Latest Version

3637.2511

February 02, 2026

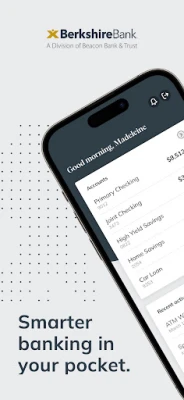

Berkshire Bank

Finance

Android

0

Free

com.berkshire.mobile

Report a Problem

More About Beacon Bank Mobile

Unlocking the Power of Beacon Bank: Your Ultimate Guide to Enhanced Banking Features

In today's fast-paced world, managing your finances efficiently is more important than ever. Beacon Bank offers a suite of innovative features designed to simplify your banking experience. From mobile check deposits to enhanced security measures, this guide will explore how these tools can empower you to take control of your financial life.

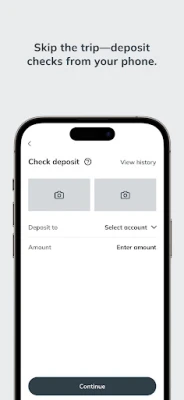

Seamless Mobile Check Deposits Anytime, Anywhere

With Beacon Bank's mobile check deposit feature, you can deposit checks 24/7, 365 days a year. This convenience allows you to manage your finances on your schedule, eliminating the need to visit a physical branch. Simply snap a photo of your check using the Beacon Bank app, and your funds will be available in no time. This feature not only saves you time but also enhances your banking flexibility.

Gain Financial Insights for Better Decision-Making

Understanding your financial health is crucial for making informed decisions. Beacon Bank provides powerful financial insights that offer a comprehensive 360-degree view of your finances. With detailed analytics and reporting tools, you can track your spending habits, set budgets, and identify areas for improvement. This feature empowers you to take charge of your financial future with confidence.

Fast and Secure Peer-to-Peer Payments

Sending money to friends and family has never been easier. With Beacon Bank's real-time P2P (Peer-to-Peer) payment system, you can transfer cash instantly using just an email address or mobile phone number. This feature eliminates the hassle of cash or checks, making it simple to split bills, pay for services, or send gifts. Enjoy the convenience of fast transactions while ensuring your financial information remains secure.

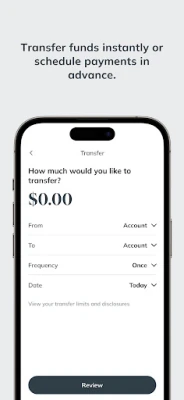

Effortless Transfers Between Accounts

Beacon Bank simplifies the process of transferring funds with both internal and external transfer options. Whether you need to move money between your accounts or send cash to family and friends who also use the Beacon Bank app, the process is straightforward and efficient. This feature ensures that your funds are always accessible when you need them, enhancing your overall banking experience.

Enhanced Security with Biometric Authentication

Your security is a top priority at Beacon Bank. The app offers biometric authentication options, including face and fingerprint recognition, to ensure that only you can access your accounts. This added layer of security provides peace of mind, knowing that your sensitive financial information is protected against unauthorized access.

Small Business Banking Made Easy

For small business owners, managing personal and business finances can be challenging. Beacon Bank addresses this with enhanced small business banking options. You can easily toggle between personal and business accounts, streamlining your financial management. Additionally, the option to authorize sub-users with unique permissions allows you to delegate tasks while maintaining control over your accounts.

Streamlined Bill Pay Services

Paying bills has never been more convenient. Beacon Bank's enhanced bill pay service allows you to pay new bills, edit scheduled payments, and review previously paid bills—all from your mobile device. This feature helps you stay organized and ensures that you never miss a payment, contributing to your overall financial health.

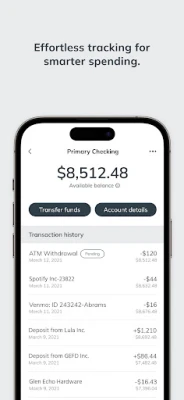

Quick Access to Your Accounts

Stay informed about your financial status with easy access to your account balances and transaction history. The Beacon Bank app allows you to check your latest account balances and search recent transactions by date, amount, or check number. This feature keeps you updated on your finances, enabling you to make timely decisions.

Card Controls for Enhanced Security

In the event that your debit card is lost or stolen, Beacon Bank provides card controls that allow you to turn your card off or on instantly. This feature gives you control over your card's security, ensuring that you can protect your funds at all times. If you ever find yourself in a situation where your card is compromised, you can act quickly to safeguard your account.

Secure Messaging for Immediate Support

Need assistance? Beacon Bank offers a secure messaging feature within the mobile app, allowing you to communicate directly with customer support. This fast and secure method of communication ensures that your inquiries are addressed promptly, enhancing your overall banking experience.

Easy Self-Service for Username and Password Resets

Managing your online banking credentials is crucial for security. Beacon Bank simplifies this process with an easy self-service option for resetting usernames and passwords. This feature allows you to regain access to your account quickly and securely, minimizing downtime and ensuring that you can manage your finances without interruption.

Conclusion: Experience the Future of Banking with Beacon Bank

Beacon Bank is committed to providing innovative features that enhance your banking experience. From mobile check deposits to robust security measures, these tools empower you to take control of your finances with ease. Explore the full range of services offered by Beacon Bank and discover how they can help you achieve your financial goals.

Rate the App

User Reviews

Popular Apps

Editor's Choice