Latest Version

4.22.0

August 07, 2024

ONE Finance, Inc.

Finance

Android

0

Free

com.onefinance.one

Report a Problem

More About One — Mobile Banking

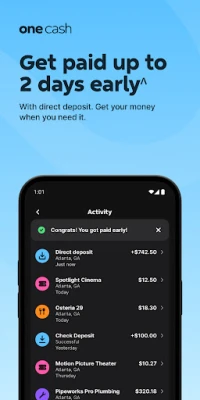

One is a financial technology company that offers banking services through Coastal Community Bank. This means that they are not a traditional bank, but they partner with a bank to provide banking services to their customers. One Cash accounts are FDIC insured up to $250,000 per depositor, giving customers peace of mind that their money is safe.

The One card is issued by Coastal Community Bank and is licensed by Mastercard® International. This means that customers can use their One card to make purchases wherever Mastercard is accepted.

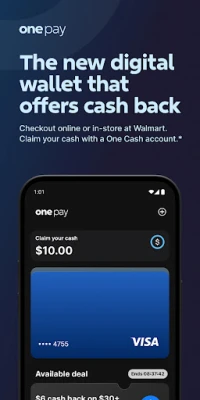

One is currently offering a special deal for consumers who open an account through Walmart.com, the Walmart app, one.app, or the One app between 6/10/24 and 8/31/24. This deal allows customers to earn cash back on their purchases, but it is only available for a limited time. Customers can find the terms and conditions for this deal at one.app/10percent.

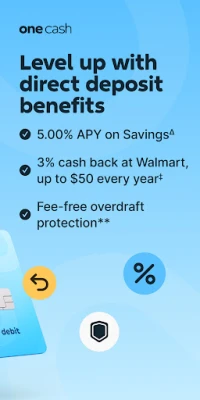

Customers can also earn cash back through the Debit Rewards Program, which offers individualized offers that can be found in the One app. To receive 3% cash back, customers must have received $500 or more of eligible direct deposits in the previous month, or have a total account balance of $5,000 or more. This cash back is limited to $50 per year and applies only to purchases made at U.S. Walmart locations and on Walmart.com. Customers can find the full terms and conditions for this program at one.app/rewards-terms.

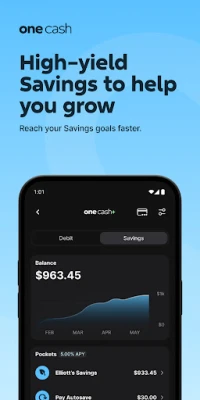

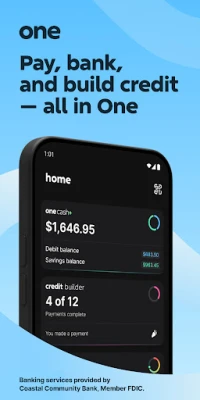

One also offers a high annual percentage yield (APY) of 5.00% on customers' total Savings balance if they have received $500 or more of eligible direct deposits in the previous month, or have a total daily account balance of $5,000 or more. This APY is limited to a total Savings balance of up to $250,000. Customers can also earn 5.00% APY on Pay Autosave and ONE@Work Save balances without these deposit or balance requirements. All other Savings balances will earn 1.00% APY. These APYs are accurate as of 4/17/2024, but are subject to change at any time.

One offers a Credit Builder Program that can help customers improve their credit score. However, it is important to note that using this program does not guarantee an improvement in credit score. Customers must have eligible direct deposits totaling at least $500 in the previous month to qualify for this program. One is not a credit repair service and does not remove negative credit history from customers' credit profiles. Customers can find more information about this program on the Licenses page of the One app.

One also offers a loan option with a 0% APR and $25 monthly payments. Customers can choose how much they want to contribute towards their monthly payment, with a minimum of $1. Any remaining balance will be paid from the loan proceeds held in the Credit Builder lockbox. This loan is based on a 12-month term and can help customers build their credit score.

The credit score provided by One is the VantageScore® 4.0 by TransUnion®, which may not be the same credit score model used by lenders. Lenders use a variety of different types of credit scores to make lending decisions.

One also offers global transfers, although this service may not be available to all customers. Customers can find more information about this service on the One app.

All third party products, names, logos, and brands mentioned are the trademarks or registered trademarks and property of their respective owners. One does not claim ownership, affiliation, or endorsement of these products. Customers can find the terms and conditions for One's products at www.one.app/terms.

One's mailing address is P.O. BOX 513717, Los Angeles, CA 90051.

Rate the App

User Reviews

Popular Apps

Editor's Choice