Latest Version

3.58.18

August 30, 2024

U.S. Bank Mobile

Finance

Android

0

Free

com.usbank.mobilebanking

Report a Problem

More About U.S. Bank Mobile Banking

Unlock the Full Potential of Your Banking Experience with U.S. Bank

In today's fast-paced digital world, managing your finances efficiently is crucial. U.S. Bank offers a comprehensive suite of online services designed to simplify your banking experience. Whether you’re looking to monitor your accounts, make transactions, or gain insights into your spending habits, U.S. Bank has you covered. Here’s a detailed look at how you can maximize your banking experience with U.S. Bank’s digital services.

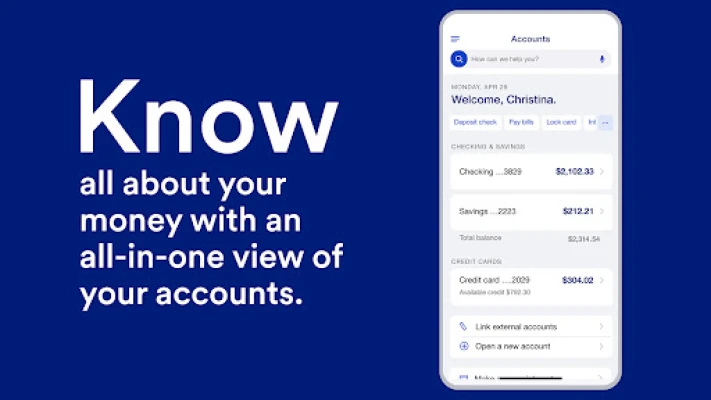

Seamless Account Management

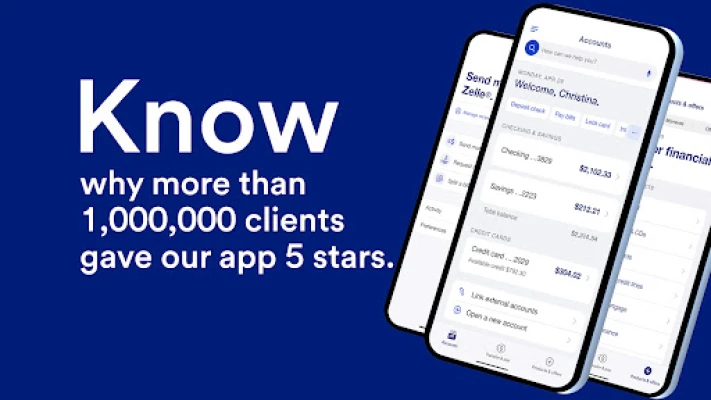

To get started, simply log in to your account at usbank.com using your credentials. If you’re new to online banking, you can easily enroll through the mobile app. Once logged in, you can:

- View All Accounts in One Place: Access your checking, savings, credit cards, loans, and more from a single dashboard.

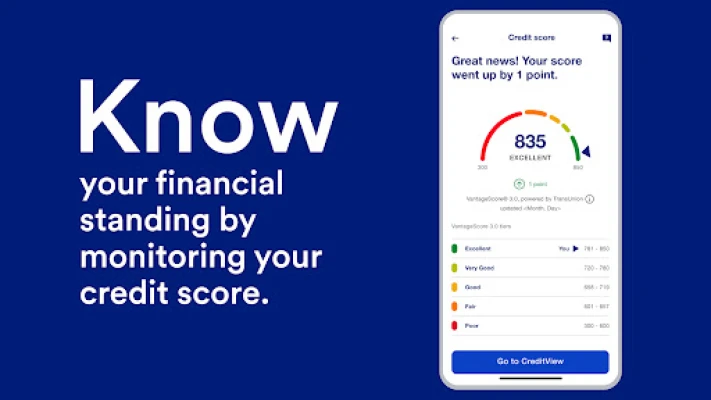

- Monitor Your Credit Score: Securely check your credit score to stay informed about your financial health.

- Set Travel Notifications: Inform the bank of your travel plans to avoid any disruptions in service.

- Lock and Unlock Cards: Manage your cards with ease by locking them if lost or unlocking them when found.

- Add Cards to Mobile Wallet: Enjoy the convenience of mobile payments by adding your cards to your digital wallet.

- Choose Your Language: Select your preferred language, either English or Spanish, for a personalized experience.

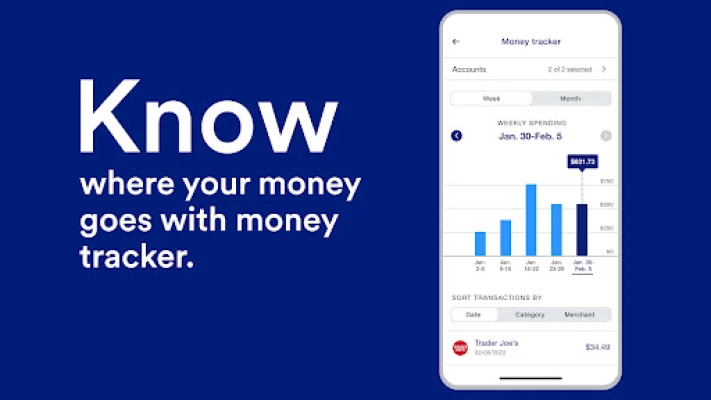

Personalized Financial Insights

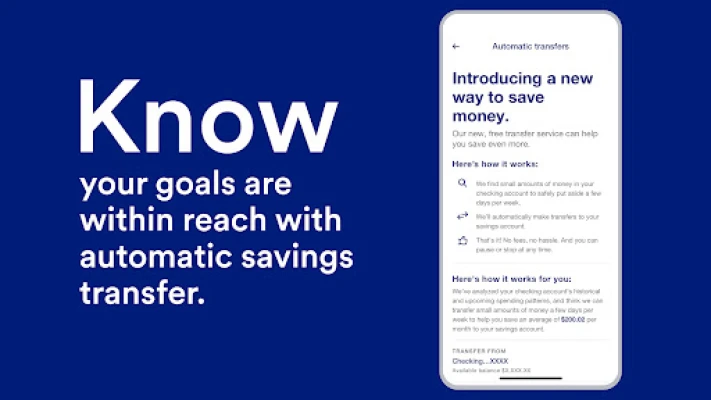

Understanding your spending habits is key to effective financial management. U.S. Bank provides personalized insights that allow you to:

- Review Monthly Spending: Analyze your expenses in key categories such as Food & Dining to identify areas for improvement.

- Receive Tailored Recommendations: Get suggestions on how to save and grow your money based on your unique spending history.

U.S. Bank Smart Assistant®

Managing your accounts has never been easier with the U.S. Bank Smart Assistant®. You can:

- Ask Questions: Inquire about your routing number or other account details simply by asking.

- Transfer Funds: Move money between accounts effortlessly by voice command, such as “Transfer $50 from checking to savings.”

Effortless Money Movement

U.S. Bank makes it simple to send and receive money. With features like:

- Zelle® Integration: Quickly send and request money from friends and family using Zelle®.

- Check Deposits: Deposit checks with increased limits for added convenience.

- Bill Management: Pay and manage all your bills in one centralized location.

- Account Transfers: Easily transfer funds between your U.S. Bank accounts.

Explore New Financial Products

Looking for new banking options? U.S. Bank allows you to:

- Discover New Accounts: Explore various accounts, credit cards, loans, and small business options.

- Apply Directly from the App: Submit applications and often receive decisions within minutes.

Comprehensive Support When You Need It

U.S. Bank is committed to providing support whenever you need it. You can:

- Visit the Help Center: Find answers to frequently asked questions.

- Watch Banking Demos: Learn how to navigate the platform with Digital Explorer.

- Schedule Appointments: Meet with a banker or receive real-time support through Cobrowse.

- Locate Branches and ATMs: Easily find nearby branches and ATMs for in-person assistance.

Investment Services with U.S. Bancorp Investments

For those interested in investment opportunities, U.S. Bancorp Investments offers:

- Account Access: View your U.S. Bancorp Investments accounts and balances seamlessly.

- Easy Transfers: Move funds between your U.S. Bank accounts and U.S. Bancorp Investment accounts with ease.

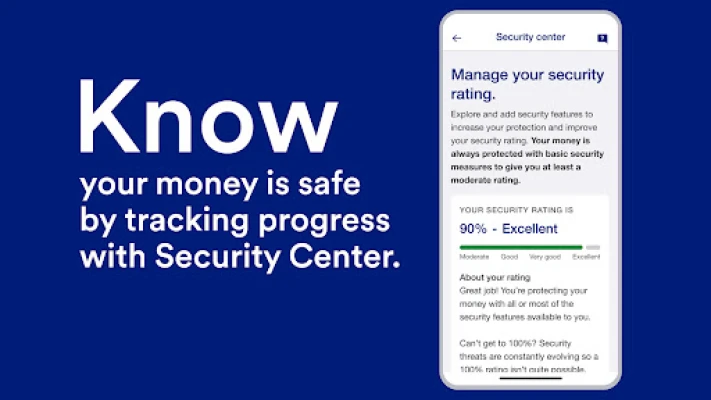

Commitment to Security and Privacy

U.S. Bank prioritizes your privacy and security. Learn more about their commitment by visiting:

- U.S. Bank Consumer Privacy Pledge

- U.S. Bancorp Investments Privacy Pledge

- Online Privacy and Security Policy

With the Digital Security Guarantee, U.S. Bank protects customers from fraud loss, ensuring peace of mind while banking online. For more information about U.S. Bank Mobile Banking, visit usbank.com/mobile or call toll-free at 800-685-5035.

Important Disclaimers

Investment and insurance products and services, including annuities, are:

- Not a Deposit

- Not FDIC Insured

- May Lose Value

- Not Bank Guaranteed

- Not Insured by any Federal Government Agency

U.S. Bank is an Equal Housing Lender. Credit products are offered by U.S. Bank National Association and are subject to normal credit approval. Deposit products are also offered by U.S. Bank National Association, Member FDIC.

U.S. Bank does not guarantee the products, services, or performance of U.S. Bancorp Investments. Investment and insurance products and services, including annuities, are available through U.S. Bancorp Investments, the marketing name for U.S. Bancorp Investments, Inc., a member of FINRA and SIPC, and an investment adviser and brokerage subsidiary of U.S. Bancorp, an affiliate of U.S. Bank.

By leveraging U.S. Bank’s digital services, you can take control of your financial future

Rate the App

User Reviews

Popular Apps

Editor's Choice