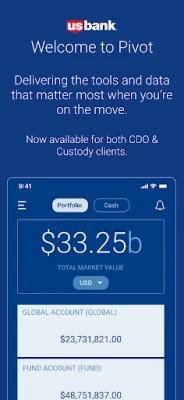

Latest Version

25.0.8

October 29, 2025

U.S. Bank Mobile

Finance

Android

0

Free

com.usbank.usbankpivot

Report a Problem

More About U.S. Bank Pivot

Comprehensive Asset Management Solutions for Custody and CDO Clients

In the fast-paced world of finance, having a robust asset management system is crucial for both Custody and CDO clients. This article delves into the essential features and functionalities that enhance asset oversight, transaction management, and overall financial efficiency.

Streamlined Asset Overview for Custody Clients

For Custody clients, the platform offers a comprehensive view of assets, trades, gains, losses, and accruals. This holistic perspective enables clients to make informed decisions based on real-time data.

File Cabinet: Easy Document Access

The File Cabinet feature allows users to effortlessly search and download statements, reports, and documents. This functionality ensures that all necessary information is readily available at your fingertips, enhancing operational efficiency.

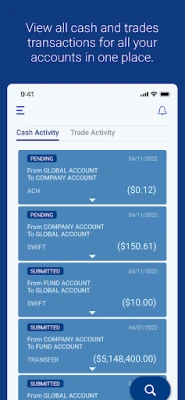

Transactions: Centralized Transaction Management

With the Transactions feature, clients can view all cash and trade transactions across their accounts in one centralized location. This capability simplifies tracking and managing financial activities, providing a clear overview of account performance.

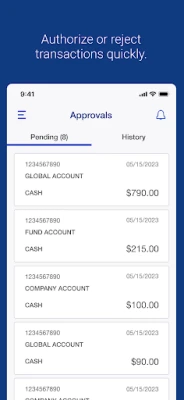

Cash Approval: Efficient Transaction Oversight

The Cash Approval functionality empowers clients to approve or decline cash transactions swiftly. This ensures timely and efficient management of transactions, reducing the risk of errors and enhancing financial control.

Corporate Actions: Comprehensive Tracking

Clients can access a comprehensive view of corporate actions, both ongoing and completed. The approval functionality facilitates efficient peer reviews on elections, allowing users to easily review, approve, or reject corporate actions as needed.

Notifications: Stay Informed

The Notifications feature keeps clients updated on critical changes to their accounts, including trade activity, cash movements, alerts, and approvals. Notifications can be tailored to specific accounts or encompass all accounts, ensuring that clients remain informed about their financial landscape.

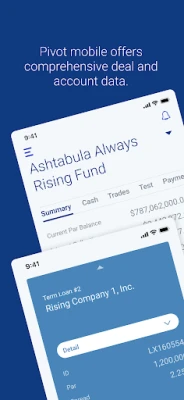

Enhanced Deal Management for CDO Clients

For CDO clients, the platform provides a comprehensive view of assets, accounts, tests, and payment information. The inclusion of the Time Machine feature allows users to access historical data, offering valuable insights into past performance.

Files: Simplified Document Management

The Files feature enables clients to search and download governing documents, cash files, trade tickets, and reports. This streamlined access to essential documents enhances operational efficiency and supports informed decision-making.

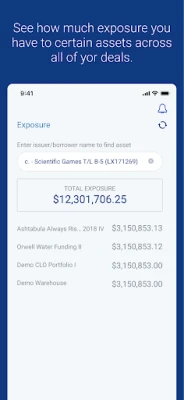

Exposure: Insight into Asset Risk

The Exposure feature provides clients with a clear understanding of their exposure to specific assets across all deals. This insight is crucial for risk management and strategic planning, allowing clients to make data-driven decisions.

Alerts: Timely Portfolio Updates

The Alerts feature notifies clients of critical changes within their portfolios, including test result updates, rating changes, and outgoing wire notifications. Staying informed about these changes is essential for effective portfolio management.

Mobile Access for Enhanced Convenience

The U.S. Bank Pivot mobile app is exclusively available for Custody and CDO clients. To utilize the mobile app, access to the U.S. Bank Pivot web application is required. The app is free to download, although mobile carriers may impose access fees based on individual plans. This mobile solution enhances convenience, allowing clients to manage their assets on the go.

Conclusion: Empowering Financial Management

In conclusion, the comprehensive features available for Custody and CDO clients significantly enhance asset management and transaction oversight. By leveraging these tools, clients can ensure efficient financial operations, informed decision-making, and effective risk management. Embrace these solutions to empower your financial management strategy today.

Rate the App

User Reviews

Popular Apps

Editor's Choice