Latest Version

4.31.2.0

September 19, 2024

Stash Financial

Finance

Android

0

Free

com.stash.stashinvest

Report a Problem

More About Stash: Investing made easy

Unlock Your Financial Future with Stash: The Ultimate Personal Finance App

Recognized by CNBC and Statista as one of the World’s Top Fintech Companies for 2024 in the Wealth Technology category, Stash is revolutionizing personal finance management. The app has also earned the title of “Best Personal Finance App” at the 2023 FinTech Breakthrough Awards and has been listed among USA Today’s Top 500 “Best Financial Advisory Firms 2023.”

Take Control of Your Financial Journey

Are you ready to seize control of your financial destiny? The Stash app serves as your comprehensive solution, featuring expert-managed portfolios, automated saving and investing options, a Stock-BackⓇ Debit Card, and personalized guidance to help you achieve your financial aspirations. Join millions of satisfied users who rely on Stash to save money, invest wisely, and enhance their financial well-being.

Why Stash Stands Out

Build Your Safety Net Faster

With Stash, your money works harder for you compared to traditional banks, enabling you to build your savings more efficiently. Our automated savings and investing tools simplify your journey toward financial success. Customers who utilize the Auto-Stash feature see an average of over $900 in their accounts after just one year—40% more than those who don’t take advantage of this feature.

Investing Made Simple

Investing is accessible to everyone, regardless of experience. Stash takes the complexity out of investing, allowing you to focus on your financial goals. With our expert-managed portfolios and tailored guidance, anyone can embark on their investment journey and watch their money grow.

Expert Advice You Can Trust

As a registered investment advisor (RIA), Stash prioritizes your best interests, similar to how affluent individuals seek advice from high-priced financial experts. Our platform provides reliable investing tips and recommendations, empowering you to understand personal finance, investing, and effective money management. Stash makes smart investing achievable for everyone.

Features of the Stash App

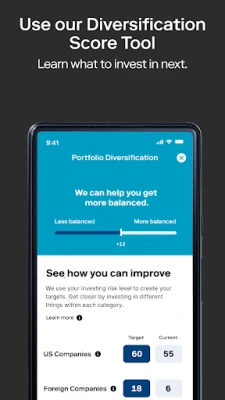

Inside the Stash app, you’ll discover award-winning tools designed to enhance your saving and investing experience:

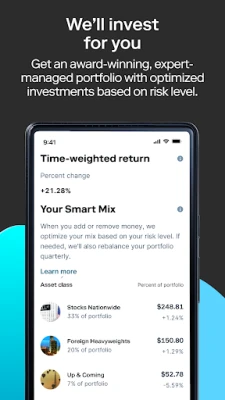

- Stash Managed Portfolio: Experts build and rebalance your investments for optimal performance.

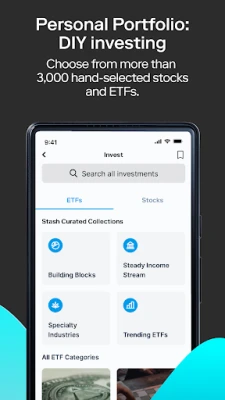

- Self-Directed Portfolios: Take control by choosing your own stocks and ETFs.

- Auto-Stash: Establish a regular investing schedule to capitalize on market fluctuations.

- Penalty-Free Withdrawals: Access your funds whenever you need them.

- Stock-BackⓇ Debit Card: Earn stock rewards on everyday purchases.

- Retirement Accounts: Choose between traditional and Roth individual retirement accounts.

- Custodial Accounts: Save for a child’s future with ease.

- Financial Goals: Set specific financial objectives and receive guidance throughout your investment journey.

- Financial Education: Participate in exclusive live webinars and access content that enhances your understanding of investing, saving, and money management.

Important Disclosures

According to Stash's internal data as of February 29, 2024, “Set Aside” refers to complete incoming transfers from external funding sources to Stash across all brokerage and banking accounts. This statistic does not account for withdrawals.

The monthly subscription fee starts at $3/month. Additional fees charged by Stash and/or its custodian are not included in the subscription fee. For more details, please refer to the Advisory Agreement & Deposit Account Agreement.

A Stash Managed Portfolio is an account that Stash manages with full authority.

Stash Banking services are provided by Stride Bank, N.A., Member FDIC. The Stash Stock-Back® Debit Mastercard® is issued by Stride Bank under a license from Mastercard International. Investment products and services are offered by Stash Investments LLC, not Stride Bank, and are not FDIC insured, not bank guaranteed, and may lose value.

Investment advisory services are provided by Stash Investments LLC, an SEC-registered investment adviser. Investing involves risks, and investments may lose value. You must be 18 or older to open an account. Stash is available only to U.S. citizens, permanent residents, and select visa holders.

Conclusion

Stash is more than just a personal finance app; it’s a gateway to financial empowerment. With its user-friendly interface, expert guidance, and innovative features, Stash equips you with the tools necessary to take charge of your financial future. Don’t wait—join the millions who trust Stash to help them save, invest, and thrive.

Rate the App

User Reviews

Popular Apps

Editor's Choice