Latest Version

14.6.57.1

December 23, 2024

slice - feel easy with money

Finance

Android

0

Free

indwin.c3.shareapp

Report a Problem

More About slice

Unlock Seamless Financial Management with Slice: Your Ultimate Digital Payment Solution

In today's fast-paced world, managing finances efficiently is crucial. With the Slice app, you can streamline your payment processes and enjoy a hassle-free digital experience. Here’s how Slice transforms your financial management.

Quick and Easy Onboarding

Getting started with Slice is a breeze. Simply download the Slice app and sign up in seconds. The onboarding process is entirely digital, ensuring you can start managing your finances without any delays. 🚀

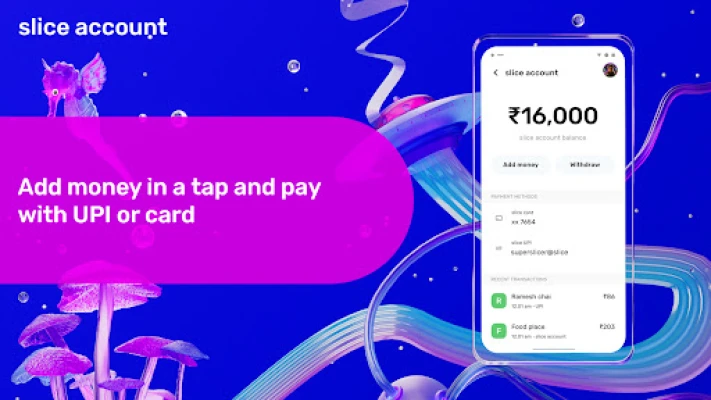

Your Slice Account: A Premium Digital Experience

With your Slice account, you gain access to a world of benefits:

- Zero Fees: Enjoy all the perks of a premium digital account without any hidden charges.

- Effortless Payments: Load your account and manage your expenses with ease.

- UPI and Debit Card Payments: Pay effortlessly using UPI or your debit card.

- Go Pinless: Make UPI payments up to ₹5000 without a PIN and earn instant cashback, up to twice your transaction amount!

- Auto-Pay for Bills: Set up automatic payments for all your bills and recharges.

- Spend Analytics: Track your spending patterns and gain insights into your financial habits.

- Instant Cashback: Earn 1% cashback on every card swipe!

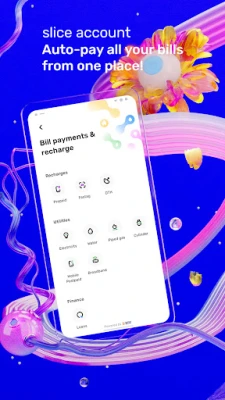

Effortless Bill Payments and Recharges

Managing your bills has never been easier with Slice:

- All-in-One Recharge: Pay for mobile, DTH, and Fastag recharges effortlessly.

- Utility Bill Management: Handle all your utility bills—electricity, water, LPG, piped gas, and broadband—without breaking a sweat.

- Loan Payments Made Simple: Manage your loan payments quickly and efficiently.

- Auto-Pay Setup: Breeze through your bills by setting up auto-pay for all your recurring payments.

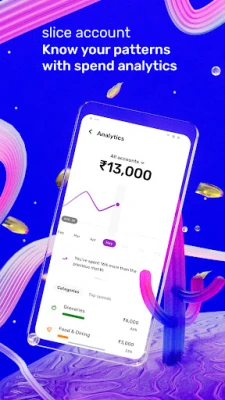

Spend Analytics: Understand Your Financial Patterns

With Slice, you can track your spending patterns effectively:

- Payment Tracking: Monitor all your payments to gain insights into your spending habits.

- Optimize Your Spending: Use the insights gained to make informed financial decisions.

Slice UPI: The Fastest Payment Solution

Experience lightning-fast transactions with Slice UPI:

- Instant Payments: Make payments in just 2 seconds using QR codes, contacts, UPI IDs, or bank accounts.

- Simple Payment Process: Enter the amount, tap, and hold to scan and pay!

- Quick Transfers: Send money to friends and family instantly.

- Geo-Tagging Feature: Track your spending locations on a map for better financial awareness.

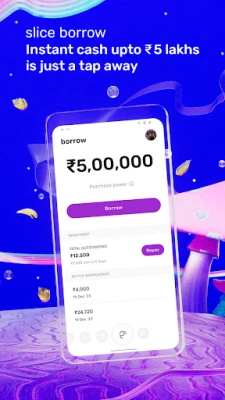

Slice Borrow: Flexible Credit Solutions

Need quick access to funds? Slice Borrow has you covered:

- Instant Money Access: Borrow up to ₹5,00,000 in seconds.

- Paperless Credit: Enjoy hassle-free access to credit without the paperwork.

- Instant Fund Transfer: The borrowed amount is transferred directly to your bank account.

- Flexible Repayment Options: Repay at your convenience and save on interest.

- Free Credit Score Check: Know your CIBIL score instantly with Slice.

Example of a Slice Borrow Transaction

To illustrate how Slice Borrow works, consider the following example:

- Amount Borrowed: ₹2,000

- Interest Rate: 18%

- Processing Fee (including GST): ₹60

- Disbursal Amount: ₹2,000

- If Repaid in 12 Months: ₹2,241

- Interest Payable: ₹181

Conclusion: Embrace the Future of Financial Management with Slice

With its user-friendly interface and a plethora of features, the Slice app is your go-to solution for managing payments, bills, and credit. Experience the convenience of a premium digital account, track your spending, and enjoy instant cashback—all in one place. Download the Slice app today and take control of your financial future!

Rate the App

User Reviews

Popular Apps

Editor's Choice