Latest Version

3.158.0

September 10, 2024

Public Holdings Inc

Finance

Android

0

Free

com.public.app

Report a Problem

More About Public – Stocks and Options

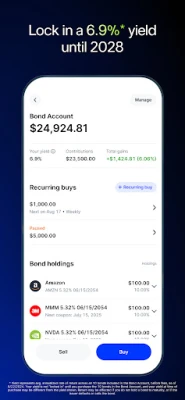

Unlocking the Potential of Corporate Bonds: A Comprehensive Guide to Diversified Investing

In today's dynamic financial landscape, investors are constantly seeking innovative ways to enhance their portfolios. One such opportunity lies in the realm of corporate bonds, which offer a unique blend of stability and yield. As of August 23, 2024, investors can earn an impressive 6.9% yield with monthly interest payments, making this an attractive option for those looking to diversify their investments.

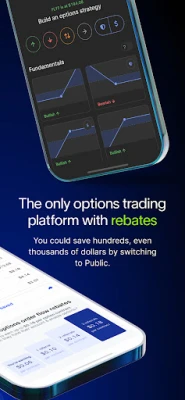

Maximize Your Earnings with Options Trading Rebates

Investing in options can be a lucrative strategy, especially when you can earn rebates on every trade. With our platform, you can receive a rebate ranging from $0.06 to $0.18 per options contract traded, depending on the number of referrals you bring in. This means you can engage in options trading without worrying about commissions or per-contract fees, allowing you to keep more of your profits.

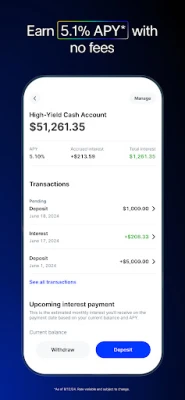

High-Yield Cash Accounts: Earn 5.1% APY

For those looking to park their cash while still earning a competitive return, our high-yield cash account offers an industry-leading 5.1% Annual Percentage Yield (APY). This account comes with no fees and provides up to $5 million in FDIC insurance, ensuring your funds are secure while they grow. This is an excellent option for investors who want to maintain liquidity without sacrificing returns.

Introducing Alpha: Your AI Investment Assistant

Stay ahead of the curve with Alpha, our cutting-edge AI tool designed specifically for investors. Alpha provides real-time insights and context, helping you make informed decisions before you even realize you need them. This innovative technology leverages advanced algorithms to analyze market trends and investment opportunities, giving you a competitive edge in your investment strategy.

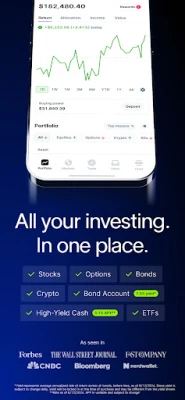

Comprehensive Investment Analysis

Effective investment requires thorough analysis. Our platform allows you to evaluate multiple assets simultaneously, compare analyst ratings, and explore earnings data. This comprehensive approach ensures that you have all the information you need to make sound investment decisions, whether you're focusing on corporate bonds, stocks, or other asset classes.

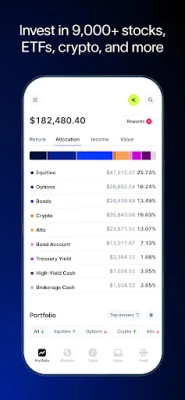

Streamlined Portfolio Management

Managing your investments has never been easier. Our portfolio management tools enable you to track your cost basis, access extended-hours trading, and schedule recurring investments. This level of control allows you to tailor your investment strategy to your specific goals and risk tolerance, ensuring that your portfolio remains aligned with your financial objectives.

Understanding the Risks of Investing

While the potential for high returns is enticing, it's essential to recognize that all investments carry risks, including the loss of principal. Our brokerage services for U.S.-listed securities, options, and bonds are offered through Public Investing, a member of FINRA and SIPC. Additionally, cryptocurrency trading services are provided by Bakkt Crypto Solutions, LLC, which is licensed to engage in virtual currency business activity. It's crucial to understand that cryptocurrency investments are highly speculative and can result in significant losses.

Important Disclosures and Considerations

Investors should be aware that securities investments are not FDIC insured, carry no bank guarantee, and may lose value. For more information, please visit public.com/disclosures-main. Before engaging in options trading, it's advisable to review the Options Disclosure Document (ODD) available at public.com/ODD. The rebate program varies based on enrollment time and the number of referrals, so be sure to check the terms at public.com/disclosures/rebate-terms.

Conclusion: A Strategic Approach to Investing

Investing in a diversified portfolio of corporate bonds, coupled with the advantages of options trading and high-yield cash accounts, presents a compelling opportunity for both novice and seasoned investors. By leveraging advanced tools like Alpha and utilizing comprehensive investment analysis and portfolio management features, you can navigate the complexities of the financial markets with confidence. Remember, informed investing is the key to achieving your financial goals.

For more information on how to get started with your investment journey, visit Public Holdings Inc today.

Rate the App

User Reviews

Popular Apps

Editor's Choice