Latest Version

10.55.0

September 13, 2024

ONE Finance, Inc.

Finance

Android

0

Free

com.even.harmony

Report a Problem

More About ONE@Work (formerly Even)

Unlock Financial Freedom with ONE@Work: Your Comprehensive Guide

In today's fast-paced world, managing finances effectively is crucial for maintaining peace of mind. ONE@Work offers a suite of features designed to empower employees by providing them with greater control over their earnings and budgeting. This article delves into the key benefits of ONE@Work, highlighting how it can transform your financial management experience.

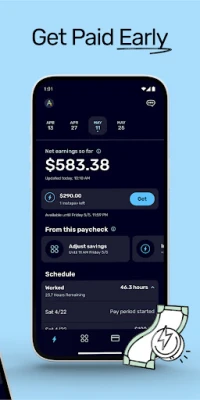

Access Your Earnings Early with Instapay

Imagine having the ability to access your net earnings before payday. With Instapay, ONE@Work allows you to do just that. This feature is particularly beneficial for those unexpected expenses that can arise at any moment. Whether it's a car repair or a medical bill, Instapay ensures you have the funds available without the burden of fees or hidden interest. It's a straightforward solution to financial emergencies, giving you peace of mind and flexibility.

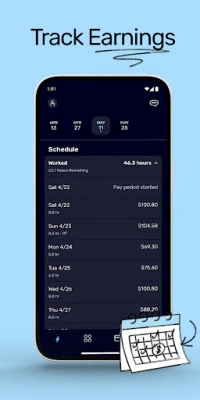

Track Your Earnings with Precision

Gone are the days of uncertainty regarding your paycheck. ONE@Work provides a user-friendly interface that allows you to track your earnings effortlessly. You can view your work schedule and see exactly how much you will earn per shift and per paycheck. This transparency eliminates guesswork, enabling you to plan your finances with confidence. Knowing your earnings in advance helps you make informed decisions about spending and saving.

Automatic Savings for a Secure Future

Saving money can often feel like a daunting task, but ONE@Work simplifies the process through its automatic savings feature. You can select a percentage of your paycheck to be automatically deducted and saved for future needs. This hands-off approach to saving ensures that you are consistently putting money aside without even thinking about it. Over time, these small contributions can accumulate into a significant financial cushion, providing you with security and peace of mind.

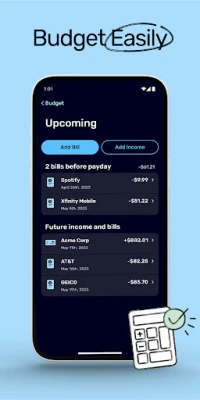

Effortless Budgeting Made Possible

Budgeting is a critical aspect of financial health, and ONE@Work makes it easier than ever. By connecting your bank account, the platform helps you calculate what you can comfortably spend. This feature takes the guesswork out of budgeting, allowing you to manage your finances more effectively. With clear insights into your spending capabilities, you can avoid overspending and make smarter financial choices.

Exclusive Employer-Provided Benefit

It's important to note that ONE@Work is available exclusively as an employer-provided benefit. This means that your employer must offer this service for you to take advantage of its features. If your workplace provides ONE@Work, you can unlock a range of financial tools designed to enhance your financial well-being.

Powered by Trusted Financial Institutions

ONE@Work Save is backed by reputable financial institutions, including Cross River Bank and Coastal Community Bank, both members of the FDIC. This partnership ensures that your savings are secure and that you are working with trusted entities in the financial sector.

Important Considerations

While ONE@Work offers numerous benefits, it's essential to be aware of certain limitations. For instance, Instapay is currently unavailable for Walmart associates in New York. Additionally, the features of ONE@Work are only accessible to members whose employers have configured this benefit within the app. Always check with your employer to understand the specific offerings available to you.

Conclusion: Take Control of Your Financial Future

ONE@Work is a powerful tool that can significantly enhance your financial management. With features like early access to earnings, precise tracking, automatic savings, and effortless budgeting, it empowers you to take control of your financial future. If your employer offers this benefit, take full advantage of it to improve your financial health and achieve your goals. Embrace the opportunity to manage your finances with confidence and ease through ONE@Work.

Rate the App

User Reviews

Popular Apps

Editor's Choice