Latest Version

2.0.7

August 30, 2025

ONESTA AGENTE DE SEGUROS Y DE FIANZAS

Finance

Android

0

Free

com.onesta.apponestaone

Report a Problem

More About Onesta One

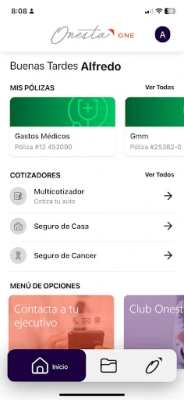

Your Comprehensive Guide to Managing Insurance Policies

In today's fast-paced world, managing your insurance policies efficiently is crucial. This guide will provide you with a detailed overview of how to access and utilize your insurance information effectively, ensuring you are always prepared for any situation.

Overview of Your Insurance Policies

Understanding the various insurance policies you have contracted is the first step in effective management. A comprehensive list of your policies allows you to keep track of coverage, premiums, and renewal dates. This information is essential for making informed decisions about your insurance needs.

Detailed Information About Your Policies

Each insurance policy comes with specific details that are vital for your understanding and peace of mind. Here’s what you should look for:

- Policy Number: A unique identifier for each policy.

- Coverage Details: What is covered and what is excluded.

- Premium Amount: The cost you need to pay for coverage.

- Deductibles: The amount you pay out of pocket before coverage kicks in.

- Policy Term: The duration for which the policy is valid.

Having this information readily available can help you make quick decisions and avoid potential pitfalls.

Direct Actions for Claims Assistance

In the unfortunate event of a claim, knowing how to act swiftly can make all the difference. Here are some direct actions you can take:

- Contact Your Insurer: Have the contact information of your insurance provider handy. Quick access can expedite the claims process.

- View Your Policy: Always have a digital or physical copy of your policy accessible. This will help you understand your coverage during a claim.

- Share Your Policy: If necessary, share your policy details with relevant parties, such as legal representatives or family members, to facilitate the claims process.

Being proactive can significantly reduce stress during challenging times.

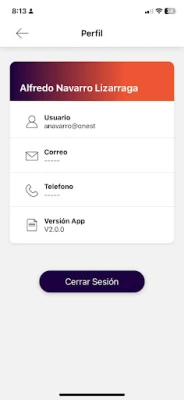

Your Profile: Accessing Registered Information

Your insurance profile is a central hub for all your registered information. It typically includes:

- Personal Information: Your name, address, and contact details.

- Policy History: A record of all your past and current policies.

- Payment History: Information on your premium payments and any outstanding balances.

Regularly reviewing your profile ensures that all information is up-to-date, which is crucial for effective communication with your insurer.

Utilizing Chat Support for Queries

Many insurance companies now offer chat support to assist customers with their inquiries. This feature can be incredibly beneficial for:

- Quick Answers: Get immediate responses to your questions without the need to wait on hold.

- Clarifying Doubts: If you have uncertainties about your coverage or claims process, chat support can provide clarity.

- Guidance on Next Steps: If you’re unsure about how to proceed with a claim or policy change, chat representatives can guide you.

Utilizing chat support can enhance your overall experience and ensure you have the information you need at your fingertips.

Conclusion: Stay Informed and Prepared

Managing your insurance policies doesn’t have to be overwhelming. By keeping a detailed list of your policies, understanding the specifics of each, and knowing how to act in case of a claim, you can navigate the insurance landscape with confidence. Regularly updating your profile and utilizing available support channels will further enhance your experience. Stay informed, stay prepared, and ensure that you are always in control of your insurance needs.

Rate the App

User Reviews

Popular Apps

Editor's Choice