Latest Version

24.2.62

August 25, 2025

Upstate Telco

Finance

Android

0

Free

com.upstatetelcofcu.mobile

Report a Problem

More About Upstate Telco FCU

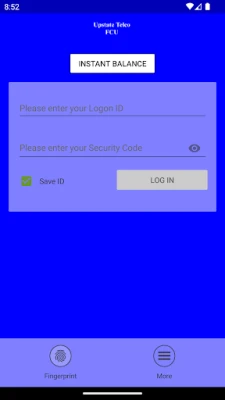

Maximize Your Banking Experience: Essential Features of Online Account Management

In today's fast-paced digital world, managing your finances efficiently is crucial. Online banking offers a plethora of features designed to enhance your banking experience. This article delves into the essential functionalities that allow you to take control of your finances seamlessly.

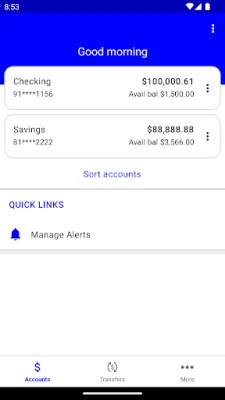

Monitor Your Account Balances with Ease

One of the primary advantages of online banking is the ability to check your account balances anytime, anywhere. Whether you’re at home, at work, or on the go, accessing your account information is just a few clicks away. This feature not only helps you stay informed about your financial status but also aids in budgeting and planning your expenses effectively.

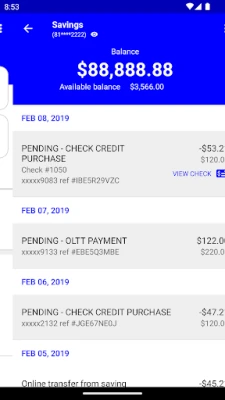

Stay Updated with Recent Transactions

Keeping track of your spending is vital for maintaining financial health. With online banking, you can easily review recent transactions to monitor your expenditures. This feature allows you to identify any unauthorized transactions quickly and helps you stay on top of your financial commitments. Regularly reviewing your transaction history can also assist in identifying spending patterns, enabling you to make informed financial decisions.

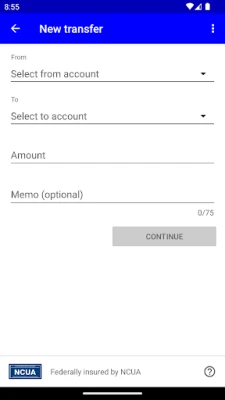

Effortless Fund Transfers Between Accounts

Transferring funds between your accounts has never been easier. Online banking provides a straightforward way to transfer funds with just a few clicks. Whether you need to move money from your checking account to your savings account or vice versa, this feature ensures that your funds are accessible when you need them. This convenience is particularly beneficial for managing your finances and ensuring that you meet your savings goals.

Secure Password Management

Security is a top priority in online banking. If you ever forget your password, the process to regain access is simple. Just click on the forgot password link, and follow the prompts to reset your password securely. This feature ensures that your account remains protected while allowing you to regain access quickly and efficiently.

Why Choose Online Banking?

Online banking offers numerous benefits that traditional banking cannot match. From the convenience of accessing your accounts 24/7 to the ability to manage your finances from the comfort of your home, the advantages are clear. Additionally, online banking platforms are often equipped with advanced security measures, ensuring that your personal and financial information remains safe.

Federally Insured for Your Peace of Mind

When you choose an online banking service, you can rest assured knowing that your funds are federally insured by the NCUA. This insurance protects your deposits, providing an extra layer of security and peace of mind. Understanding the safety measures in place can help you feel more confident in managing your finances online.

Conclusion

In conclusion, online banking offers a range of features that empower you to manage your finances effectively. From checking account balances and reviewing transactions to transferring funds and ensuring your account's security, these functionalities enhance your banking experience. Embrace the convenience of online banking and take control of your financial future today.

Rate the App

User Reviews

Popular Apps

Editor's Choice