Latest Version

4.25.0

December 28, 2024

Novo Platform Inc.

Finance

Android

0

Free

com.novo.android

Report a Problem

More About Novo - Small Business Checking

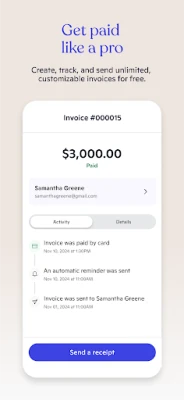

Unlock Your Business Potential with Novo: The Ultimate Fintech Solution

In today's fast-paced business environment, efficiency is key. With Novo, you can open a business account online in just minutes, allowing you to dedicate more time to what truly matters—growing your business.

What is Novo?

Unlike traditional banks, Novo operates as a fintech company, providing innovative banking solutions tailored for small businesses. Banking services are facilitated by Middlesex Federal Savings, F.A., a member of the FDIC, ensuring your funds are secure while you enjoy the flexibility and convenience of modern banking.

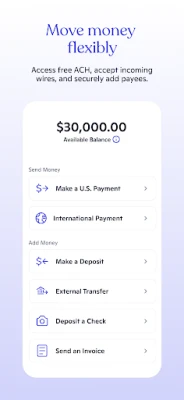

Comprehensive Banking Tools at Your Fingertips

With the free Novo app, small business owners gain access to a suite of powerful banking tools designed to streamline financial management. Here’s what you can do:

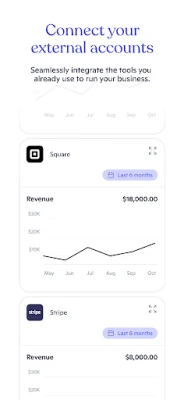

- Link Existing Accounts: Easily connect your current bank accounts for seamless financial oversight.

- Control Your Debit Card: Manage your Novo Mastercard Business Debit Card directly from the app.

- Pay Bills Effortlessly: Set up bill payments to keep your business running smoothly.

- Process ACH Transfers: Handle electronic payments with ease.

- Deposit Checks: Use your mobile device to deposit checks quickly and securely.

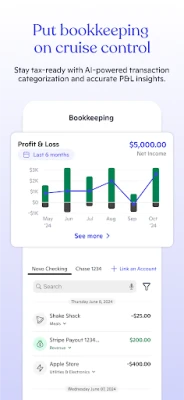

- Categorize Transactions: Organize your expenses for better financial tracking.

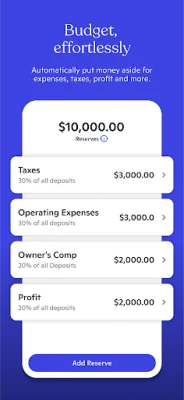

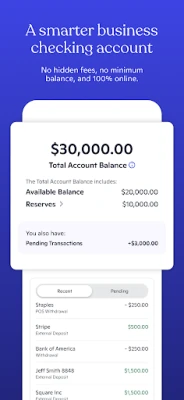

- Separate Funds for Savings: Utilize the Reserves feature to allocate funds for future needs.

Enjoy Fee-Free Transactions

When you choose Novo, you receive a Novo Mastercard Business Debit Card and a Virtual Card for online purchases. Enjoy the freedom to make transactions globally without incurring fees from Novo. Additionally, you can send unlimited payments and paper checks at no cost, making it easier to manage your finances without worrying about hidden charges.

Who Can Benefit from Novo?

Almost any business operating in the United States can take advantage of Novo's services. As long as the business owner possesses a social security number, they are eligible to apply for a Novo Business Checking Account. This inclusivity ensures that a wide range of entrepreneurs can access the financial tools they need to succeed.

Why Choose Novo for Your Business Banking Needs?

Choosing the right banking partner is crucial for your business's success. Here are several reasons why Novo stands out:

- Speed and Convenience: Open your account in minutes and manage everything from your smartphone.

- Innovative Features: Benefit from a range of tools designed specifically for small businesses.

- Cost-Effective: Enjoy free transactions and no monthly fees, allowing you to allocate more resources to your business.

- Security: Rest easy knowing your funds are protected by a reputable banking partner.

Getting Started with Novo

Ready to take your business banking to the next level? Signing up for a Novo account is simple:

- Visit the Novo website or download the app.

- Complete the online application form.

- Link your existing accounts and set up your Novo Mastercard.

- Start managing your business finances with ease!

Conclusion

In a world where time is money, Novo offers a streamlined, efficient banking solution for small businesses. With its user-friendly app, innovative features, and commitment to customer satisfaction, Novo empowers entrepreneurs to focus on what they do best—growing their businesses. Don’t let traditional banking hold you back; embrace the future of finance with Novo today!

Rate the App

User Reviews

Popular Apps

Editor's Choice