Latest Version

1.53.0

September 22, 2024

Green Dot

Finance

Android

0

Free

com.greendot.walmart.prepaid

Report a Problem

More About Walmart MoneyCard

Unlock Financial Freedom with Walmart MoneyCard: Your Ultimate Guide

In today's fast-paced world, managing your finances efficiently is crucial. The Walmart MoneyCard offers a range of features designed to simplify your financial life while providing valuable benefits. Whether you're looking to receive your paycheck early, earn cash back, or enjoy overdraft protection, this card has you covered. Let’s explore the key features and benefits of the Walmart MoneyCard.

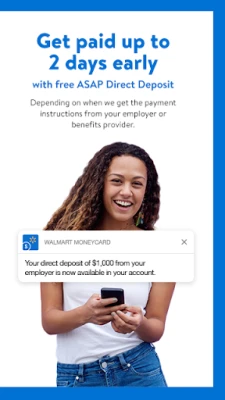

Get Paid Early with Direct Deposit

One of the standout features of the Walmart MoneyCard is the ability to receive your pay up to two days early with direct deposit. This benefit allows you to access your funds sooner, giving you more flexibility in managing your expenses. Keep in mind that the early availability of direct deposit depends on the timing of your employer's payment instructions, so it may vary from pay period to pay period.

Earn Cash Back on Your Purchases

With the Walmart MoneyCard, you can earn cash back rewards on your purchases. Enjoy:

- 3% cash back on purchases made at Walmart.com

- 2% cash back at Walmart fuel stations

- 1% cash back at Walmart stores

These rewards can add up to $75 each year, making your shopping experience even more rewarding.

Share the Benefits with Family

Walmart MoneyCard allows you to share the love by ordering accounts for up to four additional approved family members aged 13 and older. This feature is perfect for families looking to manage their finances together while enjoying the same benefits.

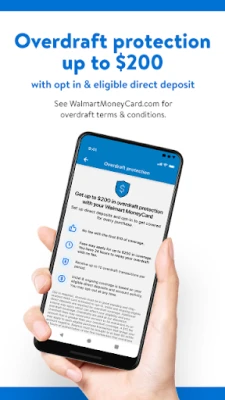

Overdraft Protection for Peace of Mind

Walmart MoneyCard offers overdraft protection of up to $200 when you opt-in and have eligible direct deposits. This feature ensures that you can cover unexpected expenses without the stress of declined transactions. Remember, your account must be in good standing to qualify for this protection.

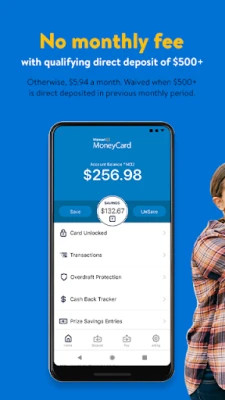

No Monthly Fees with Direct Deposit

Say goodbye to monthly fees! With a qualifying direct deposit of $500 or more, you can enjoy the Walmart MoneyCard without any monthly charges. If you don’t meet this requirement, a nominal fee of $5.94 will apply. This flexibility makes it easier for you to manage your finances without worrying about hidden costs.

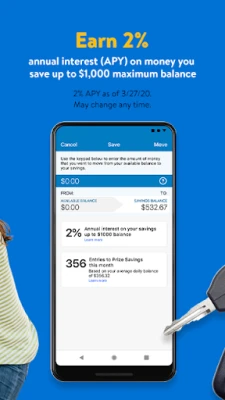

Earn Interest on Your Savings

Another attractive feature of the Walmart MoneyCard is the opportunity to earn a 2% interest rate on your savings. This interest is paid annually based on your average daily balance, allowing your money to grow over time. It’s a simple way to make your funds work for you.

Enhanced Security with Lock Protection

Misplaced your card? No problem! The Walmart MoneyCard app includes a lock protection feature. Simply press LOCK to prevent any purchases, and when you find your card, press UNLOCK to restore access instantly. This feature provides peace of mind, knowing that your funds are secure.

Convenient Usage Anywhere

The Walmart MoneyCard can be used for purchases wherever Debit MasterCard® or Visa® debit cards are accepted in the U.S. This versatility makes it a practical choice for everyday transactions.

Easy Deposit Options

Funding your Walmart MoneyCard is a breeze with several convenient deposit options:

- Direct Deposit: Set up direct deposit for your paycheck or government benefits.

- Bank Transfers: Add money from your existing bank account.

- Free Cash Reloads: Reload your card for free at Walmart stores nationwide using the app.

- Mobile Check Deposit: Deposit checks using your smartphone for added convenience.

Customer Support at Your Fingertips

If you have any questions about your Walmart MoneyCard, help is just a click or call away. Log in to walmartmoneycard.com to email customer support or call the number on the back of your card for assistance.

Eligibility and Activation Requirements

To purchase a Walmart MoneyCard, you must be 18 years or older. Activation requires online access and identity verification, including your Social Security Number (SSN). Additionally, mobile or email verification and the mobile app are necessary to access all features. For detailed information on fees, terms, and conditions, visit the Walmart MoneyCard legal information page.

Conclusion

The Walmart MoneyCard is an excellent financial tool that offers a variety of features to help you manage your money effectively. From early direct deposit and cash back rewards to overdraft protection and easy deposit options, this card is designed to meet your financial needs. Take control of your finances today with the Walmart MoneyCard and enjoy the benefits it brings!

Rate the App

User Reviews

Popular Apps

Editor's Choice