Latest Version

1.18.0

September 07, 2025

SECURITY BANK CORPORATION

Finance

Android

0

Free

com.securitybank.bbx

Report a Problem

More About Security Bank App

Upgrade to the New Security Bank App: Your Guide to a Seamless Transition

As the old Security Bank Online and Mobile apps prepare for retirement, now is the perfect time to transition to the all-new Security Bank app. This upgrade not only enhances your banking experience but also introduces a host of new features designed to make managing your finances easier and more secure. Below, we address some of the most frequently asked questions and highlight the exciting new functionalities available in the app.

Frequently Asked Questions (FAQs)

1. Who Can Enjoy Unlimited Free Transfers?

Wealth clients and Gold Circle members can take advantage of unlimited free InstaPay fund transfers, making it easier than ever to send money without incurring additional fees.

2. Do I Need to Register Again?

Yes, your login credentials from the old app will not work with the new version. You will need to register again; however, rest assured that your saved favorites and scheduled transactions will automatically migrate along with your other accounts. You only need one account to complete the registration process.

3. How Can I Ensure Successful Registration?

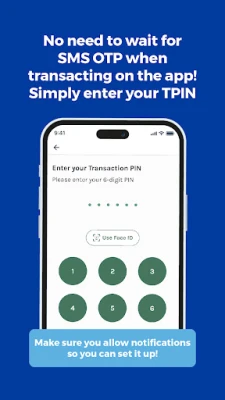

To facilitate a smooth registration, enable notifications on your device. This will keep you updated on the status of your registration and any important alerts.

4. What About My Device Settings?

Ensure that your device’s date and time settings are set to automatic. This is crucial for the app to function correctly and for your transactions to be processed without issues.

5. When Will My Newly Opened Accounts Appear?

Newly opened accounts may take a few days to show up in the app. Please be patient as the system updates your account information.

6. What Happens to My Access to the Old Apps?

Once you register for the new Security Bank app, access to the old Security Bank apps (versions 1 & 2) will be deactivated within 24 hours. Make sure to complete your registration promptly.

7. How Can Joint Account Holders Manage Access?

All account holders of Joint “OR” accounts can manage shared access by registering for the new Security Bank app. This feature enhances collaboration and ease of use for joint account holders.

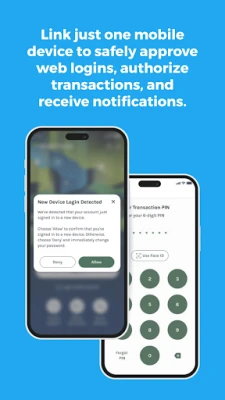

8. Can I Still Use the Web Version?

Yes, you can access the web version via your laptop or desktop. For added security, you must download the mobile app to authorize web logins and approve transactions conducted on the web version.

9. What Types of Joint Accounts Are Supported?

Joint accounts are auto-synced, but only Joint "OR" accounts can be viewed in the new app. Unfortunately, Joint “AND” and Joint ITF accounts are not eligible for online enrollment.

10. How Many Devices Can I Enroll?

For your security, you can only enroll one mobile device at a time. This measure ensures that only your designated device can authorize web logins and transactions, providing an extra layer of protection against unauthorized access or fraud.

Exciting New Features of the Security Bank App

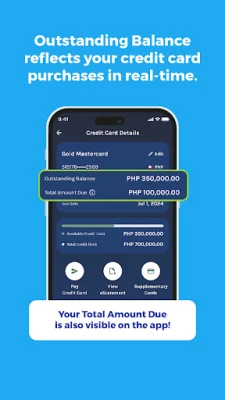

Pay Your Credit Card with Ease

One of the standout features of the new app is the ability to pay your Security Bank Credit Card directly within the app, streamlining your payment process.

Auto-Sync Feature

Register with just one account, and all your other Security Bank accounts, credit cards, investments, saved billers, and favorites will be automatically linked, simplifying your banking experience.

Quick Balance Access

Check your accounts and balances safely without the need to log in, providing you with quick access to your financial information.

Offline Soft Token

Authorize your web transactions and logins from the app even when your phone is offline, ensuring you can manage your finances anytime, anywhere.

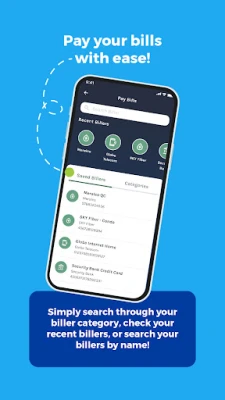

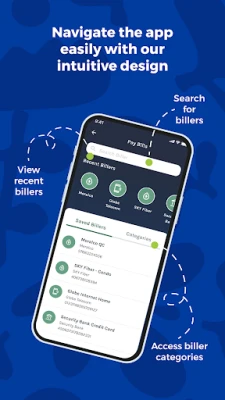

Simplified Bills Payment

Easily search, view, and schedule your recurring billers, making bill payments a hassle-free experience.

Card Control Features

Set daily budget alerts and lock or unlock your credit cards at any time, giving you greater control over your spending.

Transfer Money Effortlessly

Send or receive funds to your own accounts, other Security Bank accounts, and even other banks via InstaPay. You can also set up recurring transfers and send remittances with ease.

Mobile Top-Up

Reload prepaid mobile phones on-the-go, ensuring you stay connected without any interruptions.

eGiveCash (eGC) Feature

Make cardless withdrawals or send cash to loved ones using our eGC-enabled ATMs, providing convenience and flexibility.

eSecure Savings (eSS)

Open up to 10 accounts and save for specific goals such as trips, bills, emergency funds, and more, helping you manage your savings effectively.

In-App Notification Center

The new app features a Notification Center where users can receive and view in-app notifications regarding the status of their online fund transfers and bills payment transactions.

Easy Credit Card Activation

Activate your new or replacement credit cards directly from the home screen, making the process quick and straightforward.

Security and Support

Security Bank Corporation is regulated by the Bangko Sentral ng Pilipinas and is a proud member of BancNet. Deposits are insured by PDIC up to PHP1,000,000.00 per depositor, ensuring your funds are safe.

If you have any questions or concerns, visit the Help Center in the app. You can also reach out via email at customercare@securitybank.com.ph or contact our 24-hour customer service hotline at (+632) 8887 9188.

Make the switch today and experience the enhanced features and security of the all-new Security Bank app!

Rate the App

User Reviews

Popular Apps

Editor's Choice