Latest Version

5.10.0

September 01, 2025

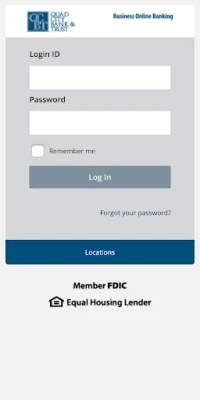

Quad City Bank & Trust

Finance

Android

0

Free

com.quadcitiesbankandtrust371004.mobile

Report a Problem

More About Quad City Bank – Business

Maximize Your Banking Experience: Essential Features for Modern Banking

In today's fast-paced world, managing your finances efficiently is crucial. With the advent of digital banking, you can now access a plethora of features that enhance your banking experience. This article explores the essential functionalities that modern banking offers, ensuring you stay in control of your finances anytime, anywhere.

24/7 Balance Checking

One of the most significant advantages of digital banking is the ability to check your account balances 24/7. No longer do you need to wait for bank hours to know your financial standing. Whether you're at home, at work, or on the go, you can quickly log into your banking app or website to view your balances. This feature empowers you to make informed financial decisions in real-time, helping you manage your spending and savings effectively.

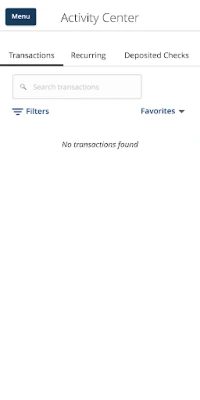

Monitor Pending Transactions

Keeping track of your finances is easier than ever with the option to view pending transactions. This feature allows you to see transactions that have been initiated but not yet completed. By monitoring these transactions, you can better understand your cash flow and avoid overdraft fees. It also helps you identify any discrepancies or unauthorized charges before they affect your account.

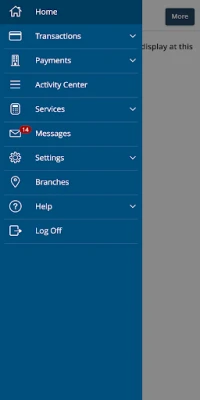

Effortless Funds Transfers

Modern banking provides a seamless way to create, approve, cancel, or view funds transfers. Whether you need to send money to a friend, pay a bill, or transfer funds between your accounts, these functionalities make the process quick and hassle-free. With just a few clicks, you can initiate transfers, and you can also easily cancel or modify them if your plans change. This level of control ensures that your money moves exactly where you want it to go.

Comprehensive Transaction History

Understanding your spending habits is vital for effective financial management. With the ability to view your transaction history, you can analyze your past transactions, categorize your spending, and identify areas where you can cut back. This feature not only helps you stay organized but also aids in budgeting and planning for future expenses. By regularly reviewing your transaction history, you can make smarter financial choices.

Secure Messaging for Enhanced Communication

In an age where security is paramount, the option to send and receive secure messages within your banking platform is invaluable. This feature allows you to communicate directly with your bank regarding any inquiries or issues without compromising your personal information. Whether you have questions about your account, need assistance with a transaction, or want to report suspicious activity, secure messaging provides a safe and efficient way to get the help you need.

Branch Hours and Location Information

Even in a digital world, knowing branch hours and location information remains essential. Whether you need to visit a physical branch for specific services or prefer to handle everything online, having access to this information ensures you can plan your visits accordingly. Most banking apps and websites provide up-to-date details about branch locations, hours of operation, and available services, making it easier for you to manage your banking needs.

Conclusion

Modern banking offers a suite of features designed to enhance your financial management experience. From 24/7 balance checking to secure messaging, these functionalities empower you to take control of your finances like never before. By leveraging these tools, you can ensure that your banking experience is not only efficient but also tailored to your needs. Embrace the convenience of digital banking and make the most of these essential features today!

Rate the App

User Reviews

Popular Apps

Editor's Choice