Latest Version

Update

September 03, 2024

September 03, 2024

Developer

Truist Financial Corporation

Truist Financial Corporation

Categories

Finance

Finance

Platforms

Android

Android

Downloads

2

2

License

Free

Free

Package Name

com.truist.mobile

com.truist.mobile

Report

Report a Problem

Report a Problem

More About Truist Mobile

Your better banking experience is here.

Master Your Finances with Truist: A Comprehensive Guide to Banking Features

Managing your finances has never been easier with Truist's innovative banking solutions. From checking balances to making payments, Truist offers a suite of features designed to empower you to take control of your financial life. This article will explore the various functionalities available, ensuring you can navigate your banking experience with confidence.Accounts & Cards: Your Financial Dashboard

Truist provides a user-friendly interface that allows you to manage your accounts and cards effortlessly. Here are some key features:- View Account Details and Transactions: Access real-time information about your account balances and transaction history.

- Set Alerts Preferences: Customize alerts to stay informed about your account activity.

- View Statements: Easily access your account statements for better financial tracking.

- Order Checks and Supplies: Request checks and other banking supplies directly through the app.

- Manage Overdraft Options: Set preferences to avoid overdraft fees and manage your funds effectively.

- Lock and Unlock Your Cards: Instantly secure your cards if they are lost or stolen.

- Set Spending and Region Limits: Control your spending by setting limits based on your preferences.

Transfer & Pay: Seamless Transactions

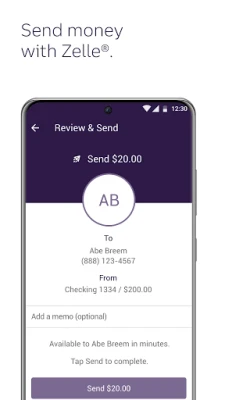

Transferring money and making payments is straightforward with Truist. Key features include:- Transfer Between Truist Accounts or External Accounts: Move money easily between your accounts or to other U.S. financial institutions.

- Send and Request Money with Zelle®: Use Zelle for quick and secure money transfers to friends and family.

Sign In & Security: Your Safety First

Truist prioritizes your security with advanced sign-in options. Features include:- Enable Fingerprint or Facial Recognition: Access your account quickly and securely with biometric authentication.

- Change Your User ID and Password: Update your login credentials to enhance security.

- See Sign-In History and Remembered Devices: Monitor your account access for added peace of mind.

Mobile Deposits: Banking on the Go

With Truist's mobile deposit feature, you can manage your finances from anywhere:- Deposit Checks: Easily deposit checks using your mobile device.

- View Deposit History: Keep track of your deposits for better financial management.

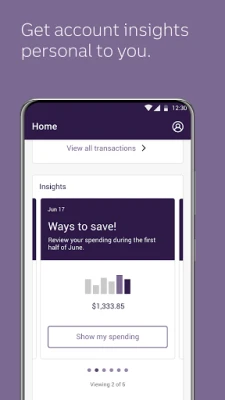

Planning & Insights: Financial Intelligence

Gain valuable insights into your spending habits and financial trends:- Get Insights on Spending, Trends, Cash Flow, and Unusual Activity: Analyze your financial behavior to make informed decisions.

- Link External Accounts: Integrate other financial accounts for a comprehensive view of your finances.

- Set and Track Spending Budgets: Create budgets to manage your expenses effectively.

- Compare Spending Habits: Evaluate your spending patterns over time.

- Monitor Savings Goals: Set and track your savings objectives to achieve your financial aspirations.

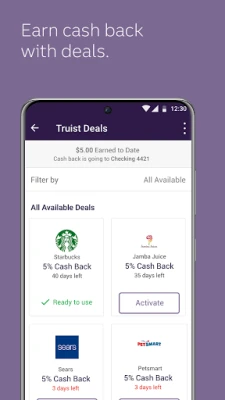

Rewards & Deals: Maximize Your Benefits

Truist offers rewards and deals to enhance your banking experience:- Earn Cash Back on Everyday Purchases: Enjoy cash back rewards at select merchants.

- Discover Offers from Places You Shop, Dine, Travel, and More: Take advantage of exclusive deals tailored to your lifestyle.

- View and Redeem Credit Card Rewards: Easily manage and redeem your rewards for added value.

Help & Support: Always Here for You

Truist provides robust support options to assist you:- Call Truist Support: Get help from customer service representatives when you need it.

- Find a Branch, ATM, or Bank Service: Locate nearby banking services for your convenience.

- View Help & FAQs: Access a wealth of information to answer your questions.

- Schedule an Appointment: Plan a visit to your local branch for personalized assistance.

- Access Your Truist Inbox: Stay updated with important messages and notifications.

Additional Features: Customize Your Experience

Truist offers several additional features to enhance your banking experience:- Add Quick Links for Frequently Used Tasks: Streamline your banking by creating shortcuts.

- Show, Hide, and Reorder Accounts: Personalize your account view to suit your preferences.

- Browse and Apply for Other Truist Accounts: Explore additional banking options that meet your needs.

- Upload Receipts and Attach to Transactions: Keep your financial records organized.

- Customized Investment Portfolio Experience: Tailor your investment strategy to align with your financial goals.

Important Considerations

While Truist offers a range of services, it's essential to be aware of certain conditions:- Paperless enrollment is required for accessing statements.

- Fees may apply to transfers to other U.S. financial institutions, and setup is required.

- Neither Truist nor Zelle® offers a protection program for authorized payments.

- Deposit limits and restrictions may apply for mobile deposits.

Conclusion

Truist provides a comprehensive suite of banking features designed to simplify your financial management. With tools for account management, secure transactions, insightful planning, and rewarding experiences, you can navigate your finances with confidence. Embrace the smarter technology and innovative features that Truist offers, and take control of your financial future today.Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Nova BrowserJef Studios

Throne WishlistThrone.com

Roman empire games - AoD RomeRoboBot Studio

Dark Web Browser : OrNETStronger Apps

XENO; Plan, AutoSave & InvestXENO Investment

CHANCE THE GAMETake Your Chance !

Dot PaintingChill Calm Cute

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD