Latest Version

3.52.0

August 13, 2024

Varo Bank, N.A.

Finance

Android

0

Free

com.varomoney.bank

Report a Problem

More About Varo Bank: Mobile Banking

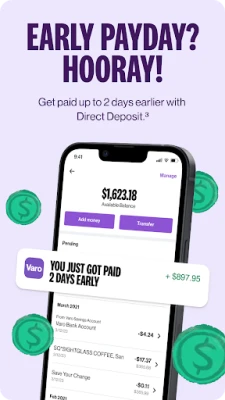

Varo Bank offers a highly rated bank account with no monthly fees or minimum balance requirements. Customers can also get paid up to two days early with direct deposit and send and receive money quickly and for free through the Varo app. The bank also provides a contactless debit card that can be instantly locked for added security. With access to over 40,000 fee-free ATMs across the United States, Varo makes it easy for customers to access their money.

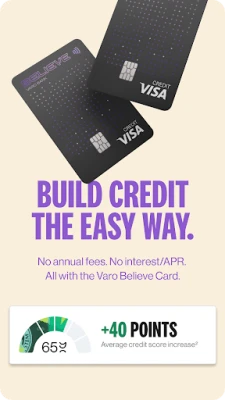

In addition to the bank account, Varo also offers a credit builder card called Varo Believe. This card does not require a security deposit and can help customers build credit through responsible use. There is no APR or annual fee associated with this card.

For those in need of a cash advance, Varo Advance allows customers to borrow up to $500 over time. This is one of the highest advance limits available and can be used to cover expenses such as rent and bills.

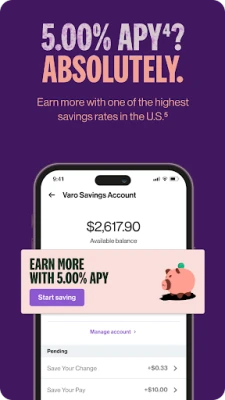

Varo also offers a high-yield savings account with easy auto-savings tools. There is no minimum balance required to open the account, but there are minimum balances required to earn interest. The bank also prioritizes security, with FDIC insurance up to $250,000 and reimbursement for unauthorized transactions through Visa Zero Liability.

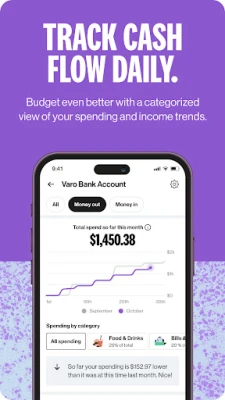

Customers can apply for Varo Bank and its services without impacting their credit score. The bank is transparent about its fees and offers a variety of tools and services to help customers manage their finances. Varo Bank is committed to helping customers achieve financial stability and growth.

Rate the App

User Reviews

Popular Apps

Editor's Choice