Latest Version

14.47.0

December 15, 2024

StockTwits, Inc

Finance

Android

0

Free

org.stocktwits.android.activity

Report a Problem

More About Stocktwits - Stock Market Chat

Invest in Stocks and ETFs Commission-Free: Your Ultimate Guide

In today's fast-paced financial landscape, investing in stocks and ETFs has never been more accessible. With the rise of commission-free trading platforms, investors can now tap into the global voice of finance and investing without incurring hefty fees. This article explores the features and benefits of investing in stocks and ETFs commission-free, providing you with the tools to make informed investment decisions.

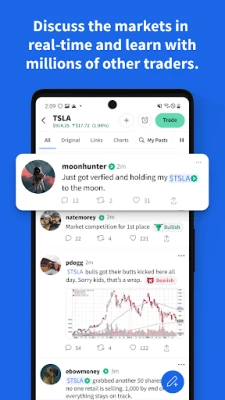

Engage with a Global Community of Investors

One of the standout features of commission-free trading platforms is the ability to connect with millions of traders and investors worldwide. These platforms allow you to discuss market trends in real-time, share insights, and exchange ideas through various media, including charts, photos, and GIFs. You can easily follow other investors, like their posts, and engage in meaningful conversations that enhance your understanding of the market.

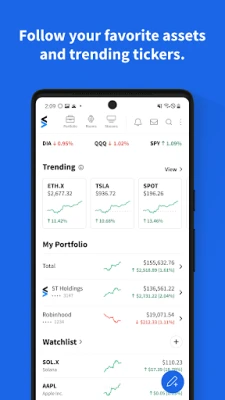

Stay Updated with Your Favorite Assets

Keeping track of your investments is crucial for successful trading. With commission-free platforms, you can create a personalized watchlist that includes stocks, ETFs, cryptocurrencies, and more. This feature enables you to monitor trending tickers and discover which assets are generating buzz each day. By staying informed, you can make timely decisions that align with your investment strategy.

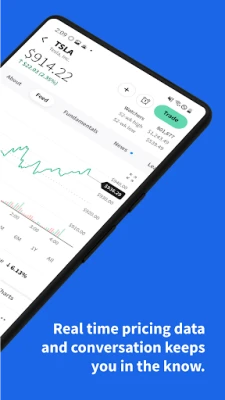

Monitor Market Sentiment in Real-Time

Understanding market sentiment is vital for any investor. Commission-free trading apps provide real-time insights into bullish and bearish sentiments across various equities, cryptocurrencies, indices, currencies, and commodities. By tracking this sentiment, you can gauge market trends and adjust your investment approach accordingly, ensuring you remain ahead of the curve.

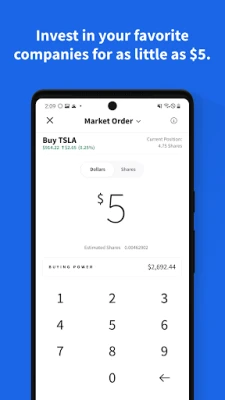

Invest in Stocks and ETFs with Ease

Investing in your favorite stocks and ETFs has never been easier. With commission-free trading, you can start investing with as little as $5. This flexibility allows you to trade fractional shares, making it possible to build a diversified portfolio without needing a large initial investment. Whether you're a seasoned investor or just starting, this feature empowers you to take control of your financial future.

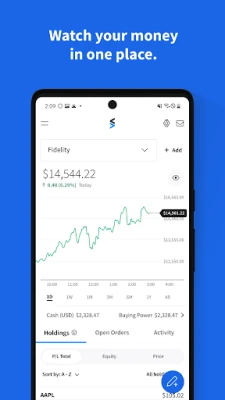

Consolidate Your Investments in One Place

Managing multiple brokerage accounts can be cumbersome. Commission-free trading platforms allow you to connect your existing brokerages to a single app, enabling you to track all your investments in one convenient location. This streamlined approach simplifies your investment management, making it easier to monitor performance and make informed decisions.

Access Essential Market Information

Staying informed about market developments is crucial for successful investing. Commission-free trading platforms offer features such as an earnings calendar, which lets you know when companies are reporting their earnings. Additionally, you can access trending news stories from top financial sources, ensuring you remain updated on the latest market events that could impact your investments.

Join Exclusive Investment Communities

Many commission-free trading platforms provide the option to create and moderate your own chat rooms. You can join existing rooms to gain access to exclusive content, concepts, and analyses from leading experts in business and finance. Engaging with these communities can enhance your investment knowledge and provide valuable insights that may not be readily available elsewhere.

Subscription Options and Products

While many features of commission-free trading apps are available for free, some platforms offer optional in-app purchases for premium content. Subscriptions typically renew automatically unless canceled at least 24 hours before the end of the current period. It's essential to review the pricing structure, especially for users outside the U.S., as local prices may vary. Always refer to the platform's Privacy Policy and Terms and Conditions for detailed information.

Important Disclosures for Investors

While commission-free trading offers numerous advantages, it's crucial to understand the associated risks. No content within the app should be considered a recommendation or solicitation for the purchase or sale of securities. All information provided is for reference only and should not be the sole basis for making investment decisions. Remember that all investments carry risks, including the potential loss of principal.

Online trading also comes with its own set of risks, such as system availability and market volatility. It's essential to be aware of these factors when engaging in trading activities.

Commission-free trading refers to $0 commissions for self-directed individual cash brokerage accounts that trade U.S.-listed securities via mobile devices or the web. However, relevant exchange and regulatory fees may still apply.

ST Invest LLC, a subsidiary of Stocktwits, Inc., offers securities and services to self-directed investors. As a member of FINRA and the Securities Investor Protection Corporation (SIPC), ST Invest LLC protects securities customers up to $500,000, including $250,000 for cash claims, in the event of insolvency. However, this protection does not cover declines in the value of securities.

Conclusion: Empower Your Investment Journey

Investing in stocks and ETFs commission-free opens up a world of opportunities for both novice and experienced investors. By leveraging the features of these platforms, you can engage with a global community, stay informed about market trends, and make informed investment decisions. Remember to approach investing with caution, understanding the risks involved, and always seek to educate yourself further. With the right tools and knowledge, you can take charge of your financial future and achieve your investment goals.

Rate the App

User Reviews

Popular Apps

Editor's Choice