Latest Version

1.6.14

February 03, 2026

Placid Inc.

Finance

Android

0

Free

money.placid.app

Report a Problem

More About Gauss: Payoff Credit Card Debt

Revolutionize Your Credit Card Management: The Ultimate Guide to Paying Off Debt Smartly

Managing credit card debt can be overwhelming, but with the right tools and strategies, you can take control of your finances. Discover how to effectively manage and pay off your credit cards while improving your credit score and financial health.

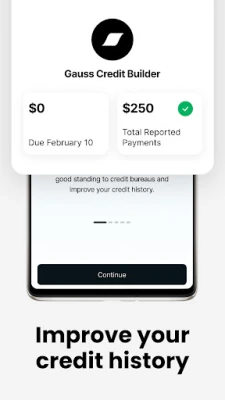

Effortless Credit Building

Enhance your credit history and boost your credit score effortlessly. With no credit checks and monthly payments under $5, you can start building your credit today. Enjoy instant initial reporting and earn rewards simply by using the service. Plus, you can apply for a low APR Gauss Credit Line, making it easier to manage your finances.

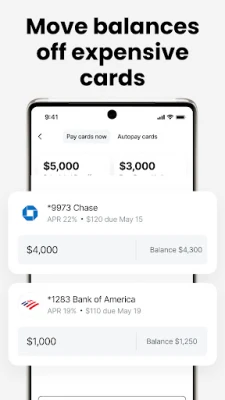

Transfer Balances from High-Interest Cards

Take advantage of the opportunity to transfer up to $15,000 from high-interest credit cards to a low APR credit line. This instant transfer not only accelerates your debt repayment but also saves you hundreds of dollars in interest charges. With instant approval and a soft credit check, you can quickly shift your balances and start saving.

Consolidate Your Credit Cards in One Convenient App

Keeping track of multiple credit cards can be challenging with varying due dates, minimum payments, and balances. Our app simplifies this process by allowing you to manage all your credit card bills from a single platform. Say goodbye to the hassle of juggling different logins and APRs.

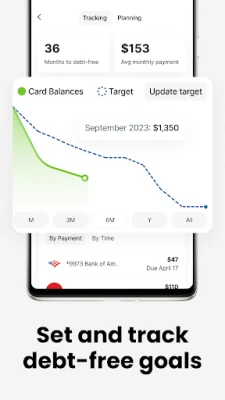

Visualize Your Debt-Free Journey

Stay motivated by seeing exactly when your debts will be fully paid off based on your monthly contributions. Our app provides recommended payment amounts to help you reach your debt-free date sooner. By increasing your contributions, you can accelerate your journey to financial freedom.

Track Your Financial Progress

Monitor your monthly progress with visual graphs that illustrate your net worth growth as you pay off debt. Witness your total debt decrease while your financial health improves, keeping you motivated throughout your journey.

Efficient Cash Flow Management

Gain a clear understanding of your finances by tracking all your income and expenses effortlessly. Our app consolidates your transactions, providing a comprehensive snapshot of your financial situation. Identify spending patterns, review larger transactions, and uncover subscriptions you no longer use, all in one place.

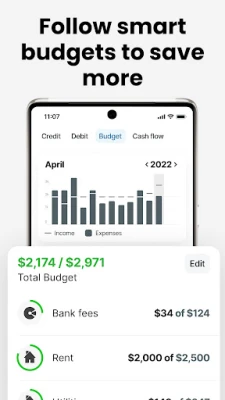

Smart Budgeting Made Simple

Set and track monthly budgets to expedite your debt repayment and increase savings. Our personalized budget recommendations, based on your financial data, allow you to get started in under a minute. Receive alerts when you exceed your budget and monitor your progress with easy-to-read graphs on your dashboard.

Prioritizing Data Security

Your privacy and data security are paramount. We implement bank-level security measures, including 256-bit encryption, to protect your information. By linking your bank accounts through Plaid, the industry leader in secure bank connectivity, you can rest assured that your data remains safe and read-only. You have the option to disconnect your accounts at any time, and we never sell or share your data with third parties unless legally required.

Exciting Features Coming Soon

Personalized Financial AI Assistant

Get ready to chat with an AI-powered personal finance assistant designed to help you make informed decisions about your money every time.

Automated Debt Payoff Strategies

Choose between the popular snowball or avalanche payoff tactics, and let the app automate the process for you. Set your plan and forget about it—our app will handle the rest!

Important Details to Consider

To qualify for a low APR Gauss Credit Line for balance transfers, a prime FICO score is required. The variable APR ranges from 14% to 18%, which adjusts with the prime rate. You will not incur any interest on your Gauss Line balance until your credit cards are paid off. Rest assured, we never charge interest on interest. Please note that our service is available only in select states, so check if your state is supported during the onboarding process in the app.

Our app and user support are exclusively available in English. Gauss is not affiliated with other financial services such as Truebill, Extra Card, Credit Karma, Earnest, and many others.

Take charge of your financial future today. Experience the smartest way to manage and pay off your credit cards, and join the thousands who have successfully paid off millions in credit card debt.

Rate the App

User Reviews

Popular Apps

Editor's Choice