Latest Version

January 20, 2026

Papaya Viet Nam

Finance

Android

0

Free

asia.papaya.health.care

Report a Problem

More About Papaya Care

Unlocking the Future of Insurance: The Digital Insurance Card Revolution

In today's fast-paced world, the insurance industry is undergoing a significant transformation. The introduction of the Digital Insurance Card is at the forefront of this change, offering policyholders a seamless and efficient way to manage their insurance needs. This article explores the key features and benefits of digital insurance cards, including insurance specifications, online claim submission, real-time claim history, and the advantages of a direct billing hospital network.

Understanding the Digital Insurance Card

The Digital Insurance Card serves as a modern alternative to traditional paper insurance cards. Accessible via mobile apps or online platforms, these digital cards provide users with instant access to their insurance information. This innovation not only enhances convenience but also ensures that policyholders have their coverage details at their fingertips whenever they need them.

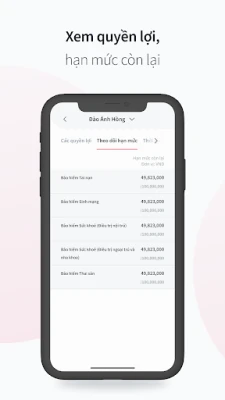

Insurance Specifications & Remaining Coverage

One of the standout features of the digital insurance card is its ability to display comprehensive insurance specifications. Users can easily view their policy details, including coverage limits, deductibles, and remaining coverage. This transparency empowers policyholders to make informed decisions regarding their healthcare and financial planning.

Moreover, the digital card updates automatically, reflecting any changes in coverage or policy terms. This real-time information helps users avoid unexpected costs and ensures they are always aware of their insurance status.

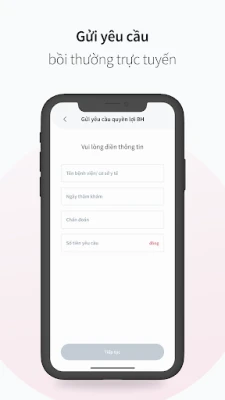

Streamlined Online Claim Submission

Gone are the days of tedious paperwork and long wait times for claim processing. The digital insurance card facilitates online claim submission, allowing users to file claims quickly and efficiently from their smartphones or computers. This feature not only saves time but also reduces the likelihood of errors that can occur with manual submissions.

With just a few clicks, policyholders can upload necessary documents, track the status of their claims, and receive notifications about any updates. This streamlined process enhances the overall customer experience and fosters greater trust in the insurance provider.

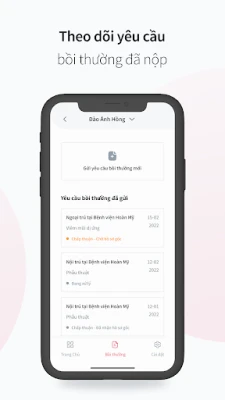

Real-Time Claim History at Your Fingertips

Another significant advantage of the digital insurance card is the ability to access real-time claim history. Users can view their past claims, including details such as dates, amounts, and statuses. This feature not only helps policyholders keep track of their claims but also aids in budgeting and financial planning.

Having a comprehensive overview of claim history allows users to identify patterns in their healthcare usage and make informed decisions about future medical needs. This level of insight is invaluable for managing both health and finances effectively.

Direct Billing Hospital Network: A Game Changer

The integration of a direct billing hospital network with digital insurance cards is a game changer for policyholders. This feature allows users to receive medical services without the need to pay upfront. Instead, hospitals and healthcare providers can directly bill the insurance company, simplifying the payment process for patients.

This not only alleviates financial stress but also enhances the overall healthcare experience. Patients can focus on their recovery rather than worrying about payment logistics, knowing that their insurance will cover eligible expenses directly.

Exciting New Features on the Horizon

The digital insurance card is continuously evolving, with a plethora of exciting new features on the horizon. Innovations such as AI-driven personalized health recommendations, telemedicine integration, and enhanced security measures are set to redefine the insurance landscape.

As technology advances, users can expect even more functionalities that cater to their unique needs. These developments will not only improve user experience but also foster a more proactive approach to health management.

Conclusion: Embracing the Digital Insurance Era

The Digital Insurance Card represents a significant leap forward in the insurance industry, offering unparalleled convenience and efficiency. With features like comprehensive insurance specifications, streamlined online claim submission, real-time claim history, and a direct billing hospital network, policyholders can navigate their insurance needs with ease.

As the industry continues to innovate, embracing these digital solutions will empower consumers to take control of their health and financial well-being. The future of insurance is here, and it is digital.

Rate the App

User Reviews

Popular Apps

Editor's Choice