Latest Version

4.41.124

January 20, 2026

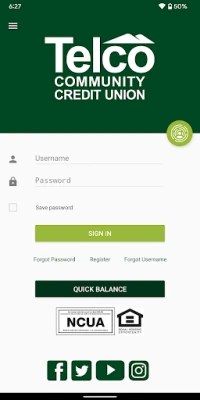

Telco Community Credit Union

Finance

Android

0

Free

com.softek.ofxclmobile.telcoccu

Report a Problem

More About Telco Mobile

Unlocking the Power of Online Banking: Essential Features You Need to Know

In today's fast-paced digital world, managing your finances efficiently is more important than ever. Online banking offers a suite of features designed to simplify your financial management, providing you with the tools you need to stay on top of your accounts. This article explores the essential features of online banking that can enhance your financial experience.

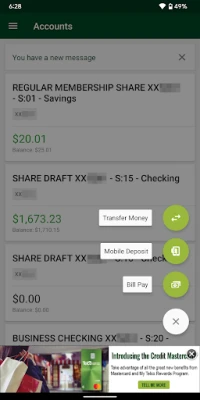

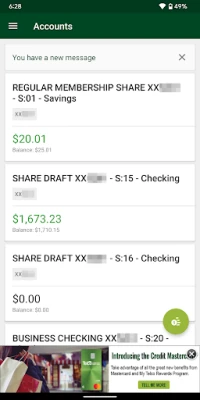

1. Monitor Your Account Balances and Activity

One of the primary benefits of online banking is the ability to view your account balances and transaction history in real-time. This feature allows you to keep track of your finances effortlessly, ensuring you are always aware of your current financial standing. With just a few clicks, you can access detailed information about your accounts, helping you make informed financial decisions.

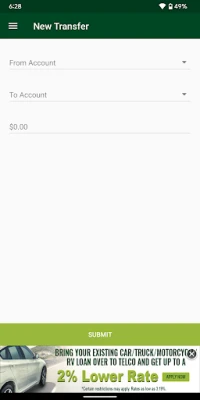

2. Effortless Fund Transfers

Online banking makes transferring funds between your accounts, shares, and even external financial institutions a breeze. Whether you need to move money between savings and checking accounts or send funds to another bank, the process is quick and straightforward. This feature not only saves you time but also provides peace of mind knowing that your money is where you need it, when you need it.

3. Visualize Your Finances with Expense Graphs

Understanding your financial habits is crucial for effective budgeting. Online banking platforms often include expense graphs that provide a visual overview of your incoming funds and outgoing expenses. These graphs help you identify spending patterns, allowing you to make adjustments to your budget and improve your financial health.

4. Convenient Loan Payments

Paying off loans can be a hassle, but online banking simplifies this process. With just a few clicks, you can make loan payments directly from your account. This feature ensures that you never miss a payment, helping you maintain a good credit score and avoid late fees.

5. Streamlined Bill Payments with Bill Pay

Say goodbye to the stress of managing multiple bills. The integrated Bill Pay service allows you to make payments or set up recurring payments with ease. You can schedule payments in advance, ensuring that your bills are paid on time, every time. This feature not only saves you time but also helps you avoid late fees and penalties.

6. Stay Informed with Account Alerts

Keeping track of important account information is crucial for effective financial management. Online banking allows you to set up account alerts that notify you of significant changes or activities in your accounts. Whether it's a low balance alert or a notification of a large transaction, these alerts help you stay informed and in control of your finances.

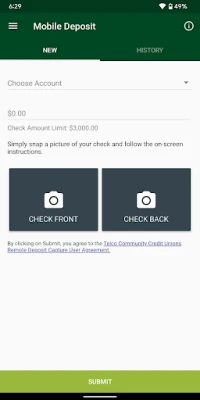

7. Quick and Easy Check Deposits

Gone are the days of visiting the bank to deposit checks. With online banking, you can deposit checks quickly and easily using your mobile device or tablet. Simply take a photo of the check, and the funds will be deposited into your account without the need for a physical trip to the bank. This feature adds convenience to your banking experience, allowing you to manage your finances on the go.

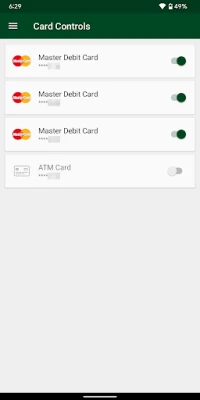

8. Enhanced Card Security Features

In an age where security is paramount, online banking offers features that allow you to manage your debit or credit card with ease. If your card is misplaced, lost, or stolen, you can quickly turn it on or off through your online banking app. This feature provides an added layer of security, ensuring that your finances remain protected at all times.

Conclusion

Online banking is revolutionizing the way we manage our finances. With features that allow you to monitor your accounts, transfer funds, pay bills, and enhance security, it provides a comprehensive solution for modern financial management. By enrolling in online banking, you can take advantage of these powerful tools and streamline your financial life. Remember, standard data and messaging rates from third parties may apply, so always check with your service provider for details.

Embrace the convenience and efficiency of online banking today, and take control of your financial future!

Rate the App

User Reviews

Popular Apps

Editor's Choice