Latest Version

Version

7.16.0

7.16.0

Update

August 11, 2025

August 11, 2025

Developer

CASE Platforms: Invest with confidence

CASE Platforms: Invest with confidence

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.smallcase.android

com.smallcase.android

Report

Report a Problem

Report a Problem

More About smallcase: Stocks, MFs, FDs

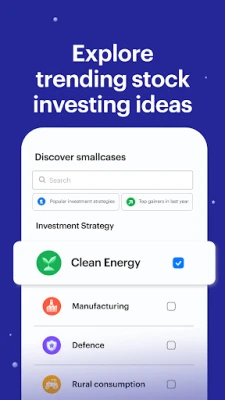

smallcase is a model portfolio-based investing app that helps you build and track a diversified investment portfolio using stocks, ETFs, mutual funds & more.

Maximize Your Investment Potential with Smallcase: A Comprehensive Guide

Investing in the stock market has never been easier, thanks to platforms like Smallcase. By connecting directly through your Demat or broking account—whether it’s Kite by Zerodha, Groww, Angel One, Upstox, or ICICI Direct—you can explore a variety of readymade model portfolios crafted by SEBI-registered investment experts. This article delves into the features and benefits of using Smallcase for your investment journey.Seamless Investment Options: Stocks, Mutual Funds, ETFs, and Fixed Deposits

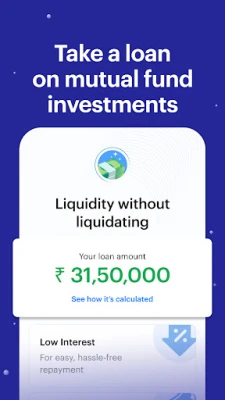

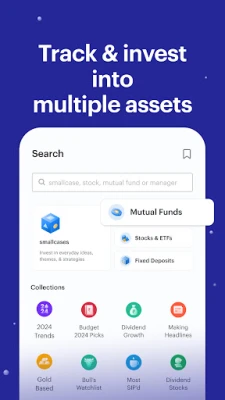

With Smallcase, you can diversify your investment portfolio effortlessly. Here’s what you can do: - **Invest and SIP**: Engage in systematic investment plans (SIPs) across stocks, mutual funds, ETFs, and fixed deposits (FDs). - **Centralized Tracking**: Monitor all your investments—stocks, model portfolios, FDs, and mutual funds—on a single platform. - **Instant Loans**: Access quick loans against your stock and mutual fund investments without hassle. Your investments remain secure in your linked Demat account, whether you choose Kite by Zerodha, Groww, or any other partner associated with Smallcase.Explore Model Portfolios for Strategic Investing

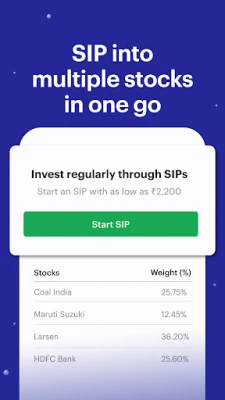

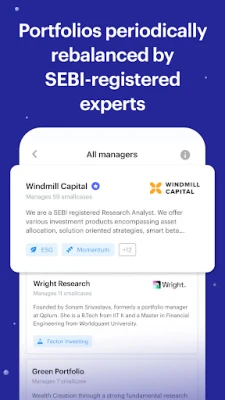

Smallcase offers a unique opportunity to invest in professionally curated model portfolios of stocks and ETFs, designed for optimal diversification. Here’s what you can expect: - **Diverse Portfolio Options**: Access over 500 readymade portfolios based on various strategies, sectors, and trending themes. - **Thematic Investing**: Explore investment themes such as Atmanirbhar Bharat, Momentum, or Electric Vehicles. - **Portfolio Managers**: Choose a portfolio manager based on their experience, investment style, and past performance. - **Risk Profiles and Goals**: Discover model portfolios tailored to different risk profiles and investment goals, whether it’s retirement planning, purchasing a home, or funding an international trip. - **Easy SIP Setup**: Initiate SIPs in a basket of stocks with just one tap. - **Custom Model Portfolios**: Start your journey into basket investing by creating your own model portfolio on Smallcase. You can easily connect your existing broking or Demat account with various platforms, including Kite by Zerodha, Groww, Upstox, ICICI Direct, HDFC Securities, and many more.Integrated Research with Tickertape

Smallcase is integrated with Tickertape, a comprehensive stock market research and analysis app. This integration empowers you to make informed investment decisions, ensuring you have the necessary tools at your disposal. Tickertape is a wholly owned subsidiary of Smallcase Technologies Pvt. Ltd., providing you with reliable insights and analytics.Investing in Mutual Funds Made Simple

Smallcase also simplifies mutual fund investments: - **Direct Mutual Funds**: Invest in direct mutual funds with zero commission fees. - **Flexible Investment Options**: Choose between SIPs and one-time investments in equity, debt, and hybrid funds. - **Fund Comparison**: Compare funds by category, past returns, and associated risks to make informed choices.High-Interest Fixed Deposits for Secure Returns

For those seeking stability, Smallcase offers high-interest fixed deposits (FDs) with returns of up to 8.4%. Here are the key features: - **DICGC Insurance**: Enjoy insurance coverage up to ₹5 lakhs. - **Multiple Bank Options**: Choose from various banks, including Slice SF, Suryoday SF, Shivalik SF, South Indian, and Utkarsh SF Banks.Comprehensive Investment Tracking

Keep your investment portfolio organized and accessible: - **Import Existing Investments**: Easily import your stocks and mutual fund investments from various brokers like Zerodha and Groww. - **Single Dashboard Tracking**: Monitor your stocks, mutual funds, FDs, and model portfolios all in one place. - **Performance Insights**: Check your investment score and portfolio performance at any time.Access Loans Against Your Securities

Smallcase allows you to obtain loans against your stock and mutual fund investments: - **Quick Loan Processing**: Get a loan against your securities without liquidating your investments. - **100% Online Application**: Complete the process in under two hours at competitive interest rates. - **Flexible Repayment**: Pay back the loan at your convenience without any early closure charges.Personal Loans with Flexible Terms

In addition to investment options, Smallcase offers personal loans with attractive features: - **Flexible Repayment Options**: Choose a tenure ranging from 6 months to 5 years. - **Competitive Interest Rates**: Enjoy low-interest rates, with a maximum APR of 27%. **Example Loan Calculation**: - **Interest Rate**: 16% p.a. - **Tenure**: 36 months - **Loan Amount**: ₹1,00,000 - **Processing Fee**: ₹2,073 - **Total Repayment Amount**: ₹1,31,184Important Considerations

Investing in equity markets carries inherent risks. It is crucial to read all related documents carefully before making any investment decisions. Consider all risk factors and consult with financial advisors to ensure your investment strategy aligns with your financial goals. Remember, past performance is not indicative of future results. For further disclosures, visit: Smallcase DisclosuresContact Information

Registered Address: smallcase Technologies Private Limited #51, 3rd Floor, Le Parc Richmonde, Richmond Road, Shanthala Nagar, Richmond Town, Bangalore - 560025 By leveraging the features offered by Smallcase, you can take control of your investment journey, ensuring a diversified and well-managed portfolio that aligns with your financial aspirations. Start investing today and unlock the potential of your financial future!Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

LINE: Calls & MessagesLINE (LY Corporation)

Rogue SlimeQuest Seeker Games

PrivacyWallPrivacyWall

Roman empire games - AoD RomeRoboBot Studio

CHANCE THE GAMETake Your Chance !

XENO; Plan, AutoSave & InvestXENO Investment

Dot PaintingChill Calm Cute

Nova BrowserJef Studios

Trovo - Watch & Play TogetherTLIVE PTE LTD

Throne WishlistThrone.com

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD