Latest Version

2.2.0

September 03, 2025

Green Dot

Finance

Android

0

Free

com.greendotcorp.walmart

Report a Problem

More About Walmart MoneyCard®

Unlock Financial Freedom with Walmart MoneyCard: Your Ultimate Guide

In today's fast-paced world, managing your finances efficiently is more important than ever. The Walmart MoneyCard offers a range of benefits designed to simplify your financial life. From early paydays to cash back rewards, this prepaid debit card is a smart choice for anyone looking to take control of their spending. Let’s explore the key features and advantages of the Walmart MoneyCard.

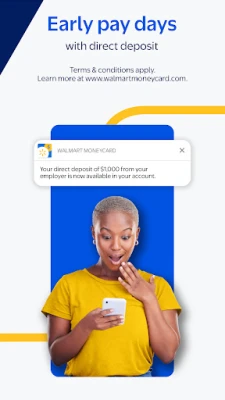

Enjoy Early Paydays with Direct Deposit

One of the standout features of the Walmart MoneyCard is the ability to receive your paycheck or government benefits through direct deposit. This means you can access your funds earlier than traditional banking methods, allowing you to manage your expenses more effectively. With direct deposit, you can enjoy peace of mind knowing your money is available when you need it.

Earn Cash Back on Purchases

Why not earn rewards while you shop? With the Walmart MoneyCard, you can earn cash back on purchases made at Walmart and Walmart.com. This feature not only helps you save money but also incentivizes you to shop at your favorite store. Every dollar spent can contribute to your savings, making your shopping experience even more rewarding.

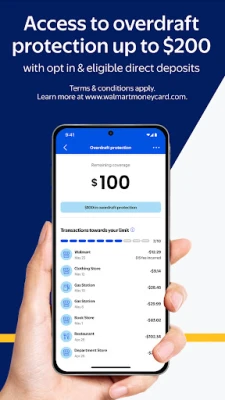

Overdraft Protection for Added Security

Financial surprises can happen, but the Walmart MoneyCard offers overdraft protection up to a specific limit when you set up eligible direct deposits and opt-in for this feature. This safety net ensures that you won’t be left in a bind if you accidentally overspend. However, be sure to review the associated fees, terms, and conditions to understand how this feature works.

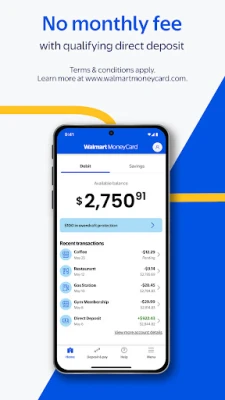

No Monthly Fees with Qualifying Direct Deposit

Many prepaid cards come with monthly maintenance fees, but the Walmart MoneyCard waives this fee when you set up a qualifying direct deposit. This means you can keep more of your hard-earned money in your pocket, making it an economical choice for budget-conscious consumers.

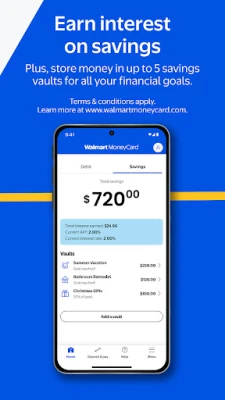

Save Smartly with Savings Vaults

The Walmart MoneyCard allows you to earn interest on your savings while providing the flexibility to store money in up to five savings vaults. Whether you’re saving for a vacation, a college fund, or any other financial goal, these vaults help you organize your savings effectively. This feature encourages disciplined saving and helps you reach your financial objectives faster.

Convenient Spending Anywhere Debit Cards Are Accepted

With the Walmart MoneyCard, you can make purchases wherever Debit MasterCard® or Visa® debit cards are accepted in the U.S. This widespread acceptance means you can use your card for everyday transactions, from grocery shopping to online purchases, without any hassle.

Easy Money Deposits

Depositing money into your Walmart MoneyCard is a breeze. You have several options to add funds:

- Direct Deposit: Set up direct deposit for your paycheck or government benefits.

- Linked Bank Account: Transfer money from a linked bank account with ease.

- Cash Reloads: Use the Walmart app to reload cash at Walmart stores nationwide.

- Mobile Check Deposit: Deposit checks using your smartphone for added convenience.

Keep in mind that fees and limits may apply, so it’s essential to review the terms before proceeding.

Eligibility and Activation Requirements

To purchase a Walmart MoneyCard, you must be at least 18 years old, as per your state’s legal age requirements. Activation of the card requires online access and identity verification, including your Social Security Number (SSN). Additionally, mobile or email verification and the Walmart app are necessary to access all features of the card.

ATM Access and Additional Fees

ATM access is available only with an activated, personalized Walmart MoneyCard. Be aware that other fees may apply, so it’s advisable to visit the official Walmart MoneyCard website for comprehensive information on fees and terms.

Privacy and Security

Your privacy is paramount. Walmart has a Technology Privacy Statement that outlines how your information is protected. Understanding these policies can help you feel secure while using your Walmart MoneyCard.

Conclusion: A Smart Financial Tool

The Walmart MoneyCard is more than just a prepaid debit card; it’s a comprehensive financial tool that offers numerous benefits to help you manage your money effectively. With features like early paydays, cash back rewards, and savings vaults, it empowers you to take control of your financial future. For complete details, including terms and conditions, visit the Walmart MoneyCard website.

Start your journey towards financial freedom today with the Walmart MoneyCard!

Rate the App

User Reviews

Popular Apps

Editor's Choice