Latest Version

3.10.2

September 28, 2024

Social Finance, LLC

Finance

Android

0

Free

com.sofi.mobile

Report a Problem

More About SoFi - Banking & Investing

Why Over 8 Million Members Trust SoFi for Their Financial Needs

In today's fast-paced financial landscape, individuals seek reliable and innovative solutions to manage their money effectively. SoFi has emerged as a leading platform, attracting over 8 million members who appreciate its comprehensive suite of financial services. This article explores the key features that make SoFi a preferred choice for mobile banking, investing, and budgeting.

High-Yield Mobile Banking: Convenience at Your Fingertips

SoFi's mobile banking services stand out for their user-friendly approach and robust features. Here’s what you can expect:

- No Account Fees: Enjoy the freedom of mobile banking without worrying about account fees or minimum balance requirements.

- Nationwide ATM Access: With access to over 55,000 ATMs across the country, managing your money has never been easier.

- Early Paycheck Access: Set up direct deposit and advance your paycheck by up to two days, giving you quicker access to your funds.*

- FDIC Insurance: Rest easy knowing your mobile bank account is secured with FDIC insurance up to $250,000.

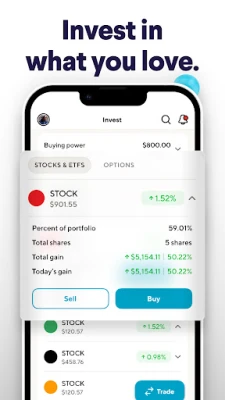

Smart Investing: Grow Your Wealth with Ease

SoFi empowers users to take control of their investment journey with its intuitive investing app. Here are some of the standout features:

- Commission-Free Trading: Invest in stocks and ETFs without incurring any commission fees, maximizing your investment potential.

- Exclusive IPO Access: Gain access to exclusive IPO investments at their initial prices directly through the app.

- Fractional Shares: Start investing with as little as $5, allowing you to diversify your portfolio without a hefty initial investment.

- Stock Bonuses: Open and fund an active investment account to receive up to $1,000 in stock, enhancing your investment strategy.

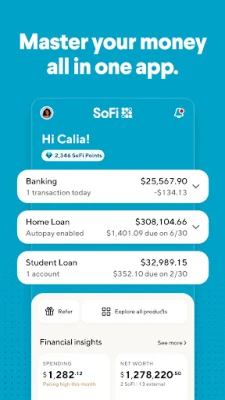

Powerful Budget Tracker: Master Your Finances

Managing your finances is crucial for achieving your financial goals. SoFi’s budget tracker offers powerful tools to help you stay on top of your spending:

- Comprehensive Financial Overview: Connect all your accounts to get a complete picture of your financial health.

- Custom Savings Goals: Set and monitor personalized savings goals with advanced budgeting tools tailored to your needs.

- Spending Insights: Analyze and categorize your spending to identify areas for improvement and savings.

- Bill Payment Reminders: Stay organized with reminders for upcoming bills, ensuring you never miss a payment.

- Credit Score Tracking: Monitor your credit score and receive updates to enhance your financial well-being.

Comprehensive Support: We're Here for You

SoFi prioritizes customer support, ensuring that members have access to assistance whenever needed. You can reach out via phone at (855) 456-SOFI (7634) or chat online at SoFi Contact Us.

*Early access to direct deposit funds is based on the timing in which SoFi receives notice of impending payment from the Federal Reserve, typically up to two days before the scheduled payment date, but may vary.

All-in-One Financial Solution

SoFi combines banking, borrowing, budgeting, and investing into one seamless app, making it easier than ever to manage your finances. Download the SoFi app for Android devices on Google Play and take the first step towards financial empowerment today.

With its innovative features and commitment to customer satisfaction, it’s no wonder that over 8 million members have chosen SoFi as their trusted financial partner. Experience the difference for yourself and join the growing community of satisfied users.

Rate the App

User Reviews

Popular Apps

Editor's Choice