Latest Version

2025.10.1

November 13, 2025

DNB ASA

Finance

Android

0

Free

no.dnb.spare

Report a Problem

More About Spare

Maximize Your Financial Potential: A Comprehensive Guide to Managing Assets and Investments

In today's fast-paced financial landscape, effectively managing your assets and investments is crucial for achieving your financial goals. This guide will walk you through the essential steps to view your assets, reach your savings goals, track mutual fund performance, and more. Let’s dive into the world of finance and empower you to take control of your financial future.

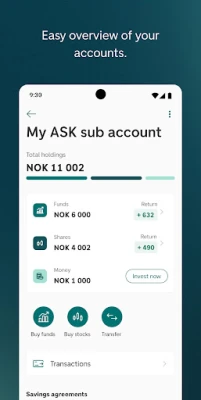

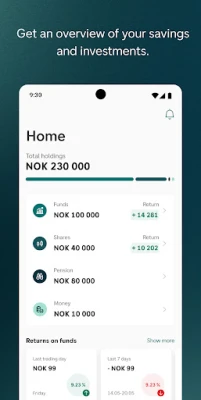

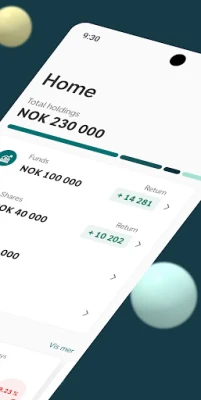

View Your Assets: A Clear Overview

Understanding your financial standing begins with a clear view of your assets. Here are the key components to consider:

- Accounts: Keep track of your bank accounts, including checking and savings, to monitor your liquidity.

- Mutual Funds: Evaluate your mutual fund investments to understand their performance and potential returns.

- Equities (Shares): Review your stock portfolio to assess its value and growth.

- Pension: Stay informed about your pension savings and how they contribute to your retirement plans.

Reach Your Savings Goals: Strategies for Success

Setting and achieving savings goals is vital for financial stability. Here’s how you can effectively reach your objectives:

- Set Your Own Goal: Define specific savings targets that align with your financial aspirations.

- Automate Your Savings: Save effortlessly by setting up automatic transfers every time you use your card or pay a bill.

- Track Your Progress: Regularly monitor your savings to stay motivated and make necessary adjustments.

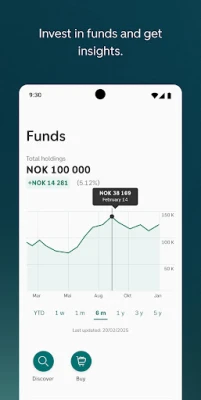

Track the Development of Your Mutual Funds Savings

Keeping an eye on your mutual funds is essential for maximizing returns. Here are some effective strategies:

- Buy, Exchange, and Sell: Take advantage of market opportunities by actively managing your mutual fund investments.

- Utilize a Digital Fund Adviser: Leverage technology to receive personalized advice and insights on your mutual funds.

- Learn About Mutual Fund Savings: Educate yourself on the various types of mutual funds and their benefits to enhance your investment strategy.

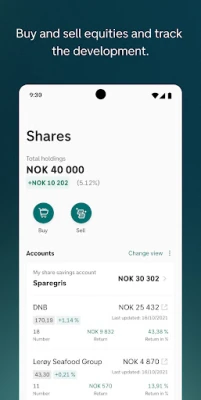

Be Your Own Stockbroker: Empowering Your Investment Journey

With the right tools, you can manage your stock investments like a pro. Here’s how:

- Track Your Equities: Regularly check the value of your shares to make informed trading decisions.

- Trade Globally: Access Oslo Børs and 15 other stock exchanges worldwide to diversify your portfolio.

Understand Your Pension: Planning for Retirement

Knowing how much pension you’ll receive is crucial for retirement planning. Here’s what you need to do:

- Track Your Pension Savings: Keep a close eye on your pension contributions and growth over time.

- Adjust Employer Contributions: Communicate with your employer to modify how they save for your pension, ensuring it meets your retirement needs.

Monitor Your Share Savings Account

Staying informed about your share savings account is essential for effective financial management:

- Track Developments: Regularly review the performance of your share savings account to understand its impact on your overall financial health.

- Learn How It Works: Familiarize yourself with the mechanics of share savings accounts to maximize their benefits.

Stay Informed: Read the Latest News on Savings and Investment

Knowledge is power in the world of finance. Here’s how to stay updated:

- Choose Your News: Select the type of financial news that interests you, whether it’s market trends, investment strategies, or savings tips.

Conclusion: Take Charge of Your Financial Future

By actively managing your assets, setting clear savings goals, and staying informed about market trends, you can significantly enhance your financial well-being. Embrace these strategies to take control of your financial future and achieve the success you desire.

Rate the App

User Reviews

Popular Apps

Editor's Choice