Latest Version

2.2.4

November 13, 2025

Universal Pay PTE. LTD

Finance

Android

0

Free

com.burma.unipay2

Report a Problem

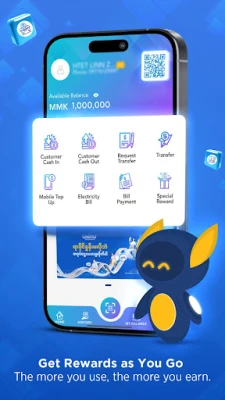

More About UniPay

Essential Functions of Modern Payment Systems

In today's fast-paced digital economy, payment systems have evolved to offer a variety of essential functions that enhance the way we conduct financial transactions. Understanding these functions can help consumers and businesses alike make informed decisions about their payment options. This article explores three key functions of modern payment systems: making payments to merchants, transferring money to individuals, and topping up accounts.

1. Making Payments to Merchants

One of the primary functions of payment systems is facilitating transactions between consumers and merchants. This process has become increasingly streamlined, allowing for quick and secure payments. Here are some key aspects of making payments to merchants:

- Variety of Payment Methods: Modern payment systems support various methods, including credit and debit cards, digital wallets, and mobile payment apps. This flexibility allows consumers to choose the method that best suits their needs.

- Enhanced Security: With advancements in encryption and tokenization, payment systems now offer robust security features that protect sensitive financial information during transactions.

- Instant Transactions: Many payment systems enable instant payments, allowing consumers to complete purchases without delays. This immediacy enhances the shopping experience and encourages consumer spending.

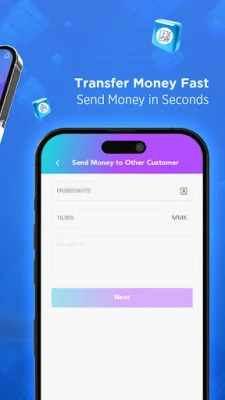

2. Transferring Money to Another Person

Another vital function of payment systems is the ability to transfer money between individuals. This feature has revolutionized how people send and receive money, making it easier than ever to settle debts, share expenses, or send gifts. Key points to consider include:

- Peer-to-Peer (P2P) Transfers: Many payment platforms offer P2P transfer services, allowing users to send money directly to friends or family with just a few taps on their smartphones. This convenience has made splitting bills and sending money for special occasions a breeze.

- Low Fees: Compared to traditional banking methods, many digital payment systems offer lower fees for money transfers, making them an attractive option for users looking to save on transaction costs.

- Global Reach: With the rise of international payment systems, users can now send money across borders quickly and efficiently, making it easier to support loved ones or conduct business globally.

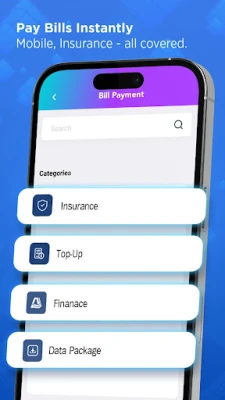

3. Topping Up Accounts

Topping up accounts is another essential function of modern payment systems. This feature allows users to add funds to their digital wallets or prepaid accounts, ensuring they have the necessary balance for future transactions. Here’s why topping up is important:

- Convenience: Users can easily add funds to their accounts through various methods, including bank transfers, credit cards, or cash deposits at partner locations. This flexibility ensures that users can maintain their account balances without hassle.

- Budget Management: Topping up accounts can help users manage their spending by allowing them to load a specific amount of money. This practice encourages responsible financial habits and helps prevent overspending.

- Access to Exclusive Offers: Many payment systems provide users with exclusive deals and discounts when they top up their accounts. This incentive can lead to significant savings over time.

Conclusion

In summary, the functions of modern payment systems—making payments to merchants, transferring money to another person, and topping up accounts—play a crucial role in enhancing the financial landscape. As technology continues to advance, these systems will likely evolve further, offering even more convenience, security, and efficiency. By understanding these functions, consumers can make better choices and fully leverage the benefits of digital payment solutions.

Rate the App

User Reviews

Popular Apps

Editor's Choice