Latest Version

5.28

October 07, 2024

Revolut Ltd

Finance

Android

0

Free

com.revolut.junior

Report a Problem

More About Revolut <18

Unlock Financial Freedom for Teens with Revolut <18: A Comprehensive Guide

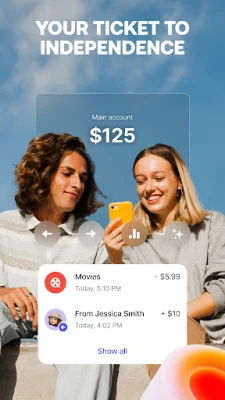

In today's digital age, managing finances has become more accessible than ever, especially for young people. With the introduction of Revolut <18, teens can take charge of their financial journey while enjoying a range of features designed to help them save, spend, and learn about money management. This article explores the exciting offerings of Revolut <18 and provides a step-by-step guide for both teens and their parents.

What Revolut <18 Offers

Revolut <18 is not just a banking app; it’s a financial tool that empowers young users to manage their money effectively. Here’s what you can expect:

- Customizable Prepaid Debit Card: Personalize your card with text, stickers, and doodles (note that personalization fees may apply).

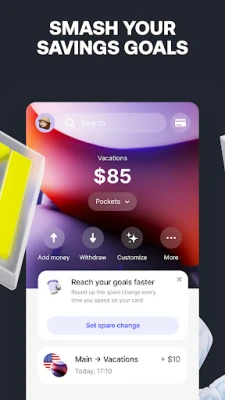

- Goal-Oriented Savings with Pockets: Set and smash your financial goals with ease.

- Round-Up Feature: Automatically round up your spare change to accelerate your savings.

- Spending Alerts and Analytics: Gain insights into your spending habits to make informed financial decisions.

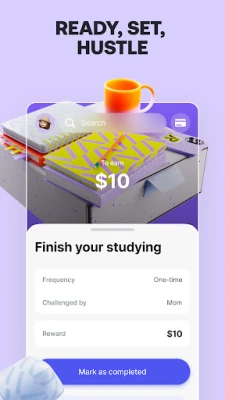

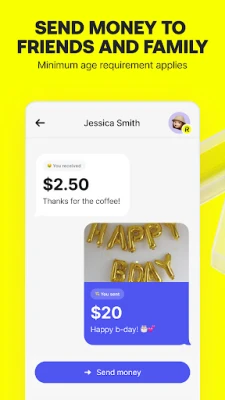

- Peer-to-Peer Money Transfers: Send and receive money effortlessly among friends with the simple command, "Revolut me" (minimum age restrictions apply).

How to Get Started with Revolut <18

Getting started with Revolut <18 is a straightforward process. Follow these steps to set up your account:

- Download the Revolut <18 App: If you’re under the age of data consent, your parent will need to create an account for you using their Revolut app.

- Account Approval: Your parent or guardian must approve your account.

- Choose and Personalize Your Card: Select a prepaid debit card and customize it to your liking (personalization fees may apply). Order it through your parent's app.

- Add to Digital Wallet: Link your card to Apple Pay or Google Pay to start spending immediately (minimum age restrictions apply).

Guidance for Parents and Guardians

Revolut <18 is designed with both teens and parents in mind. Here’s how parents can support their children in managing their finances:

- Download the <18 App: Have your child download the app and create an account.

- Account Approval: Approve their account from your Revolut app.

- Order the Prepaid Debit Card: Use your app to order their personalized prepaid debit card (personalization fees may apply).

Understanding Age Restrictions and Data Consent

Age restrictions for creating a Revolut <18 account vary by country. Here’s a breakdown:

Countries with Age 13+ Data Consent

- Countries: Bulgaria, Denmark, Estonia, Finland, Gibraltar, Iceland, Latvia, Malta, Norway, Portugal, Singapore, Sweden, Switzerland, the United Kingdom, and the United States.

- Teens aged 13+ can create an account with parental approval.

- Teens aged 12 or under require a parent or guardian to set up their account.

Countries with Age 14+ Data Consent

- Countries: Austria, Belgium, Cyprus, Italy, Lithuania, and Spain.

- Teens aged 14+ can create an account with parental approval.

- Teens aged 13 or under need parental assistance to create their account.

Countries with Age 15+ Data Consent

- Countries: Australia, Czech Republic, Greece, and Slovenia.

- Teens aged 15+ can create an account with parental approval.

- Teens aged 14 or under require parental assistance.

Countries with Age 16+ Data Consent

- Countries: Croatia, Germany, Hungary, Ireland, Liechtenstein, Luxembourg, the Netherlands, Poland, Romania, and Slovakia.

- Teens aged 16+ can create an account with parental approval.

- Teens aged 15 or under need parental assistance to create their account.

Conclusion: Empowering Teens with Financial Independence

Revolut <18 is a revolutionary tool that equips young people with the skills and resources they need to manage their finances responsibly. By offering customizable features, goal-oriented savings, and parental controls, it fosters financial literacy and independence among teens. Whether you’re a parent looking to guide your child or a teen eager to take control of your finances, Revolut <18 is the perfect solution for navigating the world of money management.

Start your financial journey today with Revolut <18 and unlock a world of possibilities!

Rate the App

User Reviews

Popular Apps

Editor's Choice