Latest Version

3.7.10

October 03, 2024

U.S. Bank Mobile

Finance

Android

0

Free

com.usbank.instantcard

Report a Problem

More About U.S. Bank Instant Card™

Revolutionize Your Business Expenses with Instant Card: A Complete Digital Payment Solution

In today's fast-paced business environment, managing expenses efficiently is crucial for success. The Instant Card by U.S. Bank merges the convenience of a virtual credit card with the functionality of a smartphone, offering a seamless digital payment experience. This innovative solution allows organizations to streamline their expense management processes, eliminating the hassle of using personal credit cards and waiting for reimbursements.

Key Features of Instant Card

Instant Card is designed with a variety of features that cater to the needs of modern businesses. Here are some of the standout functionalities:

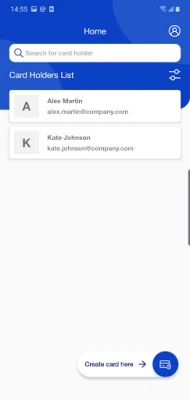

- Real-Time Card Distribution: Instantly send virtual cards to employees and contractors via a user-friendly web portal or mobile app.

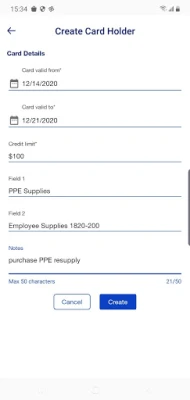

- Customizable Activation Period: Set the card activation period to match specific business needs, ensuring control over spending.

- Flexible Spending Limits: Define card limits based on available credit, allowing for tailored financial management.

- Google Pay Integration: Effortlessly push the virtual card to Google Pay with a single click for easy access.

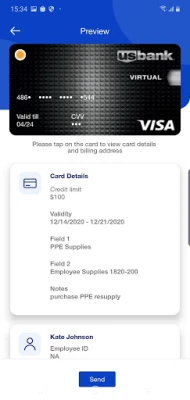

- Secure Card Information: View the full card number and CVV code securely within the app.

- Comprehensive Reporting: Integrated with U.S. Bank Access® Online for detailed expense reporting and tracking.

- Multiple Card Issuance: Send multiple cards to a single user for various business needs.

- Instant Deactivation: Deactivate cards immediately when they are no longer required, enhancing security.

How Instant Card Works

The process of creating and managing virtual cards with Instant Card is straightforward and efficient. Here’s how it works:

- Invitation and Registration: An authorized provisioner in your organization receives an email invitation from U.S. Bank, containing all necessary information to download the Instant Card app and register.

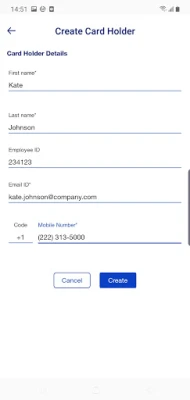

- Card Creation: Once registered, the provisioner can create a virtual card by:

- Setting the desired credit limit and expiration date.

- Entering essential recipient details.

- Pushing the virtual credit card to the recipient through the Instant Card app.

- Recipient Notification: The recipient receives an email notification with instructions to download the app and complete their registration.

- Activation: After registration, the virtual card becomes active and can be added directly to Google Pay for convenient use.

Requirements for Using Instant Card

To utilize the Instant Card service, organizations must meet specific requirements:

- Your organization must be a U.S. Bank Instant Card customer.

- You must be designated as an authorized provisioner by your organization or receive a mobile card from a provisioner.

If your business is interested in becoming an Instant Card customer, you can easily get in touch with U.S. Bank by calling 800.344.5696.

Benefits of Adopting Instant Card for Your Business

Implementing Instant Card can significantly enhance your organization's financial management. Here are some of the key benefits:

- Increased Efficiency: The ability to issue cards instantly reduces the time spent on expense management, allowing employees to focus on their core responsibilities.

- Enhanced Control: Organizations can set specific limits and activation periods, providing better oversight of spending.

- Improved Security: With instant deactivation and secure access to card information, businesses can protect themselves against unauthorized transactions.

- Streamlined Reporting: Integration with U.S. Bank Access® Online simplifies the reporting process, making it easier to track expenses and analyze spending patterns.

Conclusion

The Instant Card by U.S. Bank is a game-changer for businesses looking to modernize their expense management processes. By combining the power of a virtual credit card with the convenience of a mobile app, organizations can enjoy a fully digital payment experience that enhances efficiency, control, and security. Don't miss out on the opportunity to transform your business expenses—consider adopting Instant Card today.

Rate the App

User Reviews

Popular Apps

Editor's Choice