Latest Version

Version

1.2.64

1.2.64

Update

August 06, 2025

August 06, 2025

Developer

IndusInd Bank Ltd.

IndusInd Bank Ltd.

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.indusind.indie

com.indusind.indie

Report

Report a Problem

Report a Problem

More About IndusInd Bank: Savings A/C, FD

A faster, smarter banking experience awaits! Try the new IndusInd Bank Mobile Banking App - INDIE.

Unlock the Benefits of an IndusInd Bank Savings Account: A Comprehensive Guide

Opening a savings account has never been easier, thanks to IndusInd Bank's fully digital process. With a plethora of premium features at your fingertips, you can enjoy seamless banking experiences, including scan-and-pay options, bill payments, and zero-fee transactions. This article delves into the advantages of opening a savings account with IndusInd Bank, along with insights into fixed deposits, personal loans, credit card management, and more.Why Choose an IndusInd Bank Savings Account?

IndusInd Bank offers a hassle-free way to open a savings account with zero paperwork through its user-friendly mobile app. You can select an account that best fits your financial needs, including a zero-balance option. Here are some exclusive features that make IndusInd Bank stand out:- Competitive Interest Rates: Enjoy interest rates of up to 5% per annum.

- No Fees for Banking Services: Benefit from free NEFT and RTGS transactions.

- Unlimited ATM Withdrawals: Access free cash withdrawals at IndusInd Bank ATMs.

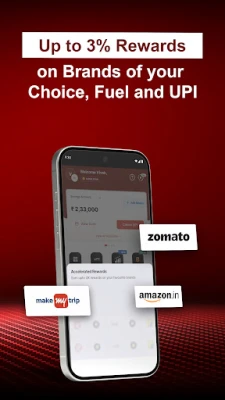

- Reward Programs: Earn up to 3% rewards on selected brands, UPI transactions, and fuel purchases.

- Forex Mark-up Waiver: Enjoy 0% forex mark-up and complimentary airport lounge access.

Fixed Deposits Made Easy

IndusInd Bank allows you to book a fixed deposit (FD) conveniently through its mobile banking app. With competitive interest rates of up to 7% per annum, you can choose from various FD options, including regular, tax-saving, and senior citizen FDs.- Auto-Sweep Feature: This feature provides the dual benefit of liquidity and high returns.

- No Charges on Premature Withdrawals: Enjoy zero charges on premature withdrawals from Auto-Sweep FDs.

- Manage Your FDs: Access features like maturity instructions, premature withdrawals, and partial renewals directly from the app.

Instant Personal Loans and Lines of Credit

If you find yourself in need of quick cash, IndusInd Bank offers an instant personal loan with a fully digital application process.- Quick Disbursal: Receive up to ₹5 lakh directly in your bank account.

- Discounted Processing Fees: Save more with lower fees.

- Flexible Tenure Options: Choose a repayment period that suits your financial situation.

- Low Interest Rates: Enjoy competitive interest rates on your loan.

Effortless Credit Card Management

Applying for an IndusInd Bank credit card is a breeze with the 100% paperless process and instant approval. Manage your credit card effortlessly through the mobile banking app:- Set and Reset PIN: Easily manage your credit card PIN and transaction limits.

- Real-Time Tracking: Access instant statements and track your spending in real time.

- Secure Bill Payments: Pay your bills conveniently and securely from the app.

- Reward Points Management: Keep track of your reward points effortlessly.

Convenient Recharge and Bill Payment Services

IndusInd Bank's mobile app allows you to manage and pay all your utility bills, including electricity, gas, and water, directly from your device.- Mobile and DTH Top-Ups: Securely recharge your mobile, DTH, and data card anytime, anywhere.

- Automated Bill Payments: Set up automated payments to avoid late fees.

- Real-Time Confirmations: Receive instant payment confirmations and receipts for organized financial records.

Diversify Your Investments with Mutual Funds

IndusInd Bank offers a variety of mutual fund options to help you diversify your investment portfolio. Whether you are a seasoned investor or just starting, you can find funds that align with your financial goals.- Start Small: Begin your SIP investment with as little as ₹500 or opt for a one-time lump sum investment.

- Easy Management: Buy, sell, and manage your funds with just a few clicks.

- Personalized Fund Options: Choose from over 500 large-cap, mid-cap, and small-cap equity funds, including tax-saving options.

Safe and Quick Online Fund Transfers

Make secure payments via UPI, IMPS, NEFT, RTGS, and other methods quickly and safely through the mobile app.- Instant Transfers: Transfer funds without the need to add a beneficiary.

- Manage Beneficiaries: Easily add, delete, and manage your beneficiaries.

- Automate Payments: Set up recurring payments for rent, subscriptions, and more.

Contact Us for Assistance

For any queries or assistance, reach out to IndusInd Bank's customer support team:- Email: indie@indusind.com

- Phone: 1860 267 2626

- Timings: 8 am to 8 pm - All Days

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Roman empire games - AoD RomeRoboBot Studio

CHANCE THE GAMETake Your Chance !

XENO; Plan, AutoSave & InvestXENO Investment

Dot PaintingChill Calm Cute

Nova BrowserJef Studios

Trovo - Watch & Play TogetherTLIVE PTE LTD

Throne WishlistThrone.com

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD