Latest Version

7.26.0.1

September 04, 2024

Regions Bank

Finance

Android

0

Free

com.regions.mobbanking

Report a Problem

More About Regions Bank

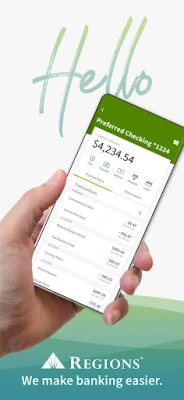

Unlock the Power of Mobile Banking: Your Comprehensive Guide to Regions Bank Features

In today's fast-paced world, managing your finances on the go has never been easier. With Regions Bank's mobile banking app, you can access a wide array of features designed to enhance your banking experience. This article will explore the key functionalities of the Regions Bank mobile app, ensuring you make the most of your banking needs.

Secure Login with Advanced Technology

Regions Bank prioritizes your security. With the mobile app, you can securely log in using fingerprint or facial recognition. This advanced technology not only simplifies the login process but also ensures that your personal information remains protected.

Easy Access to Account Information

Managing your finances is straightforward with Regions Bank. You can easily access your account and routing numbers directly from the app. This feature is particularly useful for setting up direct deposits or making electronic payments.

Transaction Activity at Your Fingertips

Stay informed about your financial activities by viewing your transaction history for the last 18 months. This feature allows you to track your spending habits, making it easier to manage your budget effectively.

Seamless Fund Transfers

Need to transfer funds? The Regions Bank mobile app makes it simple. You can quickly and securely transfer money between your accounts or send funds to others, ensuring your transactions are completed without hassle.

Convenient Mobile Deposits

Gone are the days of visiting a bank branch to deposit checks. With the mobile deposit feature, you can deposit checks directly from your smartphone. Just snap a picture of the check, and the funds will be available in your account shortly.

Manage Your Financial Health

Regions Bank offers a suite of tools to help you manage your financial health. Utilize budgeting and planning tools to set financial goals, track your spending, and monitor your progress. Additionally, access your FICO® Score to stay informed about your credit health.

Send Money Instantly with Zelle®

Need to send money to family or friends? The Regions Bank app integrates with Zelle®, allowing you to send money instantly. This feature is perfect for splitting bills or sending gifts without the need for cash.

Effortless Bill Payments

Paying bills has never been easier. With Regions Bill Pay, you can schedule and manage your bill payments directly from the app. Set up recurring payments to ensure you never miss a due date.

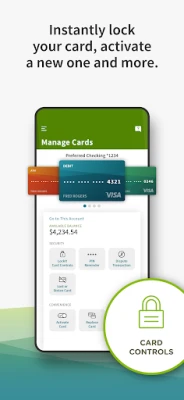

Control Your Card Activity with Regions LockIt®

Take control of your card activity with Regions LockIt®. This feature allows you to lock and unlock your debit card instantly, providing peace of mind if your card is lost or stolen.

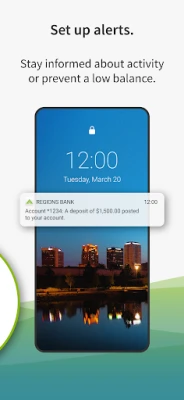

Stay Informed with Alerts

Set up personalized alerts to stay updated on your account activity. Whether it's a low balance notification or transaction alerts, you can customize your preferences to ensure you never miss important information.

Access Rewards and Offers

Maximize your banking experience by viewing and activating rewards and offers available through the Regions Bank app. Take advantage of exclusive deals and promotions tailored to your banking habits.

Schedule Appointments with Regions Bankers

Need personalized assistance? The app allows you to schedule an appointment with a Regions banker at your convenience. Get the help you need without the hassle of waiting in line.

Find Your Nearest Regions Branch or ATM

Whether you need to withdraw cash or speak to a banker in person, the Regions Bank app helps you locate the nearest Regions branch or ATM. Simply use the app's location feature to find the most convenient option.

Contact Us for Support

If you have any questions or need assistance, feel free to reach out via email at MobileApps@Regions.com. Our team is here to help you navigate your banking experience.

Copyright 2024 Regions Bank. All Rights Reserved. Member FDIC. Equal Housing Lender.

Regions, the Regions logo, and the LifeGreen bike are registered trademarks of Regions Bank. The LifeGreen color is a trademark of Regions Bank.

* Mobile Banking, Alerts, Text Banking, and Mobile Deposit require a compatible device and enrollment in Online Banking. All are subject to separate terms and conditions. Mobile Deposit may incur fees. Your mobile carrier’s messaging and data fees may apply.

* Zelle and the Zelle-related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

* FICO® is a registered trademark of Fair Isaac Corporation in the United States and other countries.

©2024 Fair Isaac Corporation. All rights reserved.

Rate the App

User Reviews

Popular Apps

Editor's Choice