Latest Version

11.281.6

February 01, 2026

86400

Finance

Android

0

Free

au.com.bank86400

Report a Problem

More About Ubank Money App

Unlock Financial Freedom with Ubank: Your Ultimate Guide to Everyday Banking

In today's fast-paced world, managing your finances efficiently is crucial. Ubank offers a seamless banking experience without the burden of monthly fees, making it an attractive option for everyday banking. This article explores the various features and benefits of Ubank, ensuring you have all the information you need to make an informed decision.

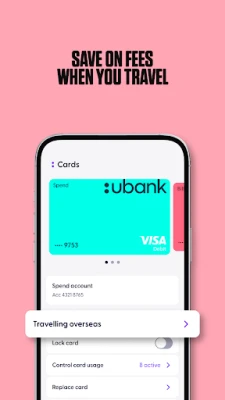

No Monthly Fees for Everyday Banking

Ubank stands out by eliminating monthly fees, both locally and internationally. This means you can enjoy your banking services without worrying about hidden charges eating into your savings. With Ubank, you can focus on what truly matters—growing your wealth and managing your finances effectively.

Unlock Bonus Interest with Ease

One of the standout features of Ubank is the opportunity to earn bonus interest on your savings. Customers can unlock a competitive interest rate on up to $1 million in total savings by meeting specific criteria. This feature encourages you to save more while enjoying attractive returns on your hard-earned money.

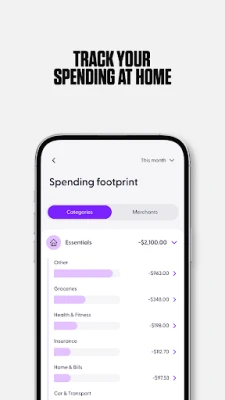

Smart Spending Insights

Understanding your spending habits is essential for effective financial management. Ubank provides insights that sync with your pay cycle, allowing you to track your expenses effortlessly. Additionally, the Split Income feature automatically divides your pay as it arrives in your account, ensuring you allocate funds to savings and bills without any hassle.

Connected Accounts for Comprehensive Financial Overview

Linking your other bank accounts to Ubank through Connected Accounts gives you a holistic view of your finances. This feature allows you to see all your money in one place, making it easier to manage your budget and plan for future expenses.

Instant Access to Your Digital Wallet

With Ubank, you can add cards to your digital wallet within minutes of signing up. This feature enables you to start spending immediately, providing convenience and flexibility in your daily transactions. Whether you're shopping online or in-store, Ubank ensures you have quick access to your funds.

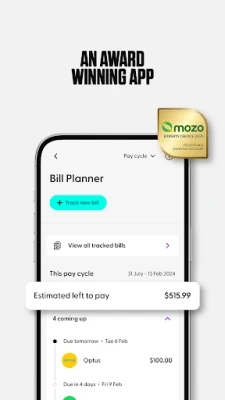

Effortless Bill Management

Staying on top of regular expenses is crucial for financial stability. Ubank offers a Bill Planner and a dedicated Bills account, making it easier to manage and pay your bills on time. This feature helps you avoid late fees and ensures that your financial obligations are met without stress.

Shared Accounts for Collaborative Finances

Ubank simplifies shared finances with its Shared Accounts feature. Whether you're managing expenses with a partner or splitting costs with friends, creating a shared account in the app is quick and easy. This functionality is perfect for everything from rent to shared experiences, fostering transparency and collaboration in financial matters.

Set and Achieve Your Savings Goals

Ubank empowers you to take control of your savings with the ability to set Savings Targets for up to 10 different accounts. You can track your progress and even automate your savings with features like Split Income and Autosave. This means you can set your goals and let Ubank do the rest, making saving a breeze.

Support for Major Financial Milestones

Ubank is not just about everyday banking; it also supports you during significant financial moments. With straightforward home loan options and a fast application review process, Ubank caters to owner-occupiers, investors, and those looking to refinance. Their local home loan specialists provide excellent customer support, ensuring you have guidance every step of the way.

Quick and Easy App Setup

Getting started with Ubank is a breeze. Download the app and set up your Spend, Save, and Bills accounts in just minutes. If you have a bonus code, enter it during signup and make five eligible card purchases within the first 30 days to earn your signup bonus. Be sure to check the full terms for details.

Security and Accessibility

Ubank is part of the NAB Group, utilizing advanced encryption technology to safeguard your money. The bank is open to Australian and New Zealand citizens, as well as Australian permanent residents aged 16 and older. To open an account, you’ll need to provide at least one form of ID, such as an Australian driver’s license, passport, Medicare card, or birth certificate.

Important Considerations

While Ubank offers a range of features designed to enhance your banking experience, it's essential to consider your personal financial situation. Review the general information provided and ensure that Ubank aligns with your financial goals. For more details, read the General Terms at ubank.com.au/general-terms and the Target Market Determinations at ubank.com.au/tmd.

Conclusion

Ubank presents a compelling option for those seeking a modern, fee-free banking experience. With features designed to simplify your financial management, from bonus interest on savings to easy bill payments and shared accounts, Ubank is equipped to meet your everyday banking needs. Take the first step towards financial freedom by exploring Ubank today.

For more information on Ubank's offerings, visit their website and discover how they can help you achieve your financial goals.

Rate the App

User Reviews

Popular Apps

Editor's Choice