Latest Version

10.46.3

October 06, 2024

Revolut Ltd

Finance

Android

0

Free

com.revolut.revolut

Report a Problem

More About Revolut: Spend, Save, Trade

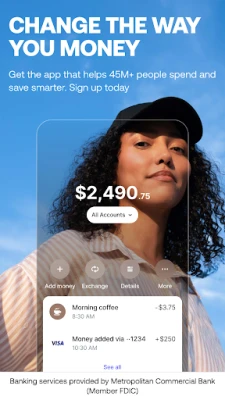

Maximize Your Spending: The Ultimate Guide to Smart Financial Management

In today's fast-paced world, managing your finances effectively is more crucial than ever. With innovative solutions like physical and virtual cards, mobile payment options, and advanced budgeting tools, you can ensure that every dollar you spend is well-spent. This guide will explore how to optimize your spending, save money, and invest wisely, all while enjoying the convenience of modern financial technology.

Flexible Payment Options for Every Need

Whether you prefer traditional methods or cutting-edge technology, you have the freedom to pay your way. Choose from:

- Physical Cards: Enjoy the classic experience of a tangible card.

- Virtual Cards: Use digital cards for online transactions, enhancing security.

- Single-Use Virtual Cards: Generate unique card details for each transaction to protect your information.

- Mobile Payments: Utilize Google Pay or Apple Pay for seamless transactions.

Spend Abroad Like a Local

Traveling internationally? Enjoy competitive exchange rates when spending abroad. Note that additional fees may apply, but with access to over 55,000 in-network ATMs worldwide, you can withdraw cash without incurring extra charges. This feature allows you to manage your finances effortlessly while exploring new destinations.

Track and Analyze Your Spending

Stay on top of your finances by linking your external bank accounts. This integration allows you to monitor all your spending in one convenient location. With advanced tracking tools, you can analyze your expenses, set budgets, and make informed financial decisions.

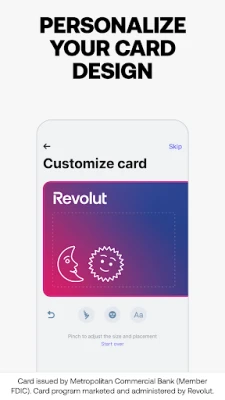

Design Your Ideal Card

Personalize your financial experience by designing a physical card that reflects your style. For those seeking a touch of luxury, consider upgrading to a Metal plan for a sleek, steel card that stands out.

Empower Your Children with Financial Literacy

Set your kids up for financial success with a dedicated account designed for those under 18. This account comes with its own card, allowing children to learn about money management in a safe and engaging environment.

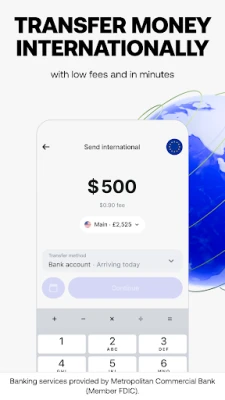

Effortless Money Transfers

Send and receive money with ease, no matter where you are. With the ability to request or send over 25 currencies at the tap of a button, you can manage your finances globally. Enjoy almost instant peer-to-peer (P2P) payments with friends and family, making it simple to split bills or settle expenses. Add a fun touch by sharing GIFs to lighten the mood during transactions.

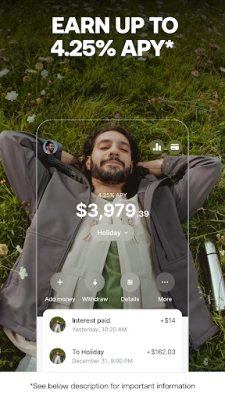

Smart Saving Strategies

Grow your wealth with innovative savings options. With Savings Vaults offering up to 4.25% APY*, you can access your funds whenever needed without penalties. Set up recurring transfers and round up spare change to effortlessly build your savings over time.

Explore Stock Trading Opportunities

Dive into the world of stock trading with minimal investment. Start trading stocks from just $1 and choose from over 2,000 popular companies. Enjoy commission-free trading within your monthly allowance, allowing you to invest without worrying about hidden fees. Remember, all investments carry risks, including the potential loss of principal.

Control Your Spending and Avoid Overspending

Stay informed about your spending habits with instant notifications for every transaction. Utilize smart budgeting tools to gain insights into your finances, helping you direct your money where it matters most. Receive alerts for upcoming payments and subscription charges, ensuring you never miss a due date.

Unlock Advanced Security Features

Your financial security is paramount. With features that allow you to freeze and unfreeze your card instantly, you can maintain control over your account. Use single-use cards for added protection, and set spending limits to keep your finances in check. Receive notifications for any suspicious activity, ensuring you can act quickly to protect your assets.

Robust Fraud Protection

Our advanced fraud prevention system monitors transactions for any high-risk activity, alerting you immediately. We prioritize your data security with extensive identity verification processes, ensuring that your account remains safe. Our dedicated customer support is available 24/7 through the app, ready to assist you with any concerns.

Conclusion: Take Charge of Your Financial Future

With the right tools and strategies, you can maximize your spending, save effectively, and invest wisely. Embrace the convenience of modern financial technology to take control of your finances and secure a prosperous future. Explore the various plans available, including Premium and Metal options, to find the perfect fit for your lifestyle.

*The highest APY is available to users on a Premium or Metal plan. Annual Percentage Yield (APY) is a variable rate and subject to change. These APYs are accurate as of October 20th, 2023. Monthly fees apply for Premium and Metal plans. Terms and Conditions Apply. No minimum amount required. Savings Vault services provided by Sutton Bank, Member FDIC.

Revolut Ltd (No. 08804411) is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 (Firm Reference 900562). Registered address: 107 Greenwich Street, 20th Floor, New York, NY 10006.

Rate the App

User Reviews

Popular Apps

Editor's Choice