Latest Version

2.9.10

December 26, 2024

Bank of China (Hong Kong) Limited

Finance

Android

0

Free

com.bochk.bocpay

Report a Problem

More About BoC Pay

Unlocking the Benefits of BoC Pay: Your Ultimate Guide

In today's fast-paced digital world, mobile payment solutions have become essential for seamless transactions. BoC Pay stands out as a versatile platform that caters to various financial needs. This article delves into the key features of BoC Pay, highlighting its advantages and how it can enhance your spending experience.

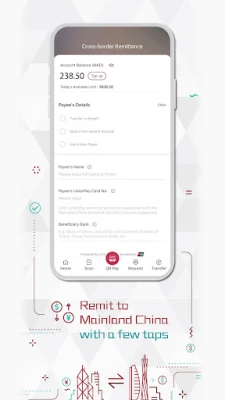

1. Cross-Border Spending Made Easy

One of the standout features of BoC Pay is its ability to facilitate cross-border spending. Whether you're shopping for essentials, dining out, or exploring retail options, BoC Pay allows you to make payments effortlessly. By simply scanning a QR code, you can shop not only in mainland China but also in Hong Kong, Macao, and around the globe. This feature is particularly beneficial for travelers and expatriates who need a reliable payment method while abroad.

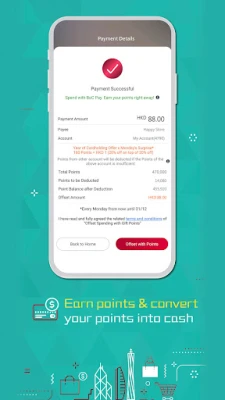

2. Attractive Rewards and Promotions

BoC Pay goes beyond basic transactions by offering a robust rewards program. Users can earn points on their spending, which can be converted into cash starting from just HK$1. This flexibility allows you to redeem your points for Gift eVouchers instantly, which can be stored within the app for future use. Additionally, BoC Pay users can take advantage of welcome offers and various promotions from partnered merchants, making every purchase more rewarding.

3. Simplified Bill Payments

Managing monthly bills can be a hassle, but BoC Pay simplifies this process significantly. Users can easily settle utility bills, including water, electricity, gas, taxes, rates, and government rent, as well as telecommunications services. This feature not only saves time but also ensures that you never miss a payment, helping you maintain a good credit score and avoid late fees.

4. Support for Faster Payment Systems (FPS)

BoC Pay is designed to enhance your financial transactions with its support for Faster Payment Systems (FPS). This feature allows users to make interbank transfers to any registered mobile number or email address, providing a convenient way to send and receive money. Additionally, you can collect funds through QR codes, making it easier than ever to manage your finances on the go.

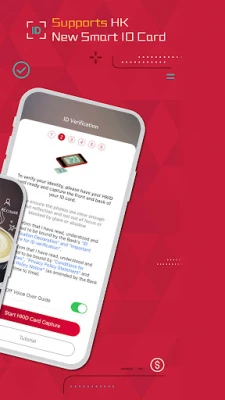

5. Enhanced Security Features

Security is a top priority for any financial application, and BoC Pay excels in this area. Before completing any transaction, users must authenticate their identity using either a password or biometric verification. This added layer of security ensures that your financial information remains protected. Furthermore, the QR code generated for payments is refreshed automatically within a specified time frame, minimizing the risk of unauthorized transactions.

6. User-Friendly Interface

BoC Pay is designed with user experience in mind. The app features a clean and intuitive interface, making it easy for users of all ages to navigate. Whether you're a tech-savvy individual or someone who prefers simplicity, BoC Pay caters to your needs, ensuring that you can manage your finances without any hassle.

7. Comprehensive Customer Support

In addition to its impressive features, BoC Pay offers comprehensive customer support. Users can access assistance through various channels, including in-app support, phone, and email. This commitment to customer service ensures that any issues or questions are addressed promptly, providing peace of mind as you use the app for your financial transactions.

Conclusion: Embrace the Future of Payments with BoC Pay

BoC Pay is more than just a mobile payment solution; it is a comprehensive platform that enhances your financial management experience. With features like cross-border spending, attractive rewards, simplified bill payments, and robust security measures, BoC Pay is poised to become your go-to app for all your payment needs. Embrace the future of payments and unlock the full potential of your financial transactions with BoC Pay today!

Rate the App

User Reviews

Popular Apps

Editor's Choice