Latest Version

10.45.0

September 27, 2024

Paytm - One97 Communications Ltd.

Finance

Android

0

Free

net.one97.paytm

Report a Problem

More About Paytm: Secure UPI Payments

Unlocking the Power of Paytm: Your Ultimate Guide to Seamless Transactions

In today's fast-paced digital world, managing your finances efficiently is crucial. Paytm has emerged as a leading platform in India, offering a plethora of services that simplify money transfers, payments, and more. This article delves into the various features of the Paytm app, highlighting how it can enhance your financial transactions.

Effortless Money Transfers with Paytm UPI

Sending money to friends and family has never been easier. With Paytm's Unified Payment Interface (UPI), you can transfer funds using just a mobile number, even to those who aren't on Paytm. This feature ensures that your transactions are quick and hassle-free.

Convenient Payments Anywhere

Paytm allows you to scan QR codes for payments at various locations, including grocery stores, petrol pumps, and restaurants. This contactless payment method not only saves time but also enhances your shopping experience.

Recharge and Bill Payments Made Simple

With Paytm, you can recharge your mobile phone and pay utility bills such as electricity, gas, water, and broadband with just a few taps. The app provides a user-friendly interface that makes managing your expenses straightforward.

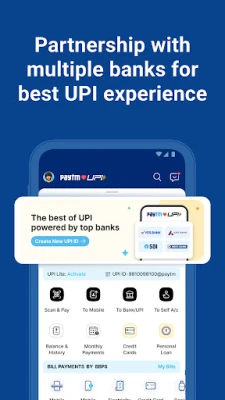

Secure Banking with Leading Indian Banks

Paytm is powered by top Indian banks, including Axis Bank, HDFC Bank, SBI Bank, and Yes Bank. This partnership ensures a seamless and secure banking experience for all users, giving you peace of mind while conducting transactions.

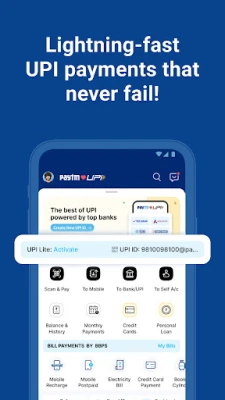

Fast and Reliable UPI Payments

- Transfer money effortlessly by entering the recipient's mobile number.

- Check your bank account balance and view your transaction history directly on the Paytm app.

- Your unique UPI ID simplifies the payment process, making it easy to send and receive money.

- Set up a UPI PIN (4 or 6 digits) for added security when creating your UPI ID.

- Utilize UPI Lite for quick payments up to ₹4000 per day without needing a PIN.

Enhanced Flexibility with RuPay Credit Card

Building on the convenience of UPI, Paytm offers the RuPay Credit Card, allowing you to make secure payments effortlessly. Here are some benefits:

- UPI Payments via Credit Card: Easily add your credit card to Paytm and make payments at any shop without needing a CVV or OTP.

- Hassle-Free Payments: No need to carry your credit card everywhere; your mobile device is all you need.

- Rewards and Cashbacks: Earn rewards and cashbacks on all your Paytm transactions, enhancing your shopping experience.

Contactless Payments at Offline Stores

Paytm UPI allows you to make contactless payments at nearby retail stores, pharmacies, restaurants, and petrol pumps. Simply use the Paytm app to pay via your mobile number or by scanning a QR code, ensuring a smooth and safe transaction.

Online Shopping Made Easy

Paytm facilitates payments for food delivery, groceries, shopping, and entertainment across 100+ apps and websites. Enjoy a seamless online shopping experience with just a few clicks.

Efficient Recharge and Utility Bill Payments

Recharge your mobile, DTH services (like Tata Play, Sun Direct, Airtel DTH), and pay for utilities such as electricity, broadband, and water bills effortlessly. Paytm also offers the latest prepaid recharge plans and mobile recharge offers for various service providers, including Jio, Airtel, Vodafone Idea (VI), MTNL, and BSNL.

Order Groceries and Food with Paytm ONDC

With Paytm ONDC, you can order food and buy monthly groceries while enjoying the best deals available. This feature enhances your shopping convenience, allowing you to manage your household needs efficiently.

Check Your Credit Score for Free

Stay informed about your financial health by checking your credit score for free through the Paytm app. This feature helps you understand your creditworthiness and make informed financial decisions.

Instant Personal Loans at Your Fingertips

Paytm offers instant personal loans ranging from ₹50,000 to ₹25 lakh, with flexible repayment options from 6 to 60 months. The annual interest rate varies between 10.99% and 35%, with a processing fee of 0-6%. Note that personal loans are available only to Indian citizens within the territory of India.

Example of Loan Calculation

For instance, if you take a loan amount of ₹100,000 with an interest rate of 23% and a processing fee of 4.25%, your monthly EMI would be approximately ₹6,621. The total interest payable would be ₹19,178, making the total amount payable ₹119,186.

Book Tickets for Travel with Paytm

Paytm is an authorized partner of IRCTC, allowing you to book train tickets, check PNR status, and access live train status effortlessly. You can also book bus and flight tickets, making travel planning convenient.

Contact Information

For any inquiries, you can reach out to:

One 97 Communications Limited

One Skymark, Tower-D, Plot No. H-10B, Sector-98, Noida UP 201304, India

*Paytm Money Ltd. is a wholly owned subsidiary of One97 Communication Ltd. (Paytm) and is registered with SEBI and PFRDA as a stockbroker (INZ000240532) and e-pop (269042019) for NPS services.

In conclusion, Paytm is revolutionizing the way we handle our finances, offering a comprehensive suite of services that cater to all your payment needs. Whether it's sending money, making payments, or managing loans, Paytm provides a secure and user-friendly platform that enhances your financial experience.

Rate the App

User Reviews

Popular Apps

Editor's Choice