Latest Version

6.7.4

September 02, 2024

Star Finanz GmbH

Finance

Android

0

Free

com.starfinanz.smob.android.sfinanzstatus

Report a Problem

More About Sparkasse Ihre mobile Filiale

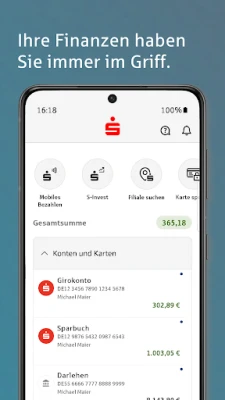

Unlocking the Benefits of the Sparkasse App: Your Ultimate Mobile Banking Solution

In today's fast-paced world, managing your finances on the go has never been easier. The Sparkasse App offers a plethora of features designed to streamline your banking experience, allowing you to check your accounts anytime, anywhere. This article delves into the numerous advantages of using the Sparkasse App, ensuring you stay informed and in control of your finances.

Convenient Account Management

With the Sparkasse App, you can effortlessly manage multiple online accounts from various banks and savings institutions. Whether you’re at home or on the move, accessing your financial information is just a tap away. The app eliminates the need for tedious paperwork, enabling you to set up transfers and standing orders quickly and efficiently.

Stay Informed with Account Alerts

The Account Alert Feature keeps you updated on all your account activities around the clock. You can customize alerts to notify you of daily balances, incoming salaries, or when your account balance exceeds or falls below a specified limit. This proactive approach ensures you are always aware of your financial status, helping you make informed decisions.

Effortless Payments with Giropay and Kwitt

Sharing expenses with friends has never been simpler. The Sparkasse App integrates Giropay and Kwitt, allowing you to send money instantly from your phone to another. Whether you’re splitting a dinner bill or collecting funds for a group gift, these features facilitate seamless transactions without any delays.

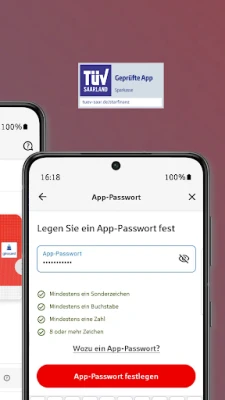

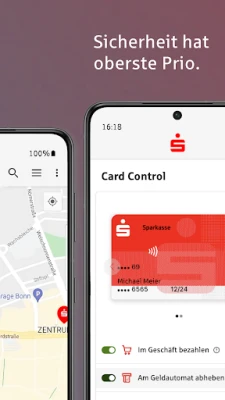

Robust Security Measures

Your security is paramount when it comes to mobile banking. The Sparkasse App employs state-of-the-art security protocols to protect your data. By utilizing verified interfaces and adhering to stringent German online banking regulations, the app ensures that all your information is encrypted and securely stored. Access is safeguarded by a password, and you can enhance security further with biometric options on your device. The app also features an auto-lock function that secures your account after a period of inactivity, providing peace of mind in case of loss or theft.

Practical Features for Everyday Use

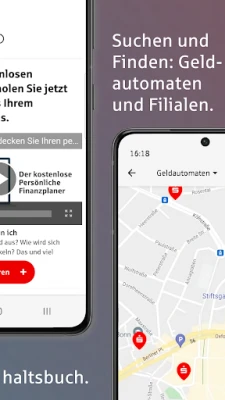

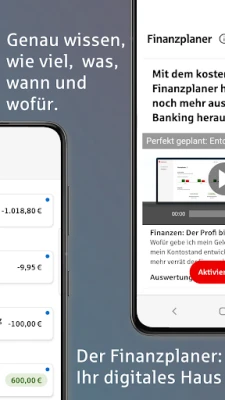

The Sparkasse App is packed with practical functionalities that enhance your banking experience. Use the search feature to navigate through your accounts and bank connections effortlessly. You can also set up a household budget with an offline account and view graphical analyses of your spending habits. The app provides direct access to your Sparkasse services, including card blocking, notifications, reminders, appointments, and even account openings, depending on your bank's offerings. Additionally, you can switch to the S-Invest app to manage your securities transactions directly.

Seamless Mobile Payments

Transitioning from the Sparkasse App to mobile payments is a breeze. With just a tap in the “Profile” section, you can access the Mobile Payment feature, allowing you to pay at checkout using your digital card. This integration simplifies your shopping experience, making transactions quick and efficient.

Requirements for Using the Sparkasse App

To take advantage of the Sparkasse App, you need an online banking-enabled account with a German Sparkasse or bank. The app supports various TAN procedures for secure transactions, including chipTAN manual, chipTAN QR, chipTAN comfort (optical), pushTAN, and smsTAN.

Important Notes

For any support inquiries, it’s best to send them directly through the app. Be aware that certain features may incur costs from your financial institution, which could be passed on to you. The Giropay and Kwitt services are available only if supported by your Sparkasse or bank.

Your data protection is taken seriously, as outlined in our Privacy Policy. By downloading and using the Sparkasse App, you fully accept the terms of the End User License Agreement from Star Finanz GmbH.

Conclusion

The Sparkasse App is an indispensable tool for anyone looking to manage their finances efficiently and securely. With its user-friendly interface, robust security features, and practical functionalities, it empowers users to take control of their banking experience. Download the Sparkasse App today and discover the convenience of modern mobile banking.

Rate the App

User Reviews

Popular Apps

Editor's Choice