Latest Version

P.12.3.1

February 25, 2025

Bajaj Finance Limited

Finance

Android

1

Free

org.altruist.BajajExperia

Report a Problem

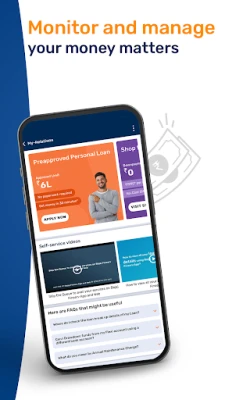

More About Bajaj Finserv: Loans, UPI & FD

Unlock Financial Freedom with the Instant Personal Loan App

In today's fast-paced world, having access to quick financial solutions is essential. The Instant Personal Loan App offers a seamless way to secure personal loans, making it easier for individuals to meet their financial needs. Whether you're a professional, self-employed, or simply looking to make a purchase, this app has you covered.

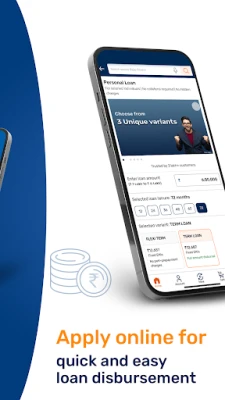

Instant Personal Loans Tailored for You

With the Instant Personal Loan App, you can obtain loans ranging from ₹20,000 to ₹55 Lakh. This flexibility allows you to choose the amount that best suits your financial situation. The app caters to various professionals, including doctors and chartered accountants, who can access specialized funding through professional loans. Additionally, self-employed individuals can benefit from affordable business loans, ensuring that everyone has the opportunity to secure the funds they need.

Key Highlights of Personal Loans

- Loan Amount: ₹20,000 to ₹55 Lakh

- Repayment Tenure: 6 to 96 months

- Rate of Interest: 10% to 32%

- Processing Fees: Up to 3.93% of the loan amount (inclusive of applicable taxes)

For instance, if you take a loan of ₹1,00,000 at an interest rate of 15% per annum for 12 months, you will incur an interest amount of ₹8,310. With a processing fee of 3.93% (₹3,930) and additional charges of ₹100, the total repayment amount after one year will be approximately ₹1,12,340. Please note that these figures are estimates; actual rates and fees may vary based on the specific loan product.

Shop with Ease on Easy EMIs

The Instant Personal Loan App also allows you to shop from over 1 million products across 1.5 lakh stores in India. From electronics and sports equipment to smartphones and furniture, you can find everything you need on Easy EMIs. Enjoy genuine products from top brands, complete with exciting offers and discounts that make shopping more affordable.

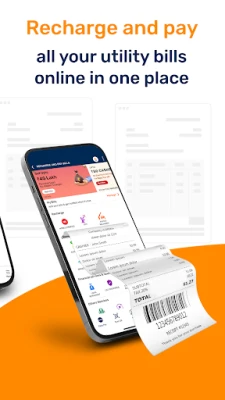

Streamlined Recharge and Bill Payments

Managing your utility bills has never been easier. With the Bajaj Finserv app, you can pay for water, LPG, electricity, and more online. Additionally, recharge your mobile numbers, DTH, and FASTag from leading providers. You can also pay fees for education, clubs, housing societies, and other services instantly. Plus, earn cashback when you use Bajaj Pay UPI for your transactions, which can be applied to future bill payments.

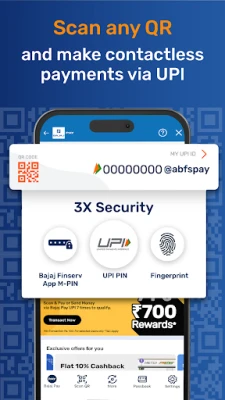

Simplified Payments with BHIM UPI

Create your unique Bajaj Pay UPI ID to enjoy exclusive UPI offers. Send and receive money, or pay bills by scanning any QR code. Authorize your payments effortlessly by entering your UPI PIN. You can also add funds to your Bajaj Pay Wallet, enabling you to make payments in seconds.

Invest with Confidence in Fixed Deposits

Maximize your savings with high returns on fixed deposits (FDs). The app offers special rates for both new and renewing FDs, allowing you to start investing online with just ₹15,000. Additionally, you can secure a loan against your FD, providing you with financial flexibility while your savings grow.

Accessible Mutual Funds for All

Investing in mutual funds has never been more accessible. With the top mutual fund app, you can start investing with as little as ₹100. Choose between monthly SIPs or lump-sum payments, and make your monthly investments via UPI. Enjoy the benefits of investing without the burden of distributor commissions, allowing you to maximize your returns.

Comprehensive Insurance Solutions

The Bajaj Finserv app offers over 300 insurance plans, including health, motor, and pocket insurance. The 100% digital process simplifies obtaining insurance, ensuring that you can protect yourself and your assets with ease.

One App for All Your Financial Needs

With the Bajaj Finserv app, you can fulfill all your shopping and travel needs on a single platform, thanks to partnerships with over 100 brands. This convenience allows you to manage your finances efficiently without juggling multiple applications.

Essential Features at Your Fingertips

- Access all your financial transactions in one place

- Calculate your EMIs using the built-in EMI Calculator

- Check your CIBIL score and obtain your credit health report online

- Download your loan account statements with ease

- Receive quick assistance and timely resolutions for your queries

Contact Us

For more information, visit Bajaj Finserv at:

Off Pune-Ahmednagar Road, Vimannagar, Pune-411014

Experience the convenience and flexibility of the Instant Personal Loan App today, and take control of your financial future!

Rate the App

User Reviews

Popular Apps

Editor's Choice