Latest Version

24.2.0

September 10, 2024

Step Mobile, Inc

Finance

Android

0

Free

com.step.step

Report a Problem

More About Step: Bank & Build Credit

Unlocking Financial Freedom: The Top Benefits of Using Step

In today's fast-paced financial landscape, finding a reliable platform that caters to your banking and investment needs is essential. Step offers a unique blend of features designed to empower users, especially those in their 20s, to take control of their finances. Here’s a comprehensive look at the benefits of using Step and how it can help you achieve your financial goals.

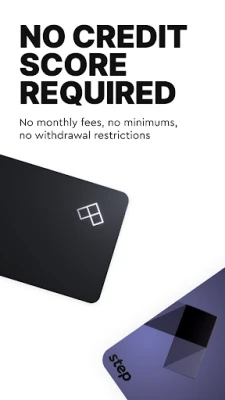

1. Build Your Credit Score Safely

One of the standout features of Step is its ability to help users build their credit scores safely. With every purchase made using the Step Card, users can monitor their credit score directly through the app. This is particularly beneficial for young adults, as the average annual credit score increase for Step users in their 20s is an impressive 57 points. By using Step, you can establish a solid credit history without the risks associated with traditional credit cards.

2. Enjoy Up to 8% Cashback on Purchases

Step users can earn up to 8% cashback on purchases made with their Step Card. This feature is available for transactions made anywhere Visa is accepted—whether online, in-store, or internationally. This cashback incentive not only rewards you for spending but also encourages smarter financial habits. Imagine earning money back on everyday purchases; it’s a win-win situation!

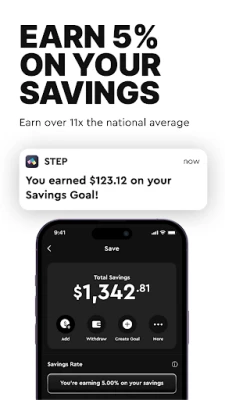

3. High-Interest Savings with 5.00% Returns

Step allows users to create Savings Goals and automatically add spare change through a feature called Round Ups. This innovative approach helps you save effortlessly while earning a remarkable 5.00% interest on your savings. By rounding up your purchases to the nearest dollar and depositing the difference into your savings, you can watch your money grow without even thinking about it.

4. Get Paid Early with Direct Deposit

With Step, you can receive your paycheck up to two days earlier than traditional banking methods through direct deposit. This feature is particularly advantageous for those who rely on timely payments to manage their expenses. Additionally, by setting up direct deposits of $150 or more, you can enter to win exciting monthly prizes, including cash, laptops, and shopping sprees. It’s a fun way to enhance your financial experience!

5. Effortless Money Transfers

Step simplifies the process of moving money. Users can instantly send and receive funds, deposit cash at over 70,000 retail locations nationwide, and access more than 30,000 fee-free ATMs. This level of accessibility ensures that you can manage your finances on your terms, without the hassle of traditional banking limitations.

6. Invest with Minimal Capital

Investing has never been easier with Step. Users can buy and sell thousands of stocks, ETFs, and even bitcoin for as little as $1. This low barrier to entry allows you to turn your spare change into smart investments through the Round Ups feature. By investing small amounts regularly, you can build a diversified portfolio over time, making investing accessible to everyone.

Conclusion: Step Towards Financial Empowerment

Step is more than just a financial services platform; it’s a comprehensive tool designed to help you build credit, save money, and invest wisely. With features like cashback rewards, high-interest savings, early direct deposits, and effortless money transfers, Step empowers users to take charge of their financial futures. Whether you’re looking to build your credit score or start investing, Step provides the resources you need to succeed.

Take the first step towards financial freedom today by exploring the benefits of the Step app. With its user-friendly interface and innovative features, you’ll be well on your way to achieving your financial goals.

¹Step is a financial services platform. Banking services provided by and the Step Visa card issued by Evolve Bank and Trust, member FDIC.

²Visa’s Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use.

³Out-of-network ATM withdrawal fees apply.

⁴Early access to direct deposit funds depends on the timing of the submission of the payment file from your payer. These funds are generally made available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

Rate the App

User Reviews

Popular Apps

Editor's Choice