Latest Version

4.5.0

September 01, 2024

Star Finanz GmbH

Finance

Android

0

Free

com.starfinanz.mobile.android.pushtan

Report a Problem

More About S-pushTAN - sichere Freigaben

Unlocking the Power of S-pushTAN: Your Guide to Secure Online Banking

In today's digital age, managing your finances has never been easier. With the S-pushTAN app, you can execute banking transactions seamlessly from your smartphone, tablet, or computer. This article will guide you through the features, setup process, and security measures of the S-pushTAN app, ensuring you can bank with confidence.

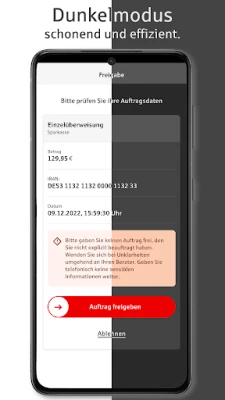

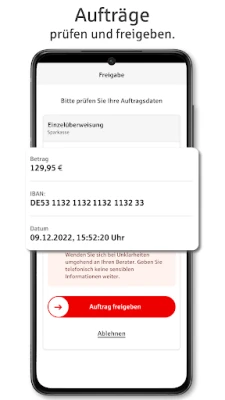

Effortless Online Banking with S-pushTAN

The S-pushTAN app simplifies online banking by allowing you to authorize transactions with just a few taps. Here’s how it works:

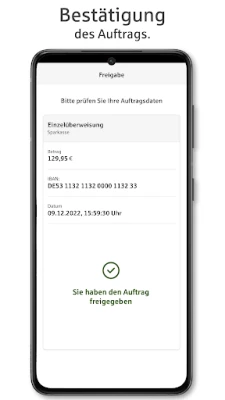

- When you initiate a transaction, the S-pushTAN app displays all relevant details, enabling you to verify the information before approval.

- Once you confirm the details, you can easily authorize the transaction, making the process quick and hassle-free.

- This app is compatible with all transactions requiring a TAN or approval, including transfers, setting up or modifying standing orders, securities transactions, and various service requests.

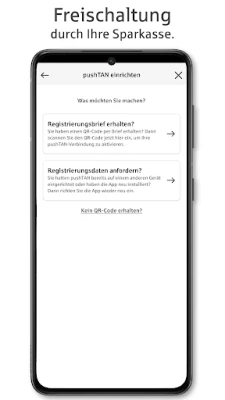

Getting Started with S-pushTAN

To begin using the S-pushTAN app, you must first be registered for the pushTAN procedure and have received your personal registration letter. Follow these steps to get started:

- Request the pushTAN procedure from your Sparkasse or switch to it online through your bank's internet portal.

- Download the S-pushTAN app for free from your device's app store.

- Set up the S-pushTAN app once you receive your registration letter from your Sparkasse.

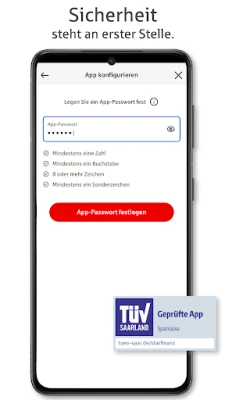

Robust Security Features

Your security is paramount when it comes to online banking. The S-pushTAN app employs several measures to ensure your data remains protected:

- The app communicates through encrypted channels, adhering to stringent German online banking regulations for secure data transfer.

- Access to the S-pushTAN app is safeguarded by a password of your choice, with optional biometric security features like fingerprint or facial recognition.

- For added security, the app automatically locks after a short period of inactivity, protecting your information in case your device is lost or stolen.

- Annual audits by TÜV confirm that the app meets the highest security standards.

Important Considerations

Before you start using the S-pushTAN app, keep these important points in mind:

- You need to be activated by your Sparkasse to use pushTAN, and a registration letter is required for initial setup.

- Ensure your device runs at least Android 6 to use the latest version of the app.

- The S-pushTAN app is not compatible with rooted devices or beta versions of operating systems, as these can compromise security standards.

- Do not deny any requested permissions during setup, as they are essential for the app's functionality.

- While the app is free to download, usage may incur costs. Check with your Sparkasse for specific details.

Data Protection Commitment

Your data protection is taken very seriously. The S-pushTAN app complies with strict privacy regulations, as outlined in the privacy policy. By downloading and using the S-pushTAN app, you agree to the terms of the End User License Agreement provided by Star Finanz GmbH.

For more information, please refer to the following links:

Conclusion

The S-pushTAN app revolutionizes the way you manage your banking transactions, offering a secure, user-friendly experience. By following the setup instructions and understanding the security features, you can take full advantage of this innovative tool. Embrace the future of banking with S-pushTAN and enjoy peace of mind knowing your financial transactions are safe and efficient.

Rate the App

User Reviews

Popular Apps

Editor's Choice