories that resonate with you, you can make tracking your expenses more engaging and intuitive. This personal touch not only enhances your budgeting experience but also encourages you to stay committed to your financial goals.Automated Management of Recurring Transactions

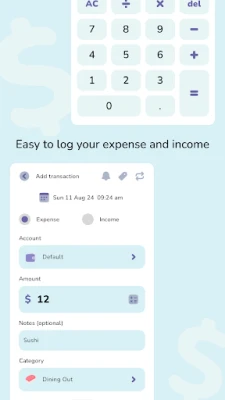

Managing recurring bills and subscriptions can be tedious, but budgeting apps simplify this process. With features that automatically track expenses like health insurance or streaming services such as Netflix, you can ensure that you never miss a payment. This automation not only saves you time but also helps you maintain a clear overview of your financial commitments.Integrated Calculator for Quick Calculations

Budgeting apps often come equipped with an in-built calculator, allowing you to perform calculations directly within the app. This feature is particularly useful when logging income or expenses, as it eliminates the need to switch between different tools. With everything in one place, you can make quick calculations and adjustments, streamlining your budgeting process.Visualize Your Finances with Timeline and Calendar Views

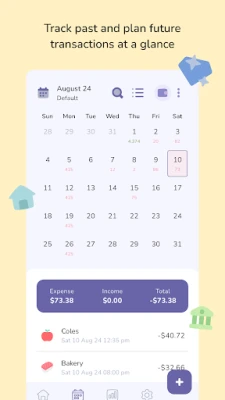

Tracking your transactions is crucial for effective budgeting, and many apps offer both timeline and calendar views. These distinct formats allow you to visualize your past spending while planning for future expenses. By having a clear picture of your financial history and upcoming obligations, you can make better decisions and avoid overspending.Gain Insights with Detailed Analytics

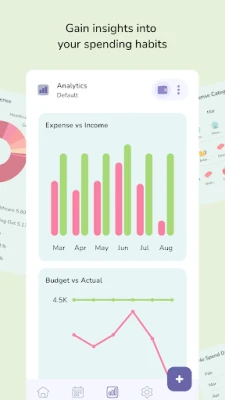

Understanding your spending habits is essential for effective financial management. Budgeting apps provide insightful analytics that help you monitor your averages and trends over time. By analyzing your financial data, you can identify areas where you may be overspending and make necessary adjustments to stay on track with your financial goals.Comprehensive Control with Multiple Accounts

For those managing various financial responsibilities, the ability to create multiple accounts within a budgeting app is invaluable. This feature allows you to set unique budgets, goals, and even currencies for each account, providing a comprehensive view of your financial landscape. Whether you’re budgeting for personal expenses, savings, or investments, having multiple accounts ensures that you maintain control over your finances.Conclusion: Take Charge of Your Financial Future

In today’s fast-paced world, effective financial management is more important than ever. By utilizing the features of modern budgeting apps—such as seamless device synchronization, flexible budgeting options, customizable categories, automated transaction management, integrated calculators, visual tracking tools, insightful analytics, and comprehensive account control—you can take charge of your financial future. Embrace these tools to simplify your budgeting process and achieve your financial goals with confidence.Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

PrivacyWallPrivacyWall

Rogue SlimeQuest Seeker Games

Trovo - Watch & Play TogetherTLIVE PTE LTD

Roman empire games - AoD RomeRoboBot Studio

XENO; Plan, AutoSave & InvestXENO Investment

Commando Assault: Gun ShooterCommando Gun Shooter Game

CHANCE THE GAMETake Your Chance !

Citi Mobile Check DepositCitibank N.A.

RBC MobileRoyal Bank of Canada

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD