Latest Version

8.69.2

August 26, 2024

PayPal Mobile

Finance

Android

0

Free

com.paypal.android.p2pmobile

Report a Problem

More About PayPal - Send, Shop, Manage

Unlock the Full Potential of PayPal: Your Ultimate Guide to Features and Benefits

In today's digital age, managing your finances efficiently is crucial. PayPal offers a suite of features designed to enhance your financial experience, from cashback rewards to secure transactions. This article explores the various functionalities of PayPal, ensuring you make the most of this powerful platform.

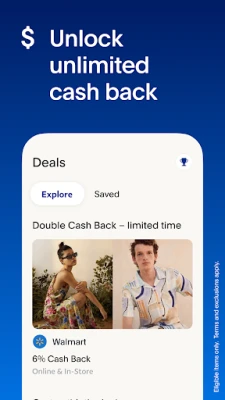

Discover Exclusive Deals Right in the App

With PayPal, you can access cashback offers from your favorite brands directly within the app. Eligible items allow you to redeem points for cash or other exciting options. Keep in mind that terms and exclusions apply, so it's essential to review the PayPal Rewards terms and conditions for complete details.

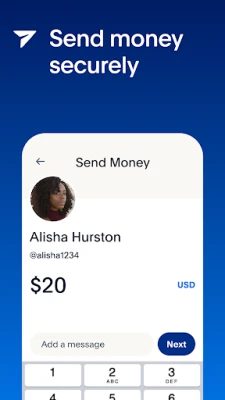

Send and Request Money for Free

One of the standout features of PayPal is the ability to send and request money without incurring fees. When you fund your transactions using a bank account or your PayPal balance, sending money to friends and family in the U.S. is entirely free. You can also personalize your payments, making it easy to request money securely from loved ones.

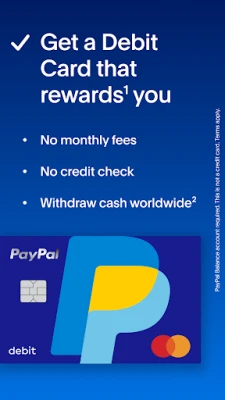

Access Your PayPal Balance with the PayPal Debit Card

The PayPal Debit Card allows you to access your PayPal balance effortlessly. To obtain the card, you need a PayPal Balance account. This card enables you to:

- Transfer funds from your bank account to your PayPal balance with ease.

- Shop at any location that accepts Mastercard® and withdraw cash at ATMs worldwide.

- Enjoy fee-free withdrawals at over 37,000 MoneyPass® ATMs.

No credit check is required to get the card, making it accessible for many users. For more information, visit paypal.com/us/debitcard.

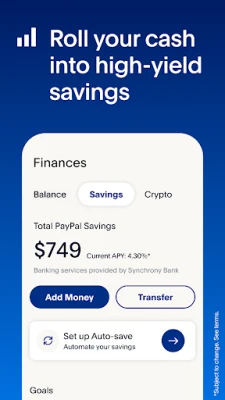

Grow Your Money with High-Yield Savings

PayPal Savings offers an impressive 4.30% APY, significantly higher than the national average. This feature allows you to roll your money into a savings account and manage it directly from the app. You can:

- Transfer money in and out with ease.

- Set individual savings goals.

- Track your progress as your savings grow.

Note that the APY is variable and can change at any time. As of June 7, 2023, this rate is available, but always check for the latest updates.

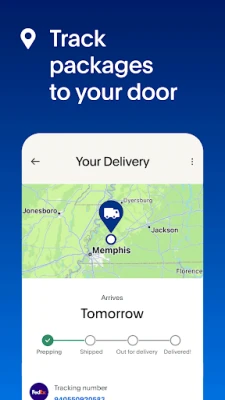

Track Orders Straight to Your Doorstep

PayPal simplifies the online shopping experience by allowing you to auto-track your packages, even if you didn’t use PayPal for payment. You can link your Gmail account to receive live updates on your shipments or manually add tracking details in the app. However, not all sellers participate in this feature, so be sure to check.

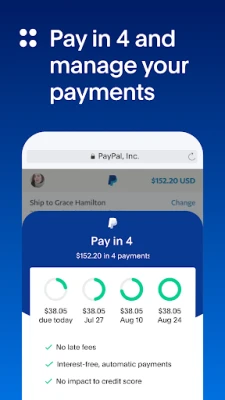

Pay in 4: Buy Now, Pay Later

With PayPal's Pay in 4 feature, you can split your purchases into four interest-free payments at millions of online retailers. This option is available for purchases ranging from $30 to $1,500, making it easier to manage your budget without incurring late fees. Payments are conveniently managed within the app, providing a seamless experience.

To qualify, you must be 18 years or older, and availability may vary by state. For more details, visit paypal.com/payin4.

Trust PayPal for Secure Transactions

Security is paramount when it comes to online transactions. PayPal employs advanced encryption and fraud protection measures to keep your financial information safe. This commitment to security ensures that you can shop and send money with confidence.

Conclusion

PayPal is more than just a payment platform; it’s a comprehensive financial tool that offers numerous features to enhance your financial management. From cashback rewards and high-yield savings to secure transactions and flexible payment options, PayPal empowers users to take control of their finances. Explore these features today and unlock the full potential of your PayPal account.

For more information about PayPal and its offerings, visit PayPal's official website.

Rate the App

User Reviews

Popular Apps

Editor's Choice